2020-9-30 10:30 |

This week the research and analysis team Coin Metrics published a report on how decentralized finance (defi) is “fueling Ethereum’s growth.” Meanwhile, the researchers also highlighted that Ethereum’s cumulative transaction fees in 2020 are now over $350 million and more than double the aggregated total of Bitcoin’s network fees.

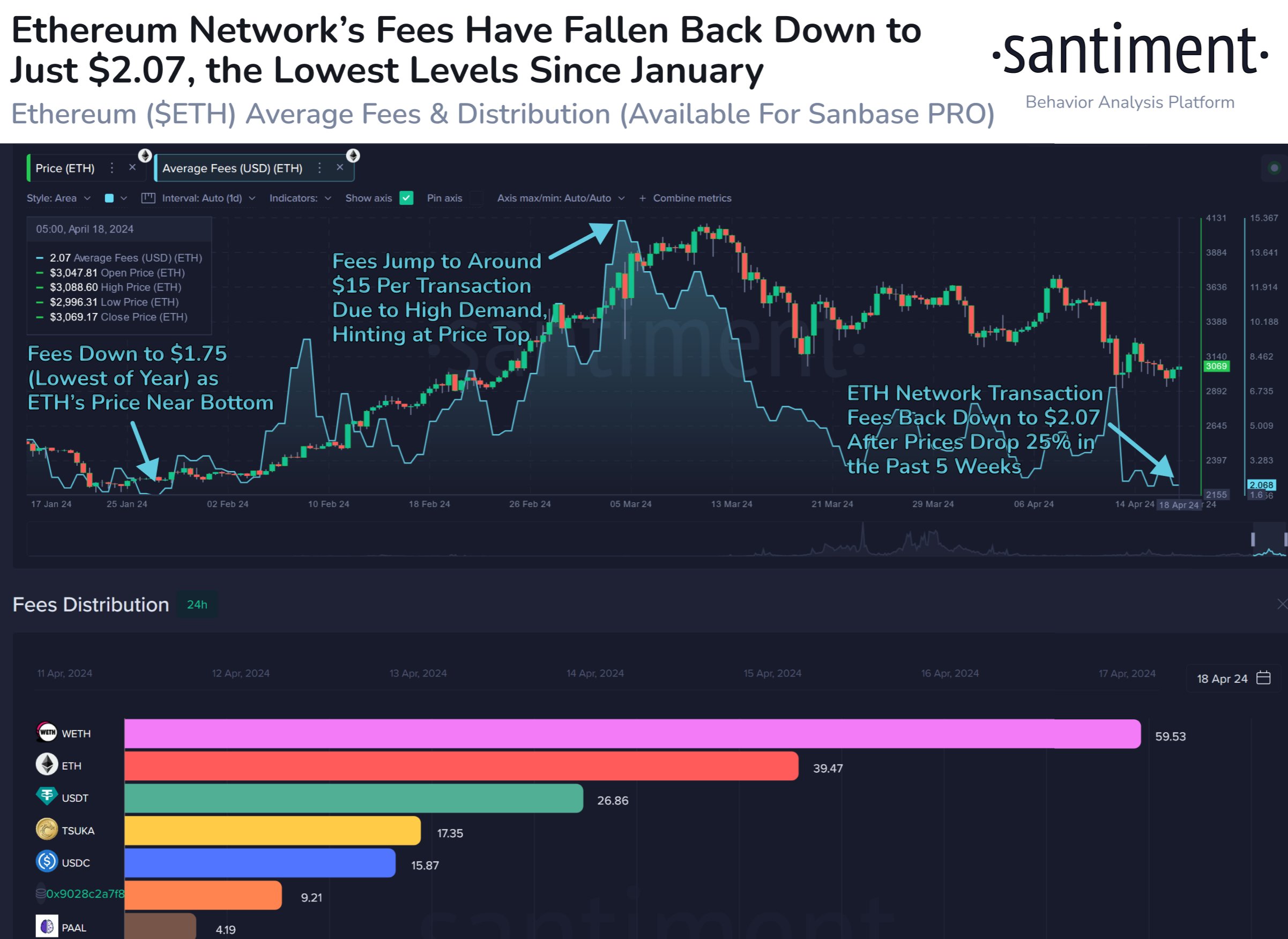

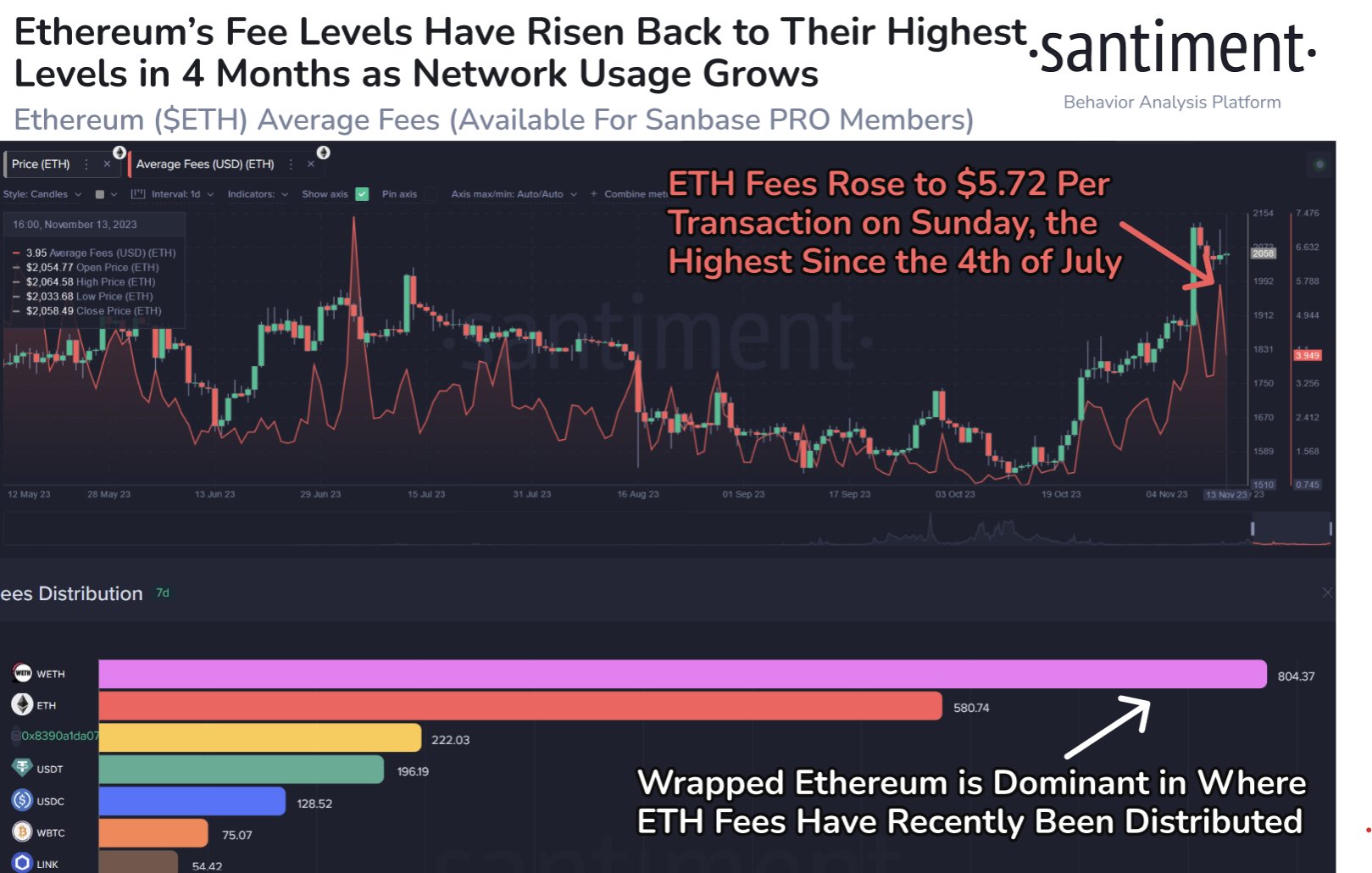

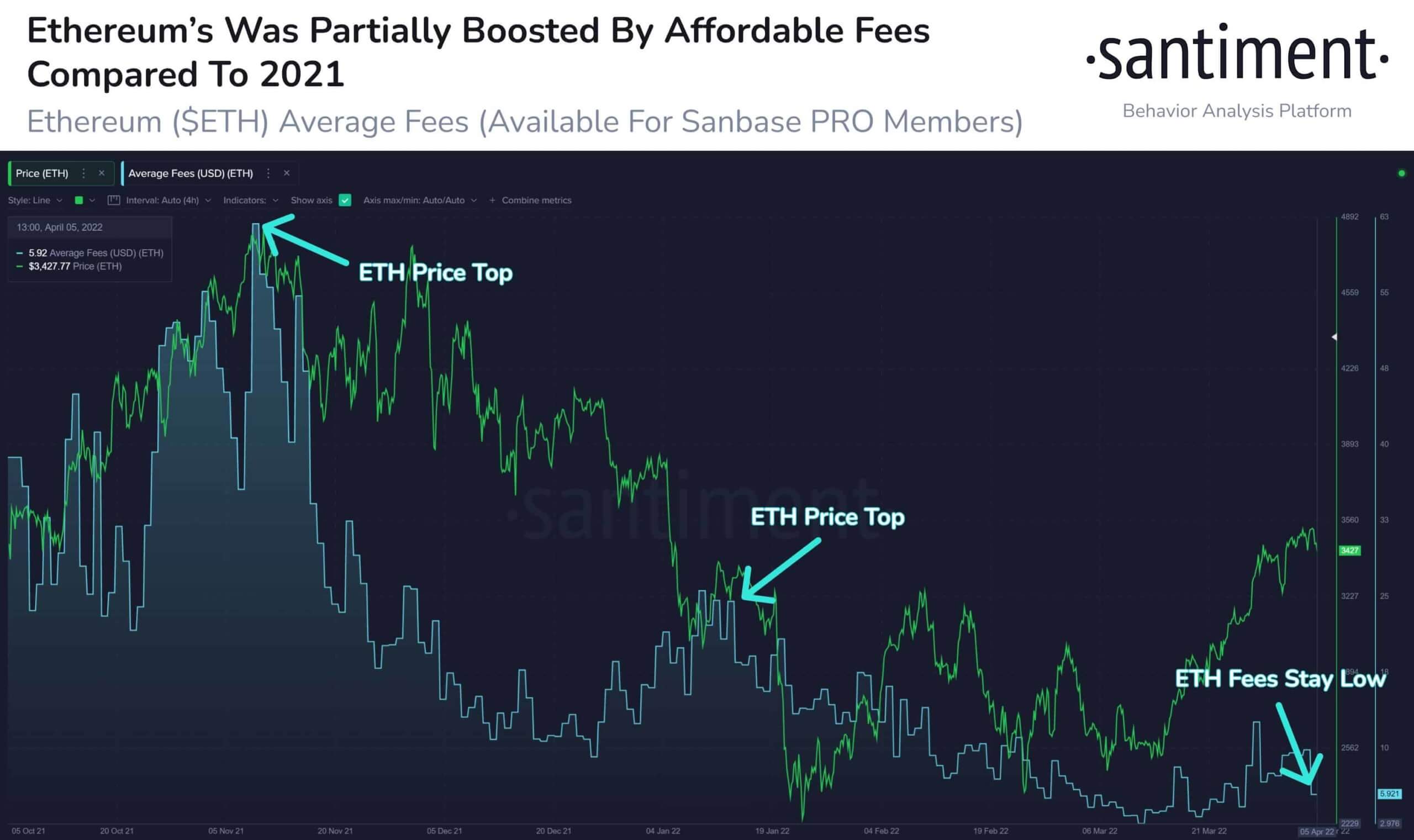

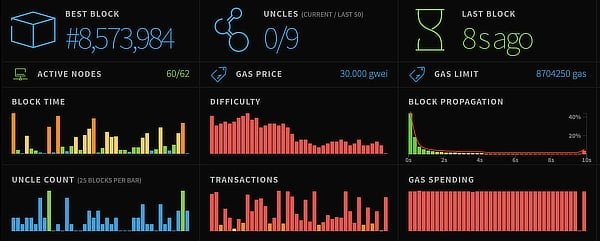

Coin Metrics researchers and Nate Maddrey published a new report that discusses Ethereum’s defi evolution and the growth the blockchain has seen this year. However, with the new demand Coin Metrics highlights that ETH fees have “changed dramatically” and the authors note “high gas prices are becoming the new norm.”

A few defi project launches contributed to the dramatic rise in network fees including UNI, SUSHI, YAM, and YFI. The trading of the new tokens has been more prevalent on decentralized exchange (dex) platforms and because swaps are onchain this created a fee market. “This can lead to escalating transaction fees as users compete to be first in line for a trade,” the report emphasizes.

“ETH median transaction fee hit a new all-time high of $8.25 on September 2nd following the launch of SUSHI,” the study’s author adds.

On Twitter, the Coin Metric’s team published a chart that shows Ethereum network fees this year are double the size of BTC’s 2020 fees. “Ethereum Total Transaction Fees during 2020 are now over $350m and more than twice Bitcoin’s,” the team’s Twitter account wrote. “By comparison, this time last year, cumulative Bitcoin Transaction Fees were $135M and Ethereum Transaction Fees were $27M,” the researchers added.

The report says that distributed ledger network fees are a “double-edged sword.” Essentially users are paying higher fees but miners are gathering all the revenue and in turn, the hashrate has increased exponentially. “As a result, Ethereum’s hash rate is climbing towards all-time highs— This is a good sign for Ethereum, as network security is critical for the long-term health and success of the blockchain.”

Although, the researchers underline that higher gas fees can make the ETH chain “prohibitively expensive” for a certain fraction of users. This can tip the scales for Ethereum whales who can swap large sums of tokens while smaller players could face a barrier to entry. “Ethereum’s median transfer value has increased to hundreds of dollars since the rise of defi, signalling that the network is shifting towards larger players,” the report points out.

What do you think about Ethereum fees growing double the size of Bitcoin’s network fees in 2020? Let us know what you think in the comments section below.

The post Cumulative Ethereum Transaction Fees in 2020 Supersede Bitcoin’s by a Long Shot appeared first on Bitcoin News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|