2020-5-7 00:15 |

Bitcoin futures platforms have recently attracted all-time high open interest. However, of the large numbers trading the contracts at various exchanges, one demographic is prohibited from contributing to the figures.

US retail investors are not allowed to trade BTC derivatives, as pointed out by CoinDesk reporter Zack Voell on Twitter. Some cryptocurrency industry analysts accuse the US Securities and Exchange Commission of “protecting investors from opportunity.”

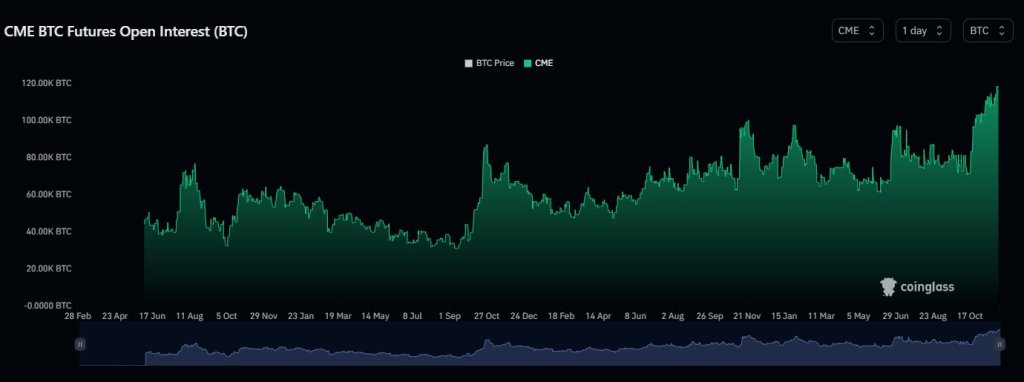

Source: Twitter Open Interest in Bitcoin Futures Still HighA few days ago, BeInCrypto reported on the soaring open interest in Bitcoin futures. Open interest refers to the number of futures contracts open on a given day.

A surge in open interest often indicates that a trend is set to continue. Recently, the trend has been upwards, with Bitcoin once again surpassing $9,000 following the BTC price crash in mid-March.

However, only a tiny handful of the wealthiest traders in the United States can actually trade the futures contracts. Both Bakkt and the CME Group welcome only accredited investors.

Meanwhile, all of the exchanges with decent liquidity that offer Bitcoin derivatives are strictly off-limits to any US traders. They include OKEx, BitMEX, Huobi, Binance, Bybit, Deribit, FTX, Kraken, and Bitfinex. This means that US retail traders are essentially barred from trading Bitcoin futures.

Zack Voell in his tweet highlighted how little access US traders have to the market. With an accompanying image of a graph depicting the roaring futures interest from market analysis firm Skew, he posted:

U.S. traders still cannot access any of the top bitcoin futures markets measured by open interest. Not one. This is for our protection. Remember to thank our regulators.

Protecting from Risk or Opportunity?Many in the Bitcoin industry are none too fond of such regulatory oversight. There is a strong disdain for the meddling of lawmakers in markets with a widespread belief that it should be up to the individual to gauge risk for themselves.

This stands at odds with the official SEC mandate to protect investors:

The mission of the Securities and Exchange Commission is to protect investors; maintain fair, orderly, and efficient markets; and facilitate capital formation.

Matt Ahlborg, a data scientist at UsefulTulips.org, is one of those that believes the SEC should not be master of who can or cannot trade which financial products. In response to Voell’s tweet above, he commented:

I love being protected away from opportunity! If Bitcoin hadn’t caught them by surprise, we’d have been protected from that as well!

With open interest across exchanges offering Bitcoin futures close to its all-time high, it would certainly be interesting to see how US retail investors would contribute to the totals were they permitted to trade the contracts. Whether their efforts to protect investors are warranted or not, the SEC seems unlikely to make any sweeping changes that would allow the likes of Binance or Huobi to offer their products to US retail investors anytime soon.

The post Traders Flock to Bitcoin Futures but US Retail Investors Still Excluded appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Filecoin [Futures] (FIL) на Currencies.ru

|

|