2024-9-30 13:08 |

Crypto investment products continued to attract institutional capital as the market recorded another week of huge net inflows.

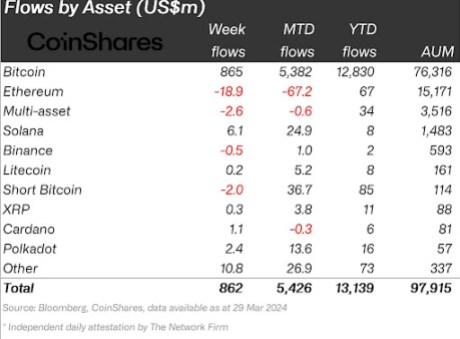

On September 30, 2024, crypto asset manager CoinShares released its latest weekly flows report, indicating a third straight week of inflows.

According to CoinShares, the digital asset investment products market added $1.2 billion in net inflows over the past week.

The scenario coincided with Bitcoin (BTC) leading cryptocurrencies higher amid its surge to above $66,000.

Bitcoin has, however, pared gains back to below $64k.

Bullish sentiment triggers inflows jump to $1.2 billionIn its report, CoinShares sees the increased inflows to $1.2 billion – up from $321 million in the week ending September 23 – as indicative of the bullish sentiment across markets.

Particularly, the upside reaction is likely pegged to the growing anticipation of a “dovish monetary policy” from the US Federal Reserve.

Crypto rose in the wake of the Fed’s 50 basis points interest rate cut, which was the first time in four years that the US central bank had cut rates.

Sentiment may also have benefitted from the approval of options trading for BlackRock’s spot Bitcoin ETF.

The bullish reaction has nonetheless not translated to an explosion in trading volumes across the digital assets investment products.

The positive price action and increased exposure through crypto exchange-traded products pushed the total assets under management from $85.8 billion to $92.7 billion, up by 6.2% over the past week.

Bitcoin saw $1 billion in weekly inflowsMost of the flows into digital asset investment products last week went into Bitcoin, the flagship cryptocurrency asset. Having recorded inflows of $284 million the previous week, BTC ETP and ETFs among other products hit a sharp upside to reach $1 billion.

According to SoSoValue data, the US spot Bitcoin ETFs market registered a seventh-consecutive trading day of net inflows with $494 million on September 27.

However, some of this upside sentiment also welcomed a spike in bearish bets on BTC. Data sowed inflows into short-bitcoin products increased slightly to $8.8 million.

Ethereum breaks 5-week slumpThis past week also saw Ethereum price surge past key levels to break above $2,700.

Amid this surge, with ETH sell-offs cooling, inflows into Ethereum products rose to $87 million. Comparatively, negative sentiment had institutional investors pulling a total of $28.5 million from ETH products.

Positive inflows into Ethereum meant it broke a 5-week streak of negative inflows, a run that goes back to early August.

Litecoin and XRP also recorded inflows, with $2 million and $0.8 million respectively.

Meanwhile, Solana recorded outflows of $4.8 million, down from inflows of $3.2 million over the previous week.

Elsewhere, products tied to Binance’s BNN registered $1.2 million in outflows as Stacks, a layer 2 network on Bitcoin, saw outflows of $0.9 million.

The post Crypto products attract $1.2 billion in weekly inflows, signaling strong investor interest appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|