2022-11-2 01:05 |

The biggest news in the cryptoverse for Nov. 1 includes Coinbase arguing that SEC’s lawsuit against Ripple caused $15 billion in losses for retail traders, Hackers stealing about $760 million in 44 hacks in October, and top 50 Dogecoin holders selling off $110 million worth of DOGE in the last seven days.

CryptoSlate Top Stories Top 50 Dogecoin holders unloaded $110M worth of DOGE over the past weekLookonchain data reveals that the top 50 Dogecoin (DOGE) investors hold 87.1 billion representing about 63.71% of Dogecoin’s total circulating supply.

Over the last seven days, the top 50 Dogecoin holders have reportedly sold 761 million tokens worth about $110 million. However, they seem to be refilling their bags, as 484 million DOGE was bought in the last 24 hours.

Development bank of El Salvador refuses to disclose country’s Bitcoin acquisition recordsEl Salvador’s Anti-Corruption Legal Advisory Center (ALAC) had requested that the country’s apex bank BANDESAL provide detailed information on its Bitcoin purchase process and the account balances.

The apex bank has declined the request stating that the information is confidential to the state and not available for public consideration.

Dogecoin x Twitter: The worst kept secret in cryptocurrency?Elon Musk has on several occasions revealed his interest to make Dogecoin a payment token for his companies including Twitter.

According to an investigation by @CroissantETH, Elon Musk’s purchase of x.com domain and the Twitter acquisition under X holdings may be linked to his plans to build a blockchain-based social media platform. However, users may have to pay a tiny amount in Dogecoin to send messages on the blockchain.

“so you’d have to pay maybe 0.1 Doge per comment or repost of that comment” Musk said.

Hackers have stolen $2.98B via exploits in the crypto industry so farBlockchain security firm PeckShield’s report shows that 53 DeFi protocols lost roughly $760 million to 44 exploits, in October 2022.

Year-to-date, the crypto industry has lost about $2.98 billion to DeFi hacks, which has doubled the $1.55 billion reportedly lost in 2021.

Coinbase argues SEC’s XRP lawsuit caused $15B in losses for retail tradersCoinbase in its amicus brief filing in support of Ripple claimed that the SEC’s order mandating U.S.-based crypto exchanges to delist XRP caused retail investors to lose about $15 billion, following XRP’s market cap decline.

Coinbase also argued that SEC’s “extensive enforcement scrutiny” against Ripple was discriminatory as it left other firms offering identical products.

Crypto employment revolution is already quietly underwayCoinmetro CEO Kevin Murcko in a conversation with CryptoSlate, noted that there has been a gradual migration of Traditional finance (TradFi) workers into crypto. The upside is that many of the TradFi workers who delved into crypto have seen their salaries explode up to five times.

Murcko highlighted that the dark side of the deal happens when legacy firms like ING are secretly advancing their cryptocurrency research efforts, while publicly expressing negative remarks about crypto.

Uptober: Bitcoin jumps 6% while DXY and gold post negative returnsHistorically September has been a red month for Bitcoin, while October has helped return the trend to the green zone. By the end of October 2022, Bitcoin crossed the $20,000 resistance level, after gaining over 6%, a significant recovery from the -3.1% decrease recorded in September.

While Bitcoin reclaimed its Uptober narrative in October, the U.S. dollar. The U.S. dollar index (DXY) ended the month in red at 111.54, down from its start of 113.32. Similarly, the price of Gold declined from a high of $1,730 to close at $1,630.

Research Highlight Destroying demand: Fed will keep hiking interest rates longer than you can stay solventCentral banks around the world are aggressively hiking interest rates to curb rising inflation. However, each interest rate hike in the U.S. has resulted in further decline of the Euro and the British Pound.

President of the Federal Reserve Bank of Kansas City Esther George said that the U.S. Fed may continue to raise rates by 75 bps until it hit a target of 3.75% to 4%, expectedly in the new year.

For households to stay solvent over the period, they may need to tap into their $1.7 trillion savings deposits, which will allow them keep spending amidst soaring rates. However, increased spending may fuel inflation, and push the Fed to raise rates further.

News from around the Cryptoverse South Korea set to protect crypto investors with new billSouth Korea’s Financial Services Commission (FSC) has proposed a bill to protect crypto investors against unfair trade manipulations, Dong-a IIbo reports.

The proposed bill will be in place, while the regulator develops a more comprehensive “Digital Asset Basic Act.” that will set similar standards for crypto as obtainable in the stock market.

Nigerians skeptical of the e-NairaAbout a year ago, Nigeria launched its CBDC, a digital version of the Naira to curtail the influx of investors into the crypto market.

A Bloomberg report indicates that Nigerians are skeptical of the government-issued eNaira, as only about 0.5% of the country’s over 200 million population are actively using the digital currency.

MoneyGram launches crypto payment on mobilePayment giant MoneyGram announced that it has opened its services to include crypto payments. US-based users will be able to buy, sell and hold their Bitcoin, Ethereum, and Litecoin via the MoneyGram mobile app.

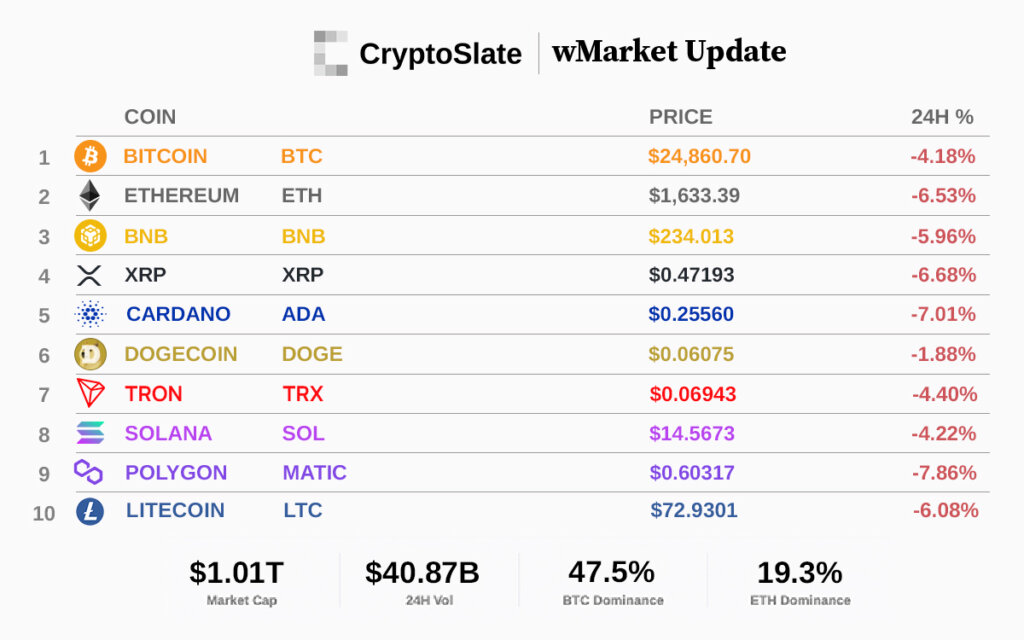

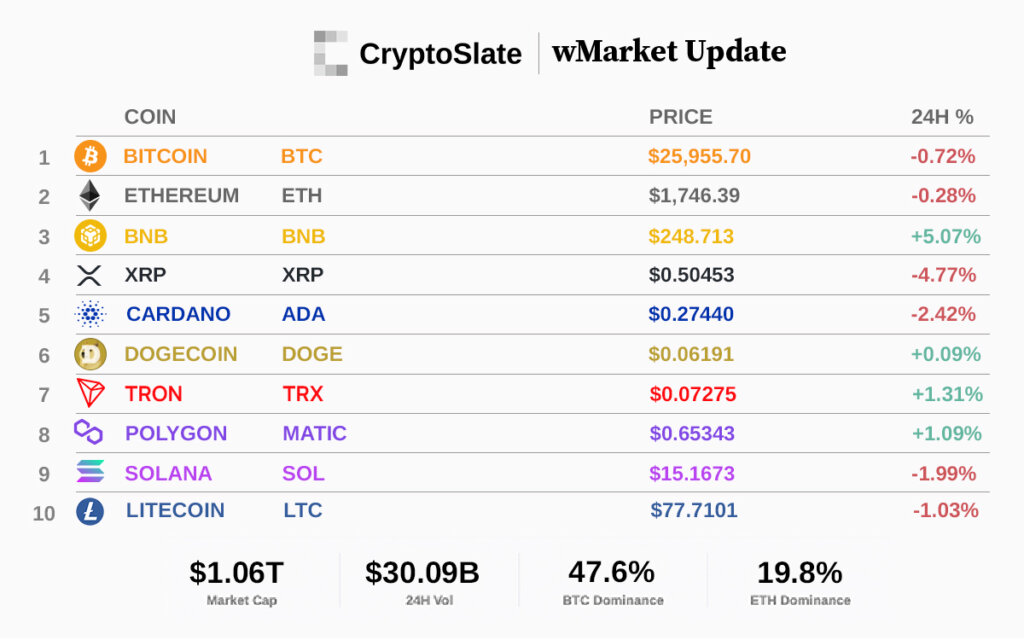

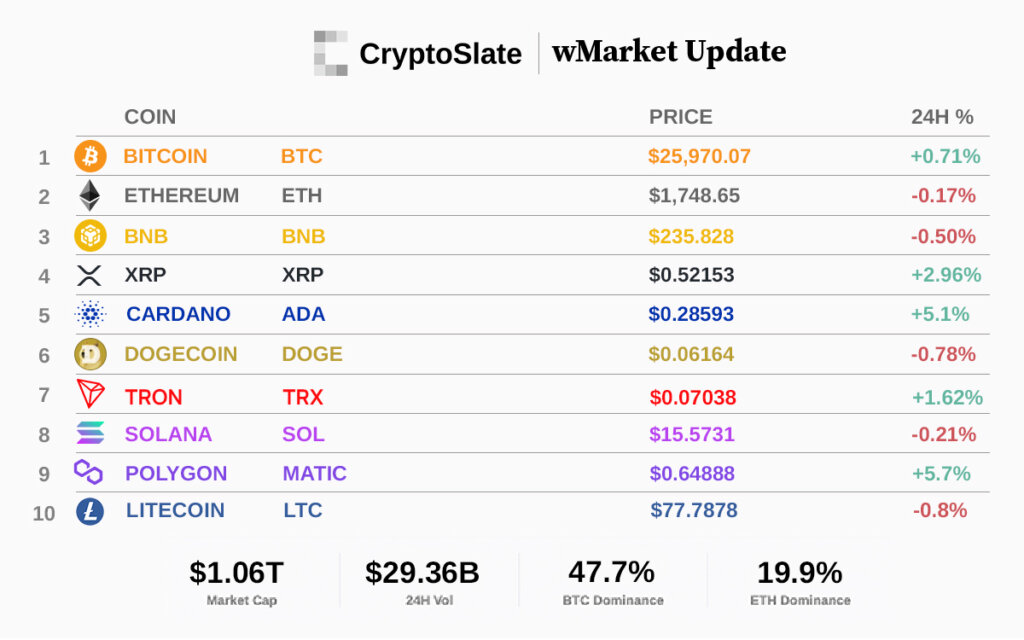

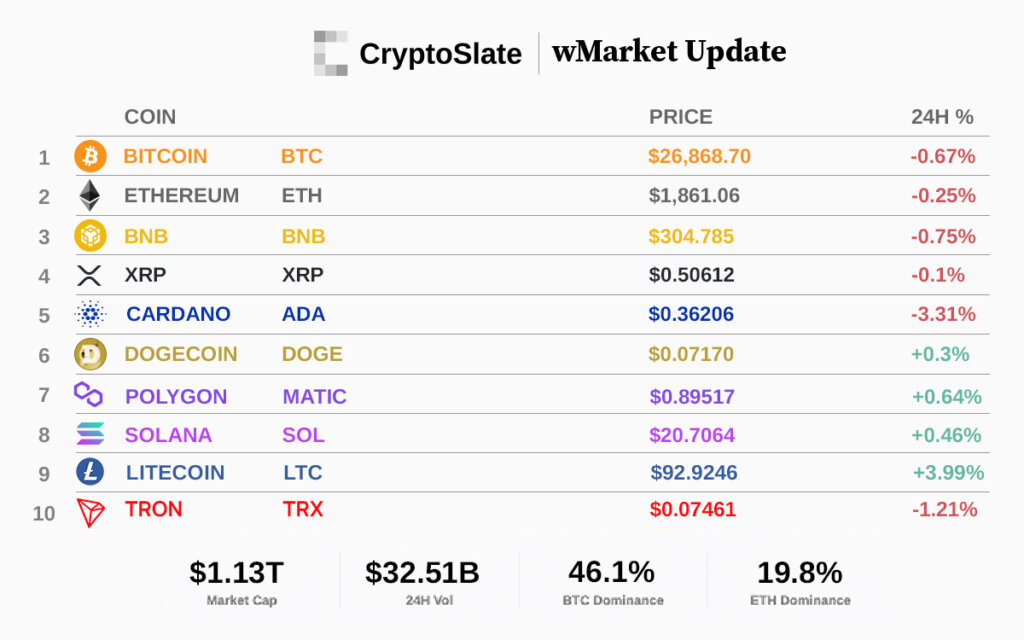

Crypto MarketIn the last 24 hours, Bitcoin (BTC) increased by 0.27% to trade at $20,451, while Ethereum (ETH) also increased by 0.69% to trade at $1,575.

Biggest Gainers (24h) Rocket Pool (RPL): +19% SwissBorg (CHSB): +14.71% ABBC Coin (ABBC): +14.35% Biggest Losers (24h) Sologenic (SOLO): -12.52% Klaytn (KLAY): -6.1% Gnosis (GNO): -5.99%The post CryptoSlate Wrapped Daily: Coinbase blames SEC’s XRP lawsuit for $15B loss to retail traders, Dogecoin investors sell $110M in DOGE appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

United Traders Token (UTT) на Currencies.ru

|

|