2023-6-15 18:50 |

The Visa cards come in three distinctive plans offering different limits, advantages and fees.

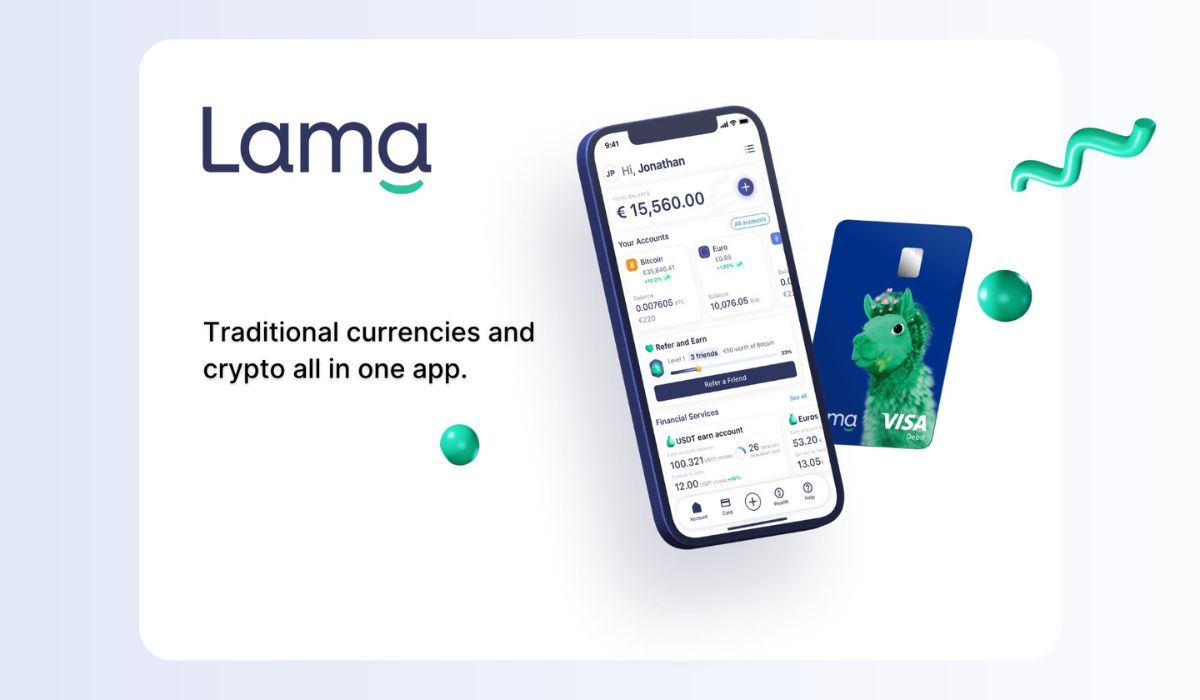

Lama, an EU-regulated crypto and fiat exchange, is finally rolling out its much-awaited crypto Visa cards to enable users to spend their crypto in their daily activities. According to the team’s statement, the Visa card automatically converts crypto to fiat at the checkpoint and can be used across the 70+ million Visa-accepted stores worldwide. Additionally, users can gain up to 2% cash back in Bitcoin for all purchases if they subscribe to the Gold plan package.

Speaking on the latest development, Brigham Santos, Head of Operations at Lama, said:

“The Lama Visa card is an essential tool for anyone looking to make the most of their crypto assets. By using Lama Visa cards, users will easily convert and spend their digital currency at millions of merchants worldwide. This makes crypto tangible and accessible, allowing users to fully participate in the global economy.”

Lama joins Visa crypto programOver the past few years, Visa has partnered with some of the biggest crypto platforms to create white-label Visa-branded debit cards. Lama is the latest company to join the fray, offering users three levels of branded Visa cards to make it easy to spend digital currencies across Visa-enabled merchants globally.

Launched in 2022, Lama aims to bridge the gap between traditional finance and crypto. The latest acceptance into Visa’s crypto card program is a testament to the exchange pushing towards this goal. Now, users can apply for a Visa debit card and enjoy the convenience of using their crypto assets while holding them for future gain.

The Lama branded Visa cards enable users to spend crypto and euros in any physical or online store that accepts Visa. Additionally, users can connect them directly to their Apple Pay and Google Pay services and earn Bitcoin every time they use the card.

Lama offers three plans for its Visa debit cards: Bronze, Silver, and Gold. The Bronze plan is a free-to-use virtual card offering a transaction limit of €1,000, a monthly limit of €2,000 and an exchange fee rate of 4%. The card can only be used for online purchases. The Silver plan costs €9.99 monthly, offering users one physical card and three virtual debit cards. The plan offers a 1% cashback in Bitcoin for all purchases, a transaction limit of €4,000, a monthly limit of €7,000 and an exchange fee rate of 3%.

Finally, the Gold plan is the most exclusive card; users can get it for €19.99 monthly. The gold plan offers one physical card and up to five virtual cards. Users on the Gold plan get 2% BTC cash back for all purchases on the card and additional benefits, including priority access to Lama NFTs and premium support. The Gold plan cards offer a transaction limit of €20,000, a monthly limit of €50,000 and an exchange fee rate of 2%.

The latest move by Lama follows the launch of several innovative products focused on supporting seamless crypto-fiat transactions, including its crypto earn account, OTC trades, and crypto loan services.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|