2019-8-8 02:14 |

UltrAlpha, the innovative comprehensive digital asset management service platform, announced that Algoz, the cryptocurrency arm of an algorithm-based trading company Fingenom Group, will join its upcoming test platform launch. Alpha Pro, another crypto asset manager with a founding members of being seasoned Wall Street insiders as well as blockchain pioneers, is also launching its digital asset management product on the UltrAlpha.

1.Current Market Development in Digital Asset Management Service Industry

With increasing recognition of digital assets all across the globe, a growing number of professional investment institutions are actively looking for opportunities to enter the digital asset market. However, one of key challenges in the space is that potential investors have limited access to suitable financial products for their investment consideration, while trading teams or digital asset managers find it difficult to get to the right investors for fundraising. This is mostly due to the lack of formal broker dealer structure in the digital asset space.

In the traditional finance industry, broker dealers play an integral role in the capital market where they connect potential investors with eligible investment products, as well as support clients in their trading and capital raising activities. However, this broker dealer function is yet to be fully developed in the digital asset industry with less clarity on overall regulatory framework.

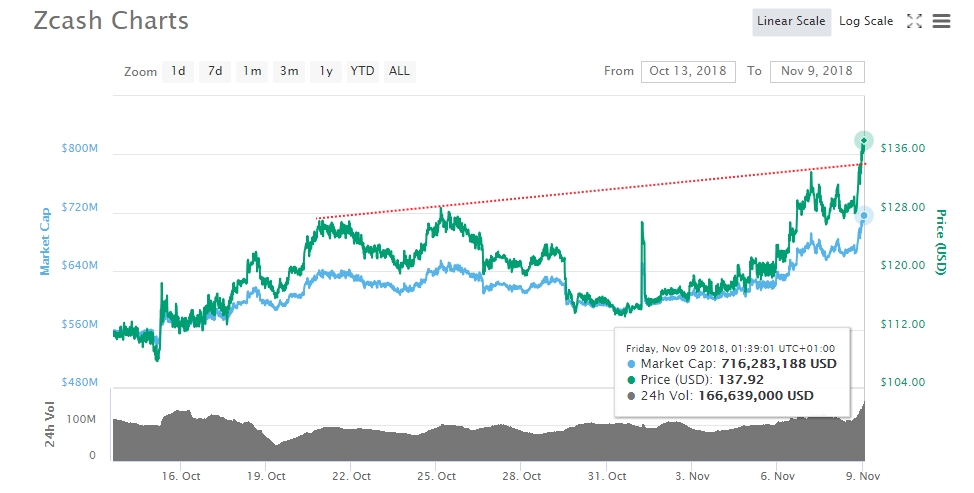

Furthermore, with lack of mature market structure and nascent development stage, the digital asset trading market has been quite volatile with inconsistent liquidity and inefficient price discovery, especially during the recent months of rapid price recovery led by bitcoin after the earlier harsh crypto winter. This unpredictable market condition has proved challenging for certain fund managers to generate consistent return, while turned out to be more opportunistic for other trading firms with volatility-driven strategies.

2. The Strategic Partnership between Two Top-tier Asset Mangers and One Innovative Service Platform

Driven by the market needs, UltrAlpha is seeking to build out its comprehensive product offering and service capabilities as an innovative digital asset management service platform through the strategic partnership with two industry top-tier asset managers, Algoz and Alpha Pro.

UltrAlphaBuilding on deep strategic collaboration with all the top-tier digital asset exchanges and brokers, UltrAlpha strives to provide investors with a professional investment platform for selecting quality investment products, as well as to effectively support fund raising and other admin needs of trading teams and crypto funds. The wide range of fund administrative services for trading teams and funds can include but not limited to account management, performance auditing, PL reporting, asset transfer, etc.

UltrAlpha’s core teams of technology and operations come from traditional finance, Internet and Blockchain industries with solid experience in quant modeling, infrastructure buildout and digital asset trading operations. Computer science major from Carnegie Mellon University, Han Liu, CEO of UltrAlpha, has developed his successful career in traditional asset management industry from BlackRock to AQR Capital Management specializing in institutional application and platform development. Christina Jin, CMO of UltrAlpha, graduated from University of Auckland and New York University, with degree in Digital Marketing. Christina co-founded Ankr Network project and was nominated as the first CMO of Ankr project.

AlgoZ is a part of the Fingenom Group – a company which stands for cracking the code of investments and creating the world’s quality trading algorithms. Equipped with Fingenom’s propriety trading algorithms, AlgoZ team of professional traders, with over a decade of experience in proprietary trading and deep understanding of both traditional and crypto markets, strives to provide AlgoZ clients with well-rounded trading solutions 24 by 7.

For specific trading product as part of UAT test launch, Algoz deploys Long/Short Alpha Links strategy to examine statistical differences and correlations between various crypto asset pairs for trading signals based on Algoz traders’ deep understanding of the crypto markets and their momentum drivers.

Alpha Pro will bring its dynamic market making and arbitrage strategies with solid track record to the UltrAlpha Platform. To cope with high volatile market, the trading strategies have more than 20 trading parameters that can be fine-tuned to adapt to a different market within very short period of time.

To balance the risk and optimize the return, the strategies employ strong set of risk control mechanism with built-in delta-neutral consideration, stop loss and adjustable market sensitivity and automatic trading volume control.

Building on its experience with Forex trading, Alpha Pro team aims to create the optimal path of arbitrage loop with efficient price discovery across different exchanges to optimize the return.

3. Conclusion

The strategic partnership of UltrAlpha with both Alpha Pro and AlgoZ trading teams is critical to the UAT platform further building out the necessary market structure to serve user needs as well as to support longer-term platform growth. By connecting potential investors with digital asset managers and providing value-added fund admin services, UltrAlpha has clearly set itself as a pioneer as professional service provider in the expansion and development of this newly developing digital asset management space. “While UltrAlpha aims to build a service platform which provides investors with a broad selection of quality digital asset management products, we do not provide direct investment advice for investors.” said Han Liu, CEO of UltrAlpha. “But it is a wise choice to leverage our platform and identify the products that suit their investment need.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Dix Asset (DIX) на Currencies.ru

|

|