2020-10-22 23:33 |

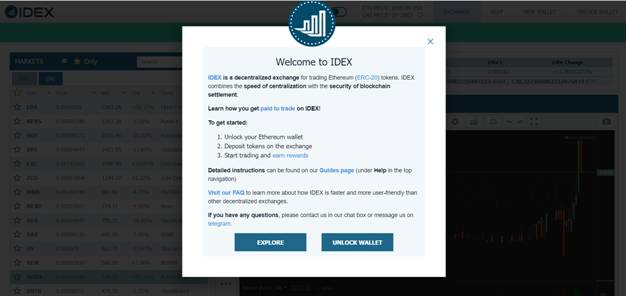

IDEX has launched a new update called IDEX 2.O promising to enhance user experience on decentralized exchanges (DEX) amid growing popularity and users. The hype around defi (decentralized finance) in 2020 has propelled DEX's to the forefront of discussions.

IDEX 2.0 is solely focused on improving the user interface and how consumers interact with DEX's. While decentralized exchanges have been in the game for quite some time, centralized exchanges (CEX) have garnered all the attention and transaction volume.

IDEX is promising to bridge the gap between centralized and decentralized exchanges for users. Among the prominent changes that come with the version, 2.0 include front-running and failed-transactions. Failed transactions have been the biggest Achilles heel for the DEX. With IDEX 2.0, users won't have to sacrifice the ease of maintaining and using truly decentralized platforms.

Alex Wearn, the IDEX CEO, addressed the issues which have plagued and limited the reach of decentralized exchanges and said,

“Decentralized exchanges put the users ‘closer’ to the blockchain. This means that they have to deal with some of the shortcomings of blockchains themselves.

In particular, this could include things like long wait times for transaction and trade execution. The open nature also exposes users to issues like front-running and trade failures.”

IDEX 2.0 promises to improve on this concerning issue and offer several improvements over the existing systems. Some of the key features include,

Frictionless onboarding, if you've traded on any centralized exchange, then you will know how to use IDEX 2.0 Instant trade execution Front-running protection Guaranteed trade settlement Private order books Capacity for thousands of users and hundreds of thousands of orders per second DEX Protocols Have Highest Transaction Failure RatesUniswap, one of the most popular DEX's which has seen a significant bump in the transaction volume; in fact, it has generated more volume than many mainstream centralized exchanges on several occasions. Despite such heightened popularity and user growth, Uniswap has also registered significantly higher translation failure rates.

As per a report published by Dex Tokenlon, Uniswap registered a whopping 22%+ failure rates during the peak trading hours as of the first couple of weeks in September. While the success of defi has been quite unprecedented, so was the transaction failure rate. This could prove to be one of the biggest points of frustration for active users and traders and, in many cases, turn away the new users.

Apart from Uniswap, many other popular Dex has registered similar failure rates, and in many cases, a defer rate of 10%. IDEX, in its report, noted that these DEX are required to “keep order matching and execution off-chain, guaranteeing successful trades all while keeping the user in control of their assets.”

The post Decentralized Exchange IDEX Launches v2.0 With A Heavy Focus on Enhancing User Experience first appeared on BitcoinExchangeGuide.

origin »Bitcoin price in Telegram @btc_price_every_hour

Decentralized Machine Learning (DML) на Currencies.ru

|

|