2020-10-21 18:45 |

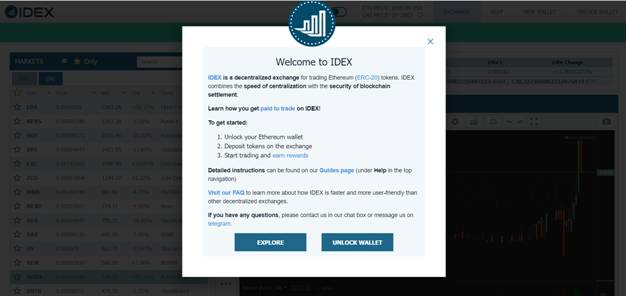

IDEX, a leading decentralized cryptocurrency exchange (DEX), today launched a new version that addresses the UX issues that have held back DEX adoption such as front-running and failed transactions. Over the long term, IDEX aims to eliminate the performance gap between centralized (CEX) and decentralized (DEX) exchange. To wit, IDEX has abstracted away the decentralized functions and now offers traders an optimized environment.

“Decentralized exchanges put the users ‘closer’ to the blockchain,” said IDEX co-founder and CEO, Alex Wearn. “This means that they have to deal with some of the shortcomings of blockchains themselves. In particular this could include things like long wait times for transaction and trade execution. The open nature also exposes users to issues like front-running and trade failures.”

Most decentralized exchanges provide a notoriously fickle experience, frustrating users with their lack of reliability. According to analysis from Token Ion, DEXs like Uniswap can have greater than 20% failure rates for trades during peak times. Likewise, other industry-leading DEXs still revert about 5 to 10% of all transactions. Additionally, the open ledger and on-chain matching systems of these DEXs invite bad actors to front-run trades and disrupt fair and seamless transactions.

Today, IDEX offers traders the same user experience as a centralized exchange but without taking control of user’s funds. Balancing decentralization with UX, IDEX keeps order matching and execution off-chain, guaranteeing successful trades all while keeping the user in control of their assets.

With the new IDEX 2.0, traders can expect the following:

Frictionless onboarding; if you’ve traded on any centralized exchange then you will know how to use IDEX 2.0Instant trade executionFront-running protectionGuaranteed trade settlementPrivate order booksCapacity for thousands of users and hundreds of thousands of orders per secondFurthermore, IDEX has streamlined support for market makers with a simple API that matches the format of centralized exchanges. High-frequency traders (HFTs) can now trade continuously without waiting for transactions to mine, and they can place or cancel orders as fast as they would on a CEX.

Following its UX update, IDEX 2.0 will continue to add new features and upgrades in three phases. The phased rollout minimizes risk by isolating each major change and prioritizing security of the system. In its next phase, IDEX will roll out a layer-2 scalability solution that will virtually eliminate gas fees.

origin »Bitcoin price in Telegram @btc_price_every_hour

DEX (DEX) на Currencies.ru

|

|