2025-3-19 15:48 |

The survey was conducted in January at the height of Bitcoin’s all-time high of $109,000 59% of institutional investors are planning on allocating over 5% of assets under management to digital assets A further 75% said they intend to invest in some form of tokenization by 2026

Institutional investors remain bullish on crypto with 83% planning to expand their crypto exposure in 2025.

The research, which polled 352 institutional decision-makers in January, was conducted by Coinbase and EY-Parthenon.

It found that “more than three-quarters of surveyed investors expect to increase their allocations to digital assets in 2025, with 59% planning to allocate over 5% of assets under management to digital assets or related products.”

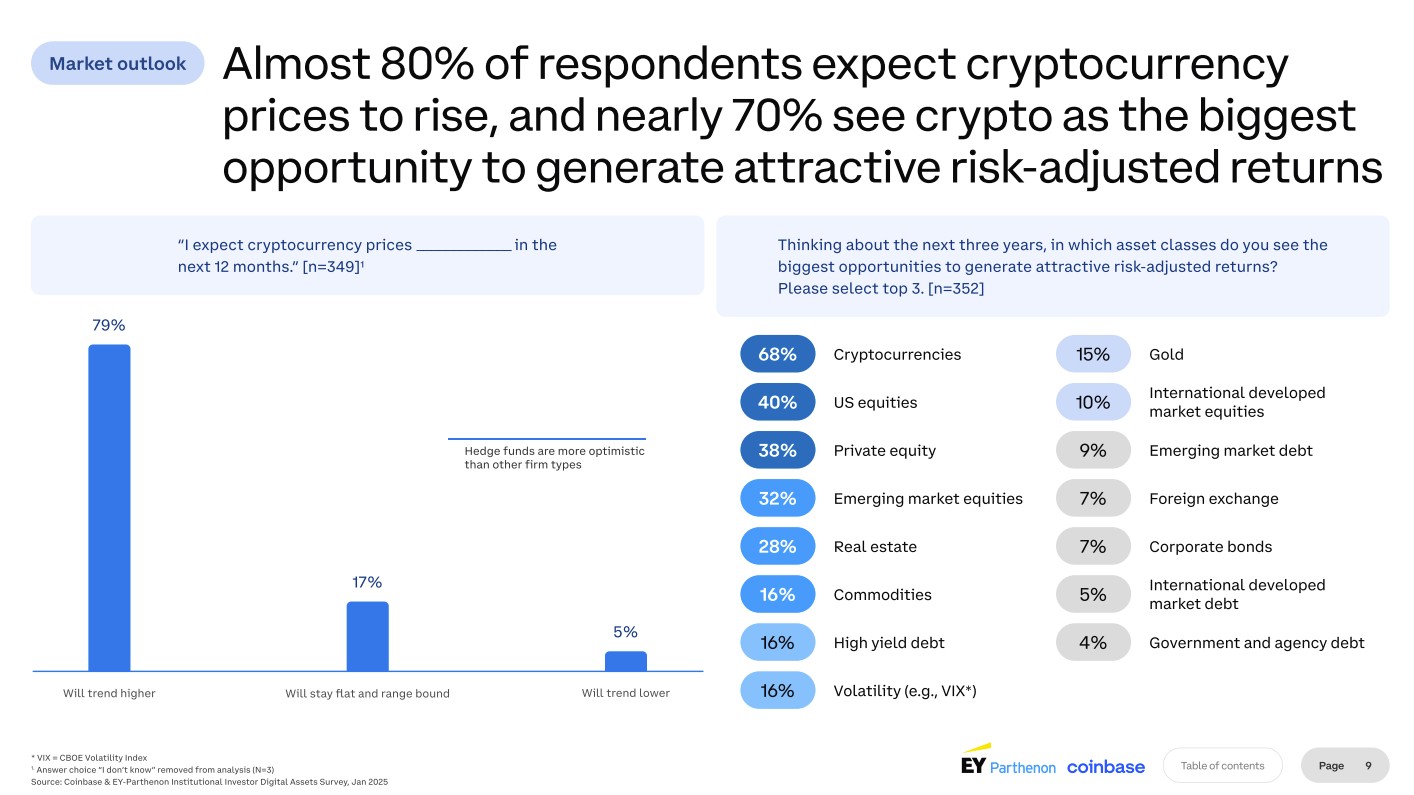

The survey, which was conducted at the height of Bitcoin’s all-time high of $109,000, found that nearly 80% of investors expect crypto prices to rise. Around 70% see crypto as the biggest opportunity to create attractive risk-adjusted returns.

2025 Institutional Investor Digital Assets Survey. Source: Coinbase Stablecoins and DeFiInterest in stablecoins is also rising. 84% of institutions are already using or planning to use stablecoins this year, and 75% indicated that they intend to invest in some form of tokenization by 2026.

With decentralized finance (DeFi), the number of investors expected to engage with it is set to rise from 24% to 75% over the next two years. Yet, despite the optimism the sector is projected to experience, barriers to DeFi include regulatory (57%) and compliance (55%) concerns, in addition to a lack of internal knowledge (51%), according to the survey.

2025 Institutional Investor Digital Assets Survey. Source: CoinbaseAmong those currently engaged in DeFi or plan to, derivatives (40%), staking (38%), and lending (34%) are the top three use cases firms are interested in.

Bringing regulatory clarityInstitutional investors see regulation as the biggest opportunity and the biggest risk for the crypto market in 2025.

According to the survey, bringing more regulatory clarity around custody, tax treatment, and the use of stablecoins should introduce new market participants and increased activity.

“We expect the positive tone and action from both the new US administration and regulatory bodies globally to accelerate an already expanding interest in digital assets,” the survey’s researchers said.

Since the survey was conducted, crypto prices have declined. At the time of publishing, Bitcoin is trading around $83,000. Earlier this month, Bitcoin fell to $76,000 after US President Donald Trump failed to rule out a possible recession.

The post Coinbase survey: 83% of institutional investors are planning to expand crypto exposure in 2025 appeared first on CoinJournal.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|