2023-9-8 10:54 |

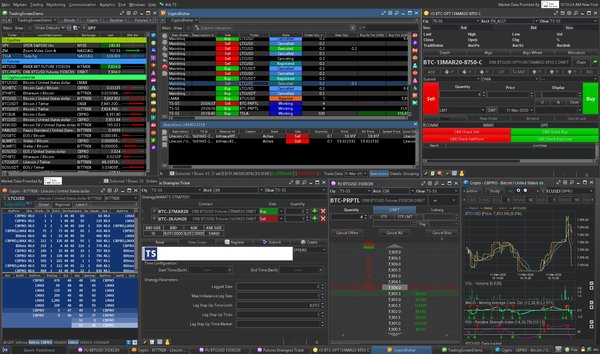

Almost half the 60 buy-side professionals surveyed from U.S. and Europe-based asset managers and hedge funds said they're actively managing digital assets. origin »

Bitcoin price in Telegram @btc_price_every_hour

Dix Asset (DIX) на Currencies.ru

|

|