2018-10-2 04:02 |

The $220 billion cryptocurrency industry is finding more and more investors that want to get involved, leading some to believe that institutional investors are being more cautious than others. However, they are more involved than the public has been led to believe.

Hedge funds have recently made some financial history, pushing ahead of the individuals with the high net worth that has predominantly ruled the industry. In private transactions, institutional investors are getting involved at around $100,000 worth of Bitcoin and other digital assets, according to the global head of trading at Cumberland, Bobby Cho. Their platform is one of the primary ones responsible for over-the-counter (OTC) purchases.

Crypto enthusiasts have largely held on to the idea that institutional investors would one day embrace the industry, which is happening at a slow and steady pace. The biggest sellers, which have been miners that generate new coins, have started planning more frequent coin sales, instead of waiting until the market needs a rally. Some of these miners have even created their own liquidity desks.

Cho commented on these changes, saying, “What that’s showing you is the professionalization that’s happening across the board in this space. The Wild West days of crypto are really turning the corner.” The OTC market is responsible for a substantial amount of the investments, which were ranging anywhere from $250 million to $30 worth of transactions daily in April alone. This allotment was recorded by both Digital Assets Research and TABB Group. Recently, these numbers are around $15 billion in daily trades, based on information gathered by CoinMarketCap.com.

Chief Executive Officer for Circle internet Financial, Jeremy Allaire, said, “We’ve seen triple-digit growth enrolling in our OTC business. That’s a big growth area.” Even though the OTC market has dropped at the same pace at crypto pricing lately, the volume has not suffered as greatly as crypto exchanges. With the wide swing in price for many tokens, institutional buyers have taken advantage of the opportunity, according to Cho.

He continued, saying,

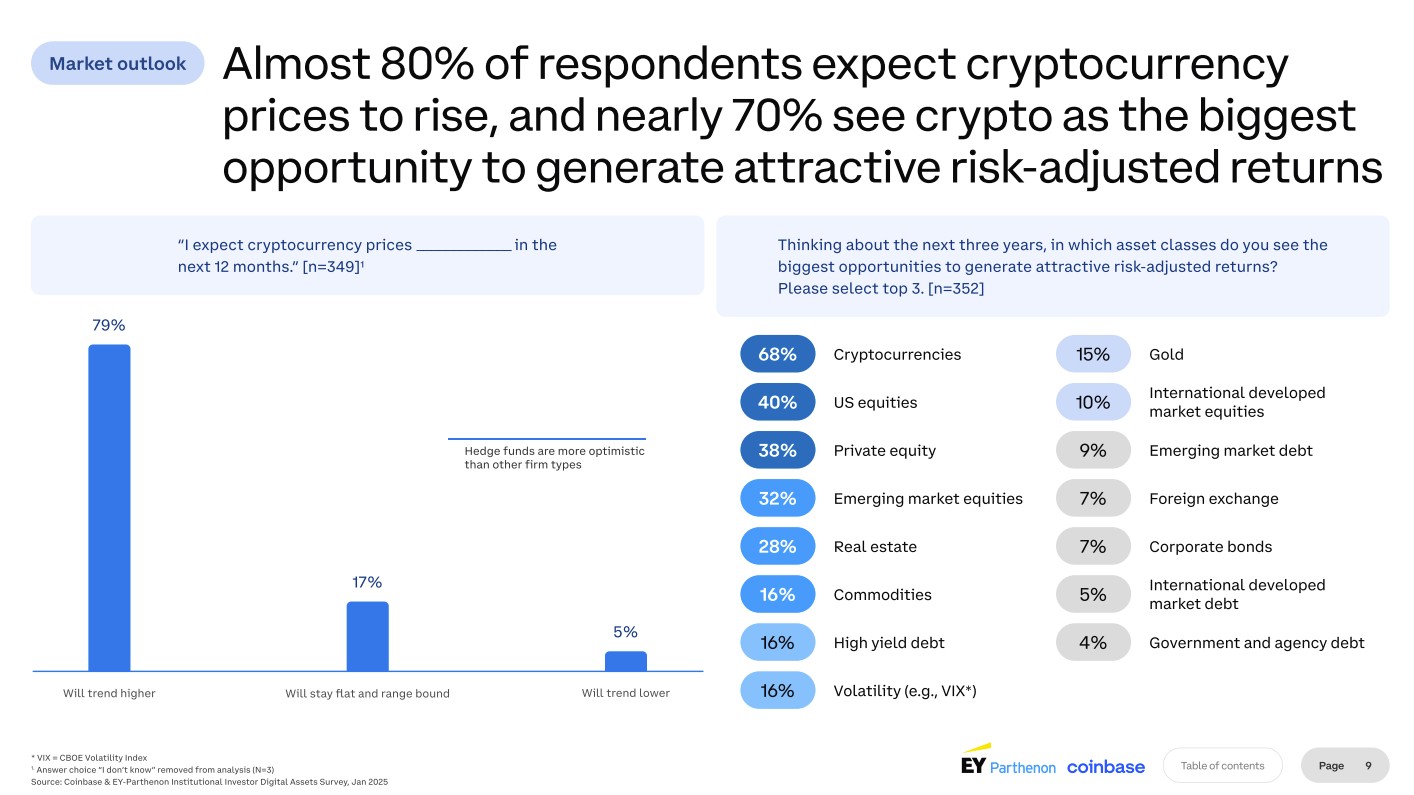

“One of the biggest criticisms of crypto by institutional investors has been the volatility. Over the last four to six months, the market has been trading in a very tight range, and that’s seems to be corresponding with traditional financial institutions becoming more comfortable diving into the space.”

The bigger buyers and sellers enjoy the concept of a private sale, because these transactions have a lot of power to move the market. A private sale lets the involved parties choose the price beforehand, rather than succumbing to major changes as transactions occur.

Because the sales provide mining facility options, and the majority of their customers are institutional miners that wants access to a great number of machines. Bigger miners will even use their own coins to sell to other sellers or to make a profit through a broker. Still, founder Tom Flake says, “If they are liquidating [coins], they are liquidating them via OTC.”

One of the greatest advantages to purchasing a coin outside of the exchanges is due to the desire from institutional buyers to purchase more of the coins than the exchanges offer. This observation has been noted by Sam Doctor, who works as the managing director and head of data research for Fundstrat Global Advisors.

Doctor added, “At this point in time, because more and more institutions are beginning to enter the market, there’s more of an imbalance.” As a result, brokers are trying to help institutional buyers find the crypto opportunities they want.

origin »Bitcoin price in Telegram @btc_price_every_hour

Vice Industry Token (VIT) на Currencies.ru

|

|