2024-6-20 20:40 |

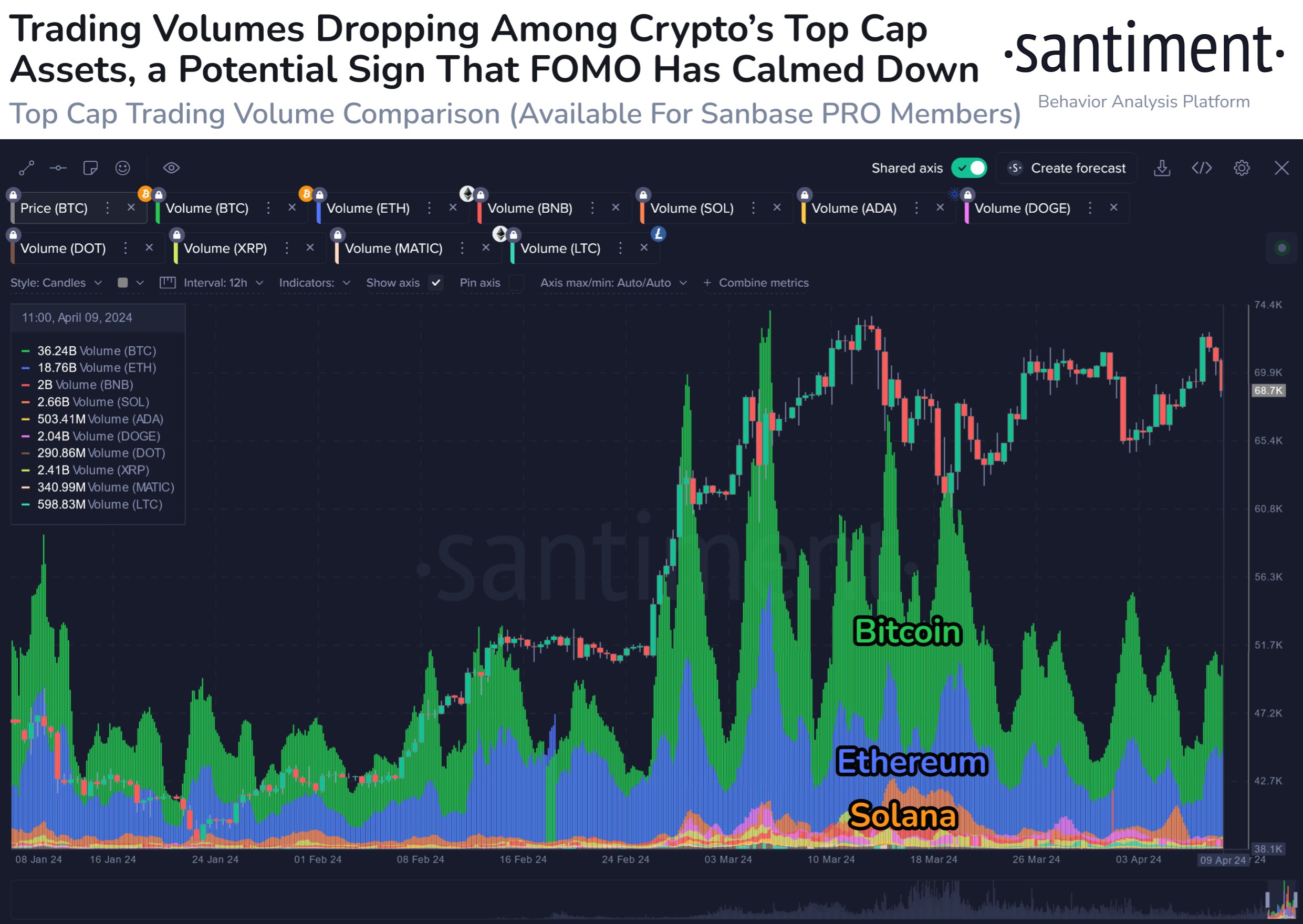

The Bitcoin derivatives market experienced significant volatility in the past week. In addition to fluctuations in open interest (OI), trading volume fluctuated significantly.

Data from Glassnode showed that the total 24-hour trading volume for perpetual futures across all exchanges dropped from $53.156 billion on June 12 to $10.910 billion on June 15. Trading volume rebounded to $51.239 billion by June 18.

When comparing these fluctuations with Bitcoin’s price during the same period, which dropped from $68,237 on June 12 to $65,160 on June 18, we notice that the trading volumes for perpetual futures do not move in strict correlation with price. For instance, the trading volume dropped significantly on June 15 and 16 while Bitcoin’s price remained relatively stable, indicating that trading volumes in perpetual futures are influenced by factors other than just price movements.

Chart showing the 24-hour trading volume for Bitcoin perpetual futures across all exchanges from June 10 to June 18, 2024 (Source: Glassnode)Looking at the trading volume for BTCUSDT perpetual futures on Binance, we observe a similar pattern of fluctuation, with a high of $22.65 billion on June 12, a low of $4.79 billion on June 15, and then a rise to $21.82 billion by June 18. This is more in line with the overall market trend, showing how significant Binance’s role is in the perpetual futures market.

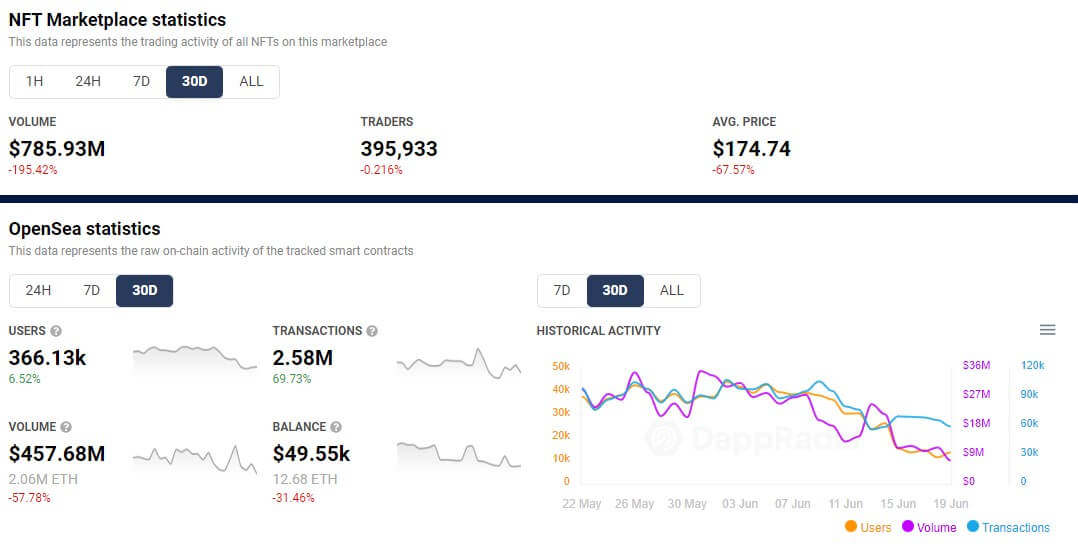

Another discrepancy arises when comparing the perpetual futures trading volume on Binance with the spot trading volume for the BTCUSDT pair. The spot trading volumes are significantly lower, peaking at $2.75 billion on June 18 compared to the perpetual futures’ $21.82 billion on the same day. The perpetual-to-spot volume ratio, which varies from 6.32 on June 15 to 9.06 on June 17, shows a persistent preference for trading perpetual futures over spot trading on the exchange.

Graph showing the trading volume for spot BTCUSDT (blue) and BTCUSDT perpetual futures (gray) from June 10 to June 18, 2024 (Source: CoinGlass)The difference between low spot volume and high perpetual futures volume can be indicative of the fact that new money is not entering the market at a significant rate. Spot trading, which involves the actual purchase and sale of Bitcoin, is generally associated with new market entrants looking to acquire the asset directly. A decline or stagnation in spot volume suggests that there may be fewer new investors buying Bitcoin, which could imply a lack of fresh capital flowing into the market.

On the other hand, perpetual futures are typically favored by more experienced and sophisticated investors looking to leverage their positions to maximize gains from price movements. Experienced traders might prefer perpetual futures due to their ability to hedge positions and the opportunity to amplify returns through leverage. Market makers and institutional players could also be responsible for the high volumes we’ve seen. They often use derivatives to manage risk and provide liquidity, significantly influencing the volume in perpetual futures markets.

Another important factor to consider is the acute state of the market. In a market characterized by uncertainty or a lack of clear direction, like we’ve seen in the past week, traders might prefer the liquidity and flexibility of derivatives. The ability to quickly enter and exit positions in the futures market allows traders to react to news and market changes more efficiently than they might in the spot market.

The post Perpetual futures trading volume surges as Bitcoin spot trading lags appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Open Trading Network (OTN) на Currencies.ru

|

|