2020-11-11 23:29 |

Ethereum has been seeing immense underlying strength as of late due to the progress towards the ETH 2.0 network upgrade, which is expected to help drive further development activity and usage to the platform.

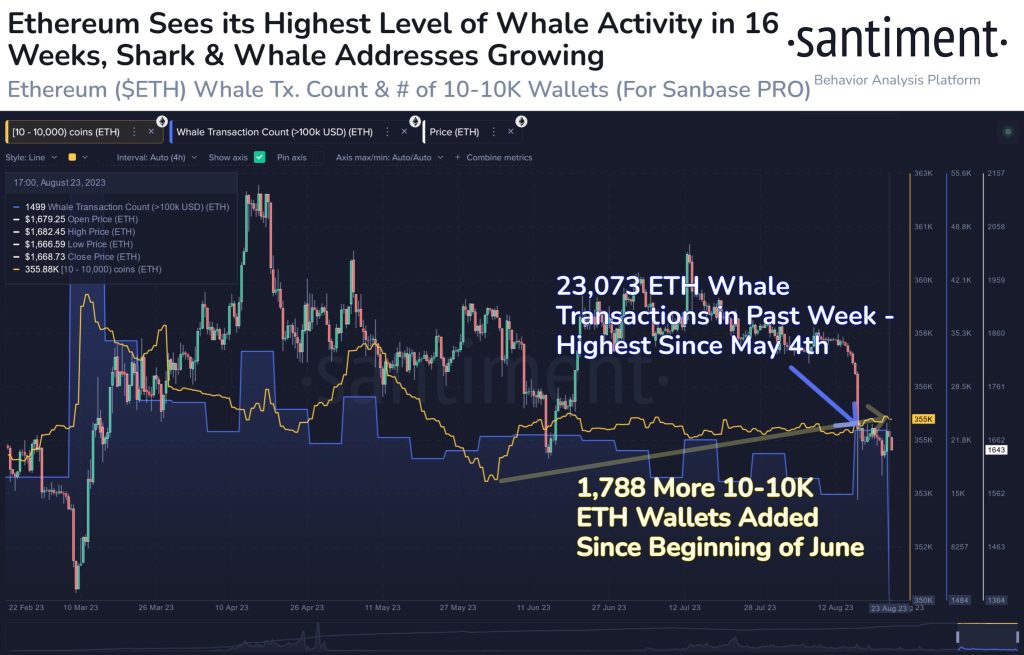

Investors are already in the process of gearing up for the transition to 2.0, with tens of thousands of tokens already locked in the ETH 2.0 staking contract. Once a certain threshold is met, Beacon Chain will be launched.

This has widely been looked upon as a bullish catalyst for the cryptocurrency. It will lock significant amounts of tokens within validator nodes and encourage further network usage and development activity.

This isn’t the only potential catalyst for upside that is currently in the pipeline, however, as Ethereum Improvement Proposal 1559 is also widely thought to provide the crypto with enhanced “tokenomics.”

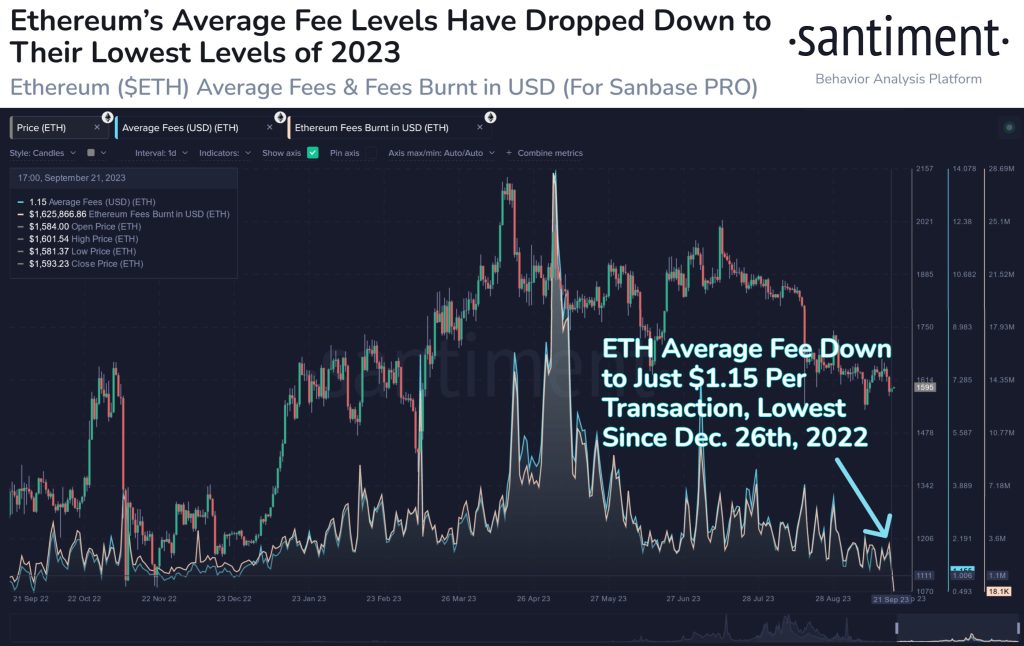

EIP-1559 to boost Ethereum’s underlying tokenomicsEIP-1559 was first put forth by Eric Conner and proposed that the majority of the ETH in each transaction fee is burned. It also established a “market rate” for block inclusion.

By burning the majority of each transaction fee, the network gains a deflationary facet. The more the network is used, the more ETH is burned.

Proponents of this improvement proposal are quick to note that it benefits all investors equally rather than just favoring large holders who can stake 32+ ETH in validator nodes.

It will also enhance how users transact with the network, removing the “auction-style” gas management system that forces users to bid up gas prices to have their transactions quickly processed.

Why this proposal could send ETH’s price rocketing higher in 2021Assuming it is passed, one analyst believes that it could significantly increase Ethereum’s price in the year to come.

One pseudonymous analyst pointed out that the annual issuance will be reduced from 4 percent to 1.5 percent, with this alone potentially sending ETH past $1,000 per token.

“EIP-1559 in 9 months. ETH has the possibility to become deflationary. Current issuance is 4% per year, same as BTC. ETH 2 will bringing down to 1.5%. A halving of its own just without the label. ETH is needed for everything… Gas. DeFi. Alts. Staking. Uniswap… $1,000+ in 2021”

The confluence of EIP-1559 and ETH 2.0 could provide Ethereum with some immense upwards momentum in 2021 and beyond, enhancing its usability, encouraging more utilization, and improving its tokenomics.

The post This analyst thinks EIP-1559 could send Ethereum past $1,000 in 2021 appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|