2024-7-22 11:06 |

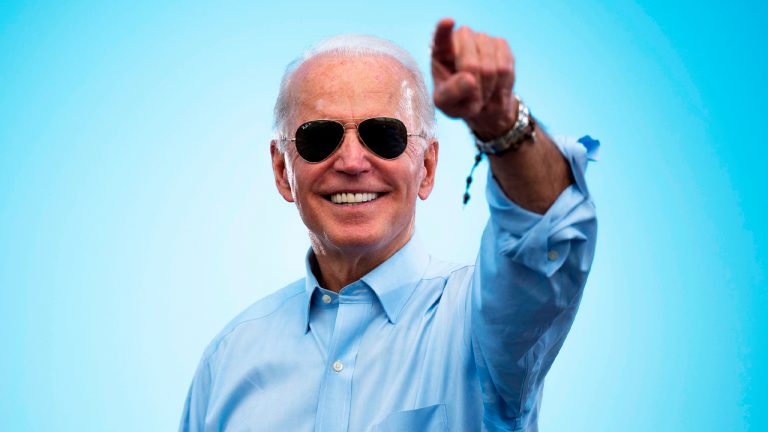

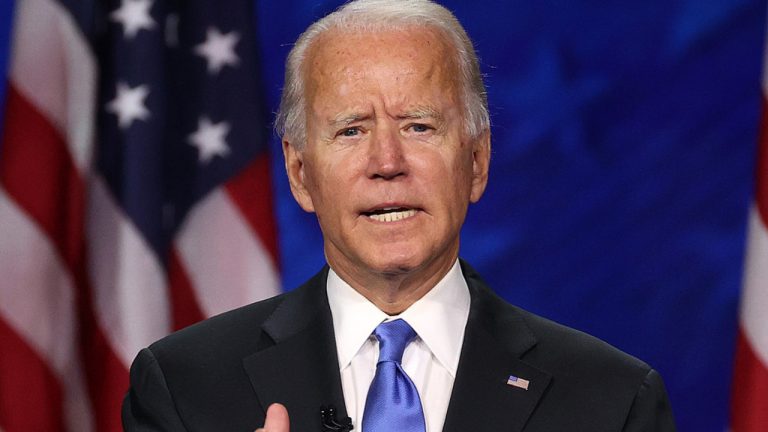

President Joe Biden announced his withdrawal from the presidential race on July 21. The cryptocurrency market reacted immediately, with $134.5 million worth of leveraged positions liquidated.

Just two crypto exchanges accounted for a huge chunk of the number. Binance saw $64.5 million in liquidation, and OKX accounted for $44 million.

Data from Coinglass show the liquidations were triggered by a 2.3% drop in Bitcoin’s (BTC) price. Soon after the news surfaced, $67 million worth of leveraged long positions were liquidated.

The price of BTC dropped to $65,880 and soon after recovered to a daily high of $68,480. Traders with leveraged short positions also lost a combined $34 million as a result.

Study charts, study news, study sentiment.$BTC behavior upon Joe Biden's announcement to not run for the US reelection caused a temporary downward spiral, which was later followed by massive positive euphoria as key leaders around the world were rumored to embrace crypto… pic.twitter.com/tws70JEDYn

— SPECTRE AI (@Spectre__AI) July 21, 2024With 12 hours, more than $81.1 million in long and $53.4 million in short positions was liquidated from the market on July 21.

Notable figures include $43.8 million worth of Bitcoin and $31.1 million of Ether, alongside $8.6 million in Solana wiped out.

Mixed views regarding market impactMeanwhile, analysts are divided on what Biden’s exit means for the cryptocurrency market. Some see the move as a positive development, while others urge caution.

According to crypto analyst Noelle Acheson, the BTC price dropped because of the “higher chance” of Biden’s replacement beating Donald Trump.

While the analyst believes this would be “less favourable for crypto,” she noted that the departure of SEC chair Gary Gensler would be “good news.”

Yet, she remained sceptical about the uncertainty over who Democrats will appoint as Gensler’s replacement.

Before coming to the office, Gensler was known to have supported cryptocurrencies in general and considered cryptocurrencies like Ethereum a commodity. However, that stance changed soon after his appointment, as the SEC chair cracked down on the crypto sector.

Gary Black, managing partner at The Future Fund, also held a similar opinion. In a July 22 X post, Black cautioned investors that it was “too early” to expect a second Trump presidency.

Black believes that the American public “doesn’t trust Trump,” especially considering the January 6 2021, attack on the United States Capitol Building by a mob of supporters of the then-U.S. president Donald Trump. The attack came just two months after Trump’s loss in the 2020 elections.

He added:

I was no fan of Biden or Kamala but Dems could still nominate Newsom, Michelle Obama, or another leading Dem to be their Presidential candidate.

On the other hand, Markus Thielen, founder of 10X Research, remained optimistic about Trump’s return to office in a July 21 report.

The analyst believes the former president could make Bitcoin a strategic reserve asset for the US government at the upcoming Bitcoin 2024 conference in Nashville on July 25.

He highlighted that the US government’s BTC holdings, worth approximately $15 billion, adding that if it were to double, it would be “nearly equivalent” to the price impact of net inflows into spot Bitcoin exchange-traded funds (ETFs) year-to-date.

Such a move could significantly drive BTC prices higher.

Similarly, eToro market analyst Josh Gilbert views Biden’s exit as a “win” for the crypto sector. According to the analyst, the longer Trump stays in the lead in terms of election odds, “the more crypto assets will price in his victory.”

At the time of publication, Bitcoin was trading at $67,636.26, up 8% over the past week.

The post Crypto sees massive liquidations amid Biden exit, analysts divided appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) íà Currencies.ru

|

|