2025-6-12 05:30 |

Ether (ETH) at $2,770, up nearly 11% this month, outperforming Bitcoin’s (BTC) 5% rise. ETH (45.2%) now overshadows BTC (38.1%) in trading volume on OKX’s perpetual futures market. Despite BTC volatility, institutions are “buying the dips,” with long-term holder supply growing, per Glassnode.

As Asian markets kicked off their Thursday trading, Ether (ETH) was changing hands at $2,770, having demonstrated robust performance throughout the month.

This strength, particularly in derivatives markets where it’s reportedly overshadowing Bitcoin (BTC), signals a growing institutional appetite for Ethereum’s structural growth potential and its pivotal role in bridging decentralized finance (DeFi) with traditional finance (TradFi).

Meanwhile, the broader crypto landscape is seeing a significant surge in stablecoin activity, with Tron emerging as a key beneficiary.

Ether has notably outperformed Bitcoin this month, with CoinDesk market data showing an almost 11% rise for ETH compared to BTC’s 5% gain.

This divergence is partly attributed to increasing institutional trading demand for Ethereum. Lennix Lai, Chief Commercial Officer at crypto exchange OKX, told CoinDesk in an interview that sophisticated investors are increasingly betting on ETH, a trend evident in its derivatives market activity.

“Ethereum is overshadowing BTC on our perpetual futures market, with ETH accounting for 45.2% of trading volume over the past week. BTC, by comparison, sits at 38.1%,” Lai revealed.

This finding aligns with similar trends observed on other major derivatives platforms like Deribit, as CoinDesk recently reported, suggesting a significant shift in how institutional players are allocating capital within the crypto space.

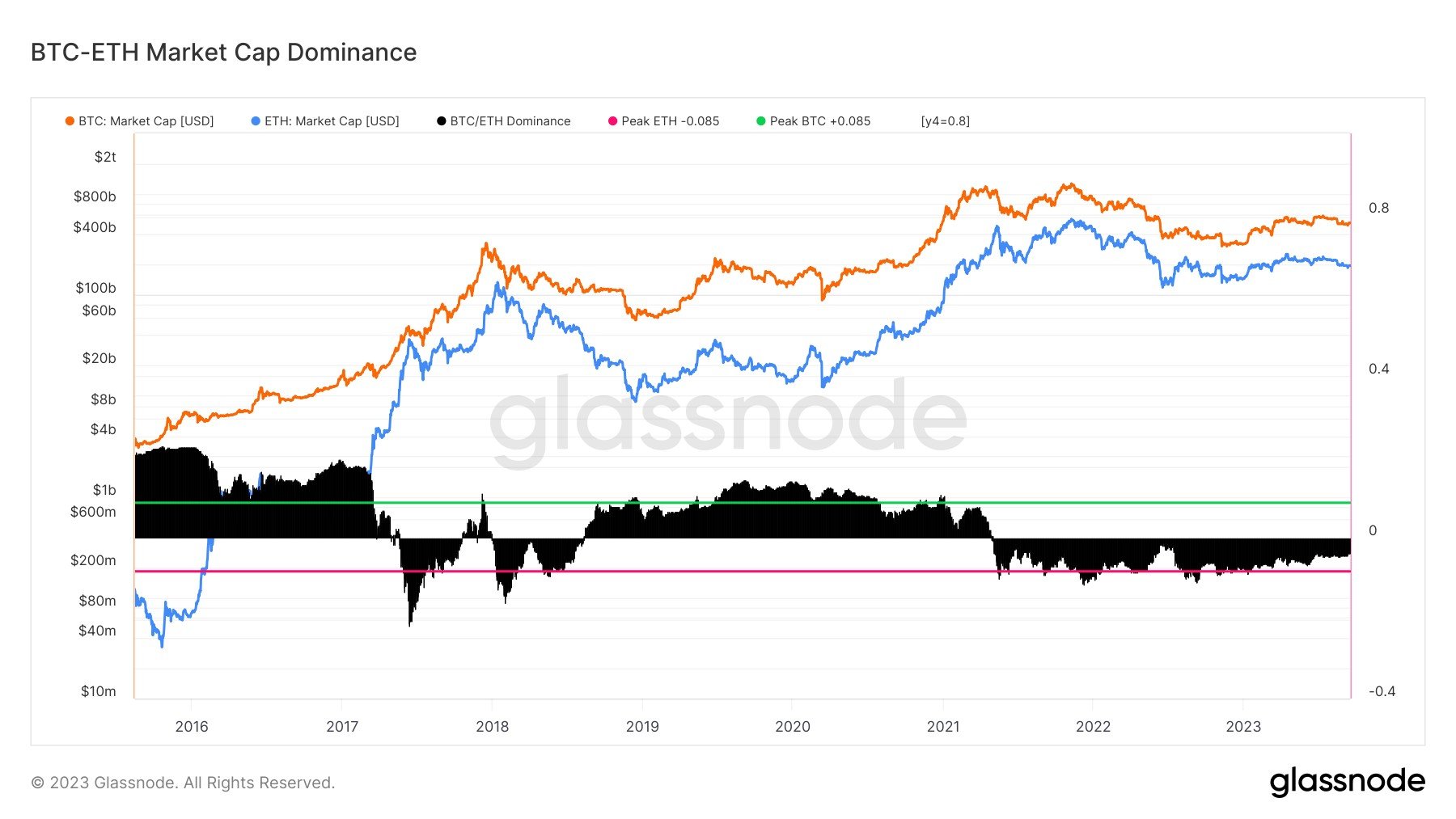

This isn’t to say that institutional interest in Bitcoin has waned. A recent report from on-chain analytics firm Glassnode indicates that despite Bitcoin’s recent price volatility, institutions have been actively “buying the dips.”

Glassnode’s analysis showed that long-term holders (LTHs) realized over $930 million in profits per day during recent BTC rallies, a distribution level rivaling those seen at previous market cycle peaks.

Remarkably, instead of triggering a broader sell-off, the supply held by these LTHs actually grew.

“This dynamic highlights that maturation and accumulation pressures are outweighing distribution behavior,” Glassnode analysts wrote, noting that this is “highly atypical for late-stage bull markets.”

Despite these underlying strengths, both leading cryptocurrencies remain susceptible to geopolitical risks and unpredictable “black swan” events, such as the recent public dispute between US President Donald Trump and tech billionaire Elon Musk.

Such episodes serve as stark reminders that market sentiment can shift rapidly, even within structurally strong markets.

However, beneath this surface-level volatility, institutional conviction appears to remain intact.

Ethereum is increasingly being viewed as the preferred vehicle for accessing regulated DeFi opportunities, while Bitcoin continues to benefit from long-term accumulation by institutions, often via Exchange Traded Funds (ETFs).

“Macro uncertainties remain, but $3,000 ETH looks increasingly likely,” Lai concluded, offering a bullish outlook for Ethereum’s near-term price potential.

Stablecoin surge: liquidity pours in, Tron leads the chargeThe stablecoin market is experiencing a significant boom, recently hitting an all-time high market capitalization of $228 billion, marking a 17% increase year-to-date, according to a new report from CryptoQuant.

This surge in dollar-pegged liquidity is being driven by renewed investor confidence, buoyed by factors such as the blockbuster Initial Public Offering (IPO) of stablecoin issuer Circle, rising yields in DeFi protocols, and improving regulatory clarity in the US This influx of capital is quietly redrawing the map of where liquidity resides on-chain.

“The amount of stablecoins on centralized exchanges has also reached record high levels, supporting crypto trading liquidity,” CryptoQuant reported.

Their data indicates that the total value of ERC20 stablecoins (those built on Ethereum) on centralized exchanges has climbed to a record $50 billion.

Interestingly, most of this growth in exchange stablecoin reserves has been a result of the increase in USDC reserves on these platforms, which have grown by 1.6 times so far in 2025 to reach $8 billion.

When it comes to the blockchain protocols benefiting most from these stablecoin inflows, Tron has emerged as the clear leader.

Tron’s combination of fast transaction finality and deep integrations with major stablecoin issuers like Tether is credited with making it a “liquidity magnet.”

Presto Research, in a recently released report echoing these findings, noted that Tron notched over $6 billion in net stablecoin inflows in May alone.

This figure topped all other chains and positioned Tron with the second-highest number of daily active users, just behind Solana.

Tron was also the top performer in terms of native total value locked (TVL) growth.

In contrast, both Ethereum and Solana experienced significant stablecoin outflows and losses in bridge volume during the same period, according to Presto’s data.

This suggests a potential lack of new yield opportunities or major protocol upgrades attractive enough to retain or draw in fresh stablecoin capital on those networks.

Presto’s data confirms a broader trend: institutional and retail capital alike are increasingly rotating towards alternative Layer 1 and Layer 2 solutions like Base, Solana (despite recent outflows, it still attracts users), and Tron.

The common denominators among these favored chains appear to be faster execution speeds, more dynamic and evolving ecosystems, and, in some cases, more substantial incentive programs.

The post Ether outperforms Bitcoin in May; ETH derivatives volume surpasses BTC on OKX appeared first on CoinJournal.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|