2021-1-11 14:51 |

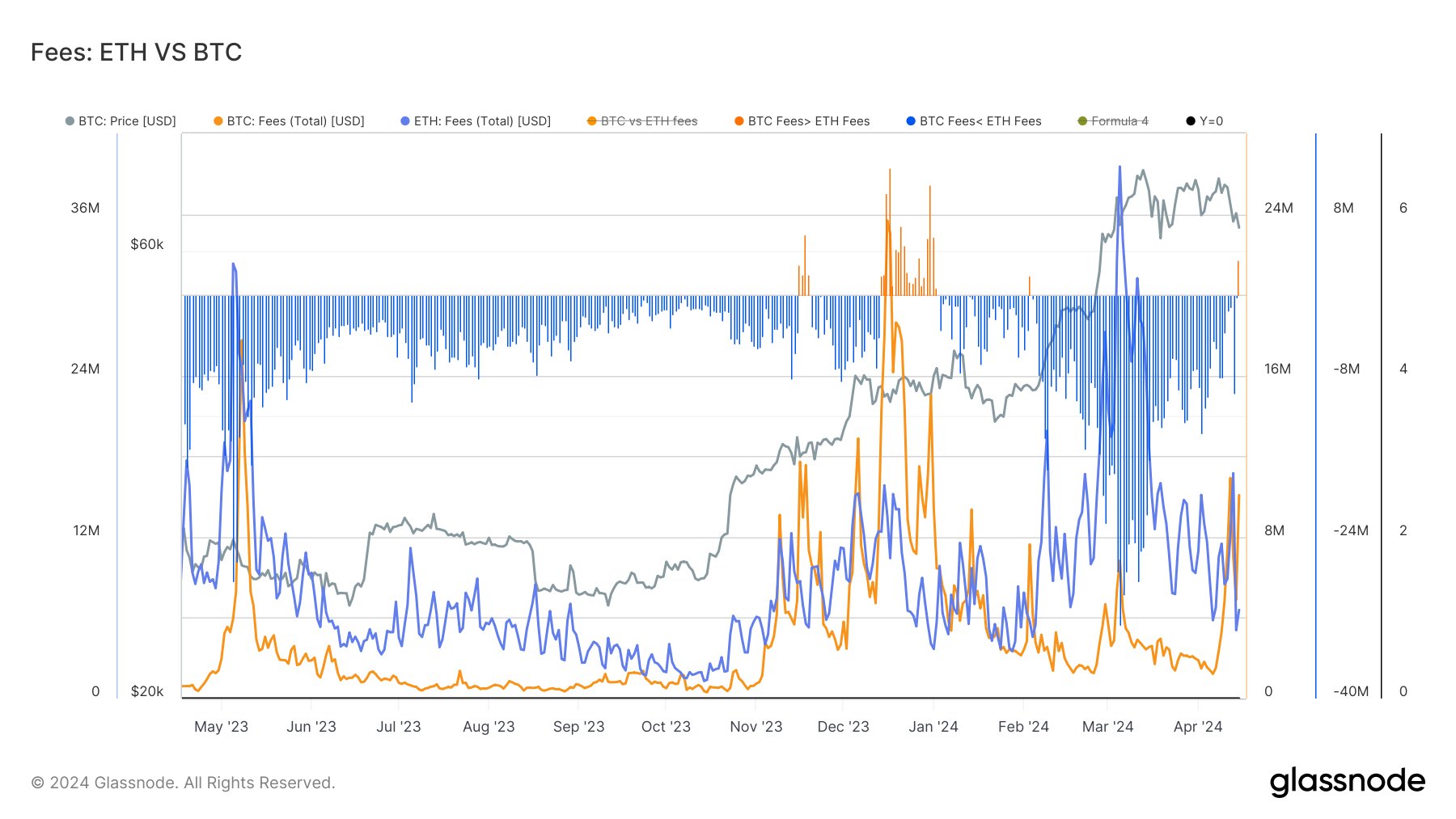

Although Bitcoin has already smashed its previous all-time high price from 2017, Ethereum is still lagging short of its $1,448 peak. Despite this fact, it seems that Ethereum is rebounding and is now crushing Bitcoin in terms of transaction fees generated.

It can be complicated to determine the underlying value of a blockchain-based network, especially when it has no traditional underlying assets to help guide the valuation. The transaction fees generated can, however, be a solid indicator of network activity.

Ethereum Network Rakes in the FeesFor the first time in its history, Ethereum has generated more total network fees, and by a significantly greater margin. According to Glassnode, an on-chain market analysis firm, Ethereum users spent 83% more in total network fees than with Bitcoin.

Referencing a Tweet by Glassnode CTO Rafael Schultze-Kraft, “In 2020, Ethereum flipped Bitcoin in terms of network fees. Users spent almost $600M in fees on the Ethereum network last year – 83% more than on Bitcoin.”

In 2020, Ethereum even managed to trump the fees on the Bitcoin network during its meteoric rise to its previous all-time high in 2017.

In 2020, #Ethereum flipped #Bitcoin in terms of network fees.

Users spent almost $600M in fees on the Ethereum network last year – 83% more than on Bitcoin.

Data: @glassnode pic.twitter.com/SMSHbkFHuC

In 2019, Ethereum generated less than $50 million in transaction fees. Even at its previous all-time high in 2018, Ethereum only generated slightly over $150 million in fees.

So what has made the total value of transaction fees increase this drastically on the Ethereum network?

One major contributor is the introduction of Decentralized Finance (DeFi) and decentralized apps.

At the end of 2019, there was well under $1 billion in total value locked in DeFi applications, which mostly run on the Ethereum network. These applications allow for financial transactions like loans, insurance, and exchange trading to take place without the need for a third party. This allows for much more competitive rates and more value returned back to the end-user.

By the end of 2020, there was over $16 billion in total value locked in DeFi, an increase of over 2,500 percent. This massive increase in DeFi app usage, driven by platforms like UniSwap and MakerDao, has led to a major increase in fees on the Ethereum network.

This has positive and negative benefits, as it indicates major increased usage of the platform, but also showcases the extremely high fees that users have to pay to transact.

The post Ethereum Flips Bitcoin in Yearly Network Fee Generation appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Santiment Network Token (SAN) на Currencies.ru

|

|