2021-12-3 20:00 |

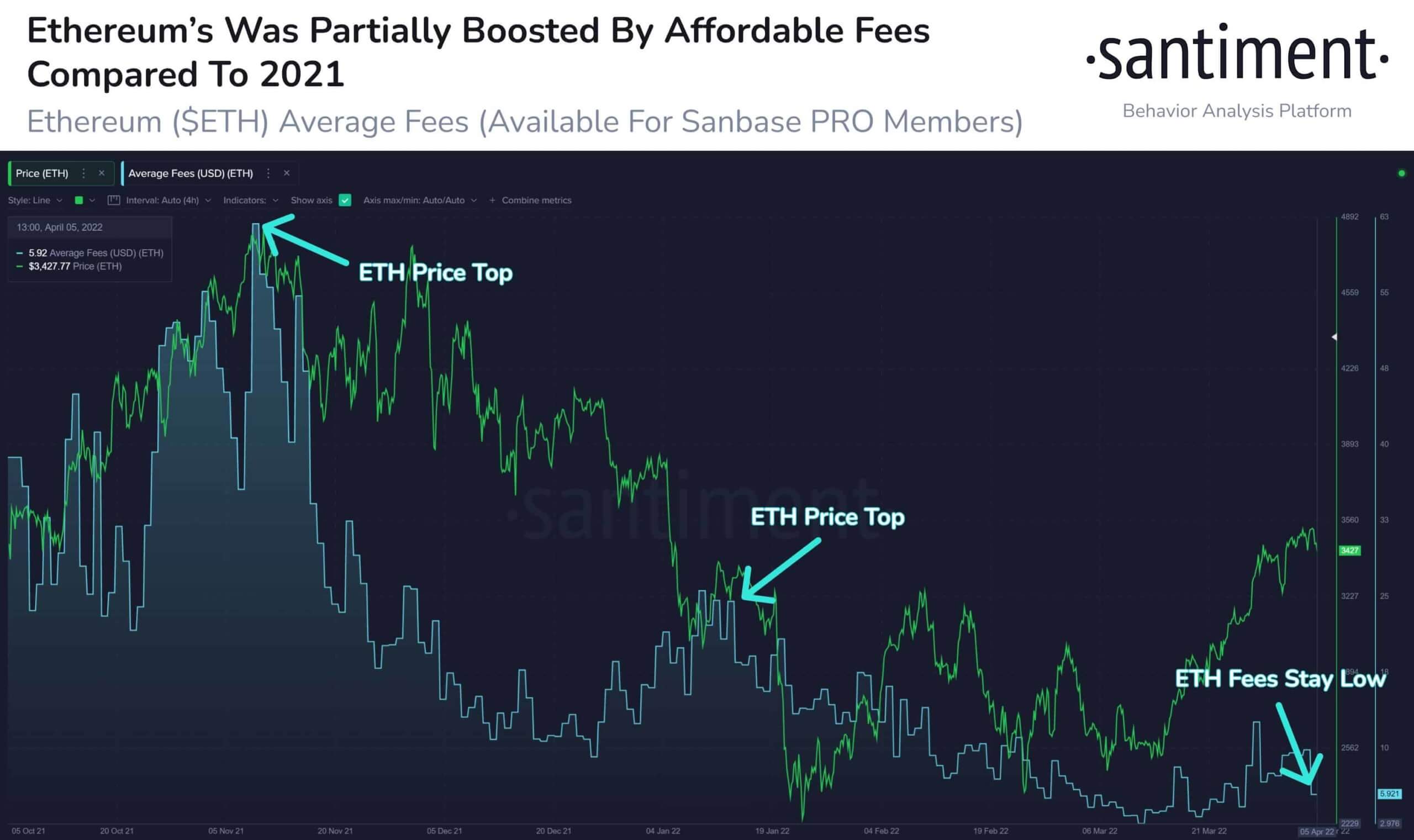

The high fees on the Ethereum network has become a concern after it had risen to the point where using ETH for small transactions became unfeasible. Users of the network realized that they were sometimes having to pay fees higher than the transaction amount, leading to calls for a solution.

There have been numerous fixes put forward to curb this issue, the most recent one being from Ethereum founder Vitalik Buterin himself. However, this problem persists and with it has come a wide divide between investors who can afford to pay the fees and those who cannot.

Average Trade Size On The RiseFigures out of the DeFi space show that the market is moving out of smaller traders’ hands into whale territory. Decentralized finance offers investors an alternative to traditional finance which usually has a huge entry barrier but now, small investors are finding it increasingly harder to take advantage of services that were created with them in mind.

Related Reading | Only In Crypto: A Croissant Says Ethereum Will Be One Of World’s Most Productive Assets

Kaiko published a research note on Monday that highlighted the growing issues in the DeFi space, one of these being an increase in average trade sizes in the space. The report focused on DEXs and their growing value. On average, trade volume on these marketplaces has grown after peaking in May. This would be a happy occurrence if fees had not grown so high on the Ethereum network.

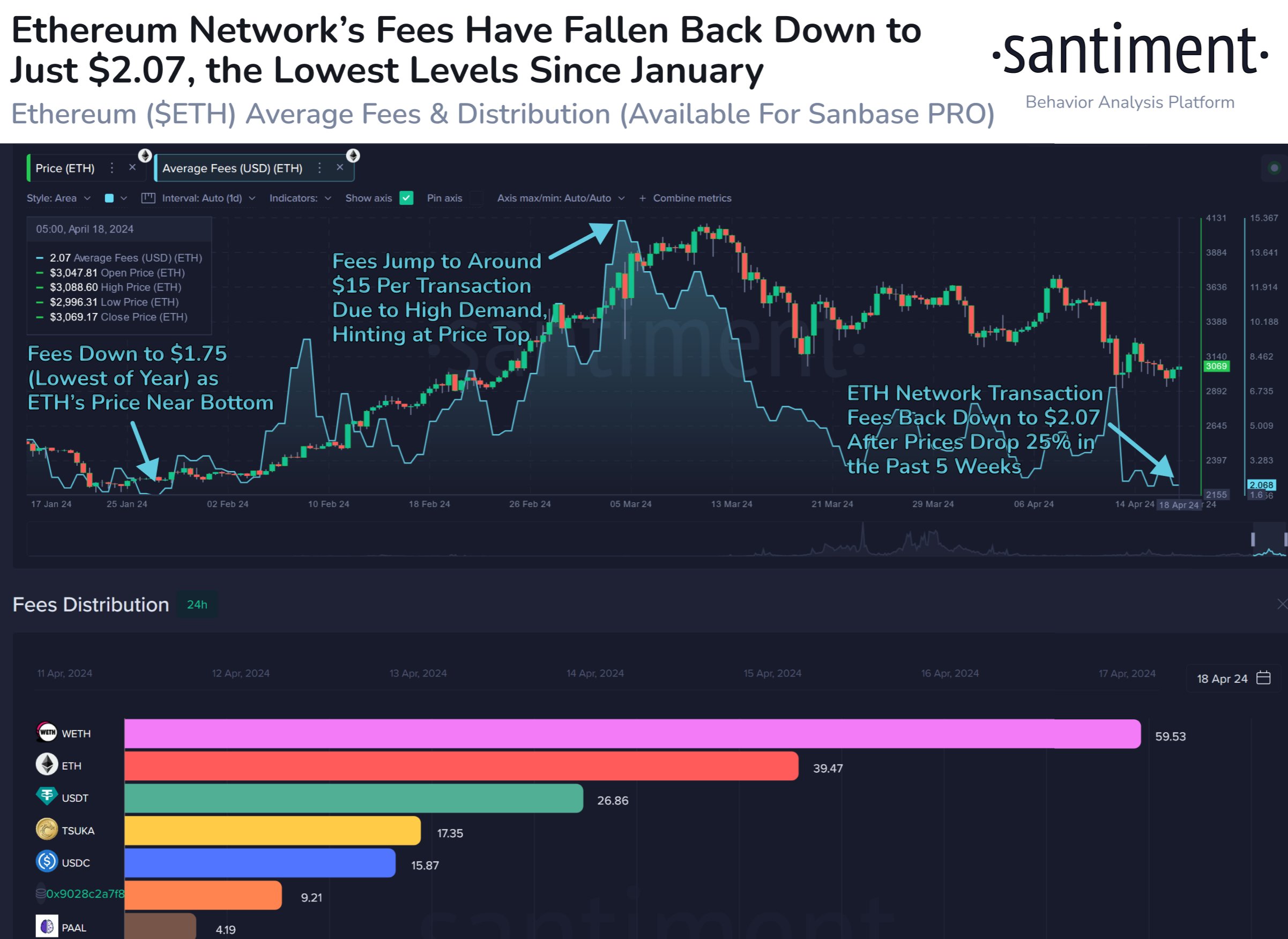

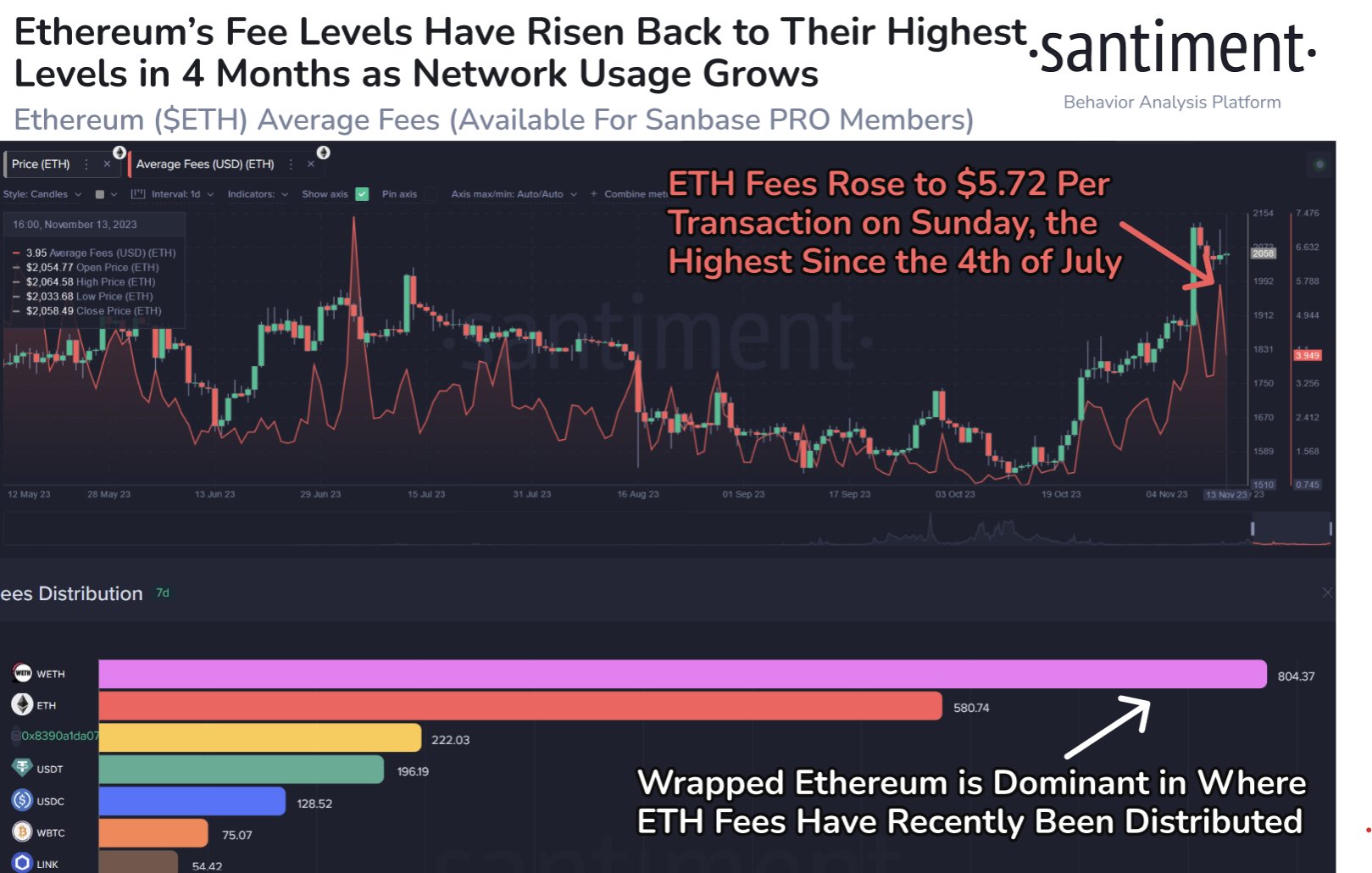

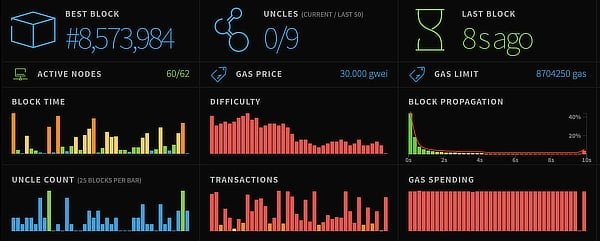

Ethereum hosts the majority of the DeFi activity making it the network of choice for investors. However, fees on the network have remained on the rise, with values touching up to $100 per transaction.

ETH trading above $4,600 | Source: ETHUSD on TradingView.comIn tandem with this has been the rise of the average trade size on DEXs in the space. Data from Kaiko’s research note shows that the average trade size on Curve has grown to between $500 to $1 million per trade.

Whales Are Taking Over DeFiCurve was not the only DEX to see a marked increase in the average trade size. DEXs all across the DeFi space have recorded higher daily trade sizes. Centralized exchanges usually see an average trade size of $2k to $4k per trade. Compared to this, the average daily trade sizes for DEXs are $10Kk to $20k.

Related Reading | New Study Says Ethereum May Become A Better Inflation Hedge Over Bitcoin

The research note attributes this growth in trade sizes to the high transaction fees on the Ethereum network. Instead of doing multiple transactions and paying large fees each time, DeFi users are opting to do single large transactions to save on fees.

Kaiko explains that this backs up data published by Chainlysis that said “whale traders” make up the majority of trades on DEXs.

“What is interesting to note is that average trade sizes have increased on all DEXs over the past few months while the actual number of trades has stayed flat, which suggests that the profile of the average trader now skews more ‘whale’,” the note read.

Featured image from RetBranche, chart from TradingView.com origin »Bitcoin price in Telegram @btc_price_every_hour

Santiment Network Token (SAN) на Currencies.ru

|

|