2019-2-9 22:14 |

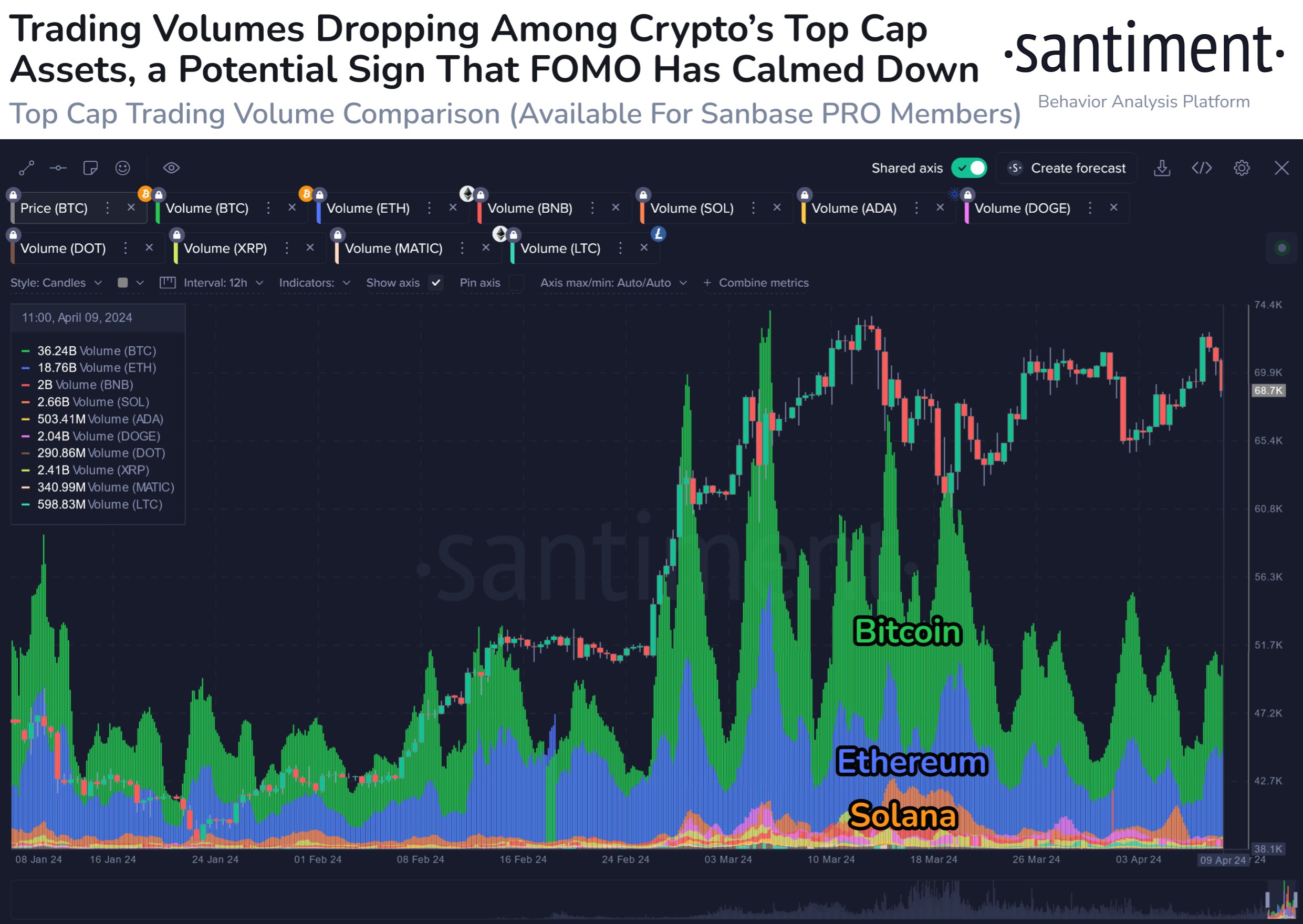

According to the latest report by Trade Block, the trading volume of Cboe and CME bitcoin futures have “fallen since reaching the peak” in 2018 summer. However, what’s interesting is, the future trading volume of CME and Cboe reached “near parity” with total bitcoin spot trading volume across five of the largest US crypto exchanges.

Between CME and Cboe, the latter one lost significant market share to CME after launching competing products in the same month over the course of 2018.

Bitcoin Futures & Spot Trading Volume FallsWhen it comes to Bitcoin spot trading volume at the popular US-based crypto exchanges including Coinbase, Kraken, itBit, Bitstamp, and Gemini, the trading activity fell considerably along with the leading cryptocurrency’s prices.

The decline in spot trading has been due to the exit of retail traders followed by the crash of prices. This has been in line with the falling search engine trends as well.

The trading volume of Bitcoin futures contracts reached a peak in the months of July and August from where they started to decline in the fall and winter of 2018. However, November was an exception to this as in this month, the trading volume of futures “experienced a near term rise in line with heightened volatility in asset prices following sudden price crashes during the month.”

Last year in December, the futures trading volume registered the lowest activity since the inception of these products.

“While bitcoin futures trading volume initially saw significant growth each month following inception, spot trading activity was steadily declining during this same time period. Given these divergent trends, total futures trading volume across the CME and Cboe reached near parity with total spot trading volume across five of the largest US accessible digital currency exchanges.”

However, in recent months, as spot volume picked up but futures trading volume kept on falling, the difference between both the volumes increased. Since reaching the peak last year, futures trading activity declined significantly and similarly spot trading activity declined considerably.

The report concludes by noting the upcoming launches of Bakkt, ErisX, and CoinFLEX in the coming months and “as these platforms come to live, it will be imperative to continue to track futures trading volumes as they change over time.”

Moreover, this month Cboe Bitcoin futures are expiring on February 13 while CME Bitcoin futures last trade date is February 22nd. So, will upcoming Bitcoin futures expiration affect the leading cryptocurrency’s prices? Though it is really hard to say if Bitcoin futures expiration has affected the prices with accuracy, it has happened in the past and could this time as well.

origin »Bitcoin price in Telegram @btc_price_every_hour

Open Trading Network (OTN) на Currencies.ru

|

|