2024-12-8 21:30 |

In the last seven days, the price of Chainlink (LINK) has climbed by 36.55%, bringing the token’s value to its highest level since January 2022. This increase coincides with a broader altcoin rally that has seen many cryptos erase a big bunch of the losses accrued over the last few months.

But that is not all. Based on this analysis, LINK may not be done with the upswing, with indicators suggesting a higher value in the coming weeks.

Chainlink Bearish Sentiment Is Not Entirely Bad NewsThe recent Chainlink price rally has ensured that the altcoin now trades at $25. This milestone could be linked to rising buying pressure, especially from crypto whales.

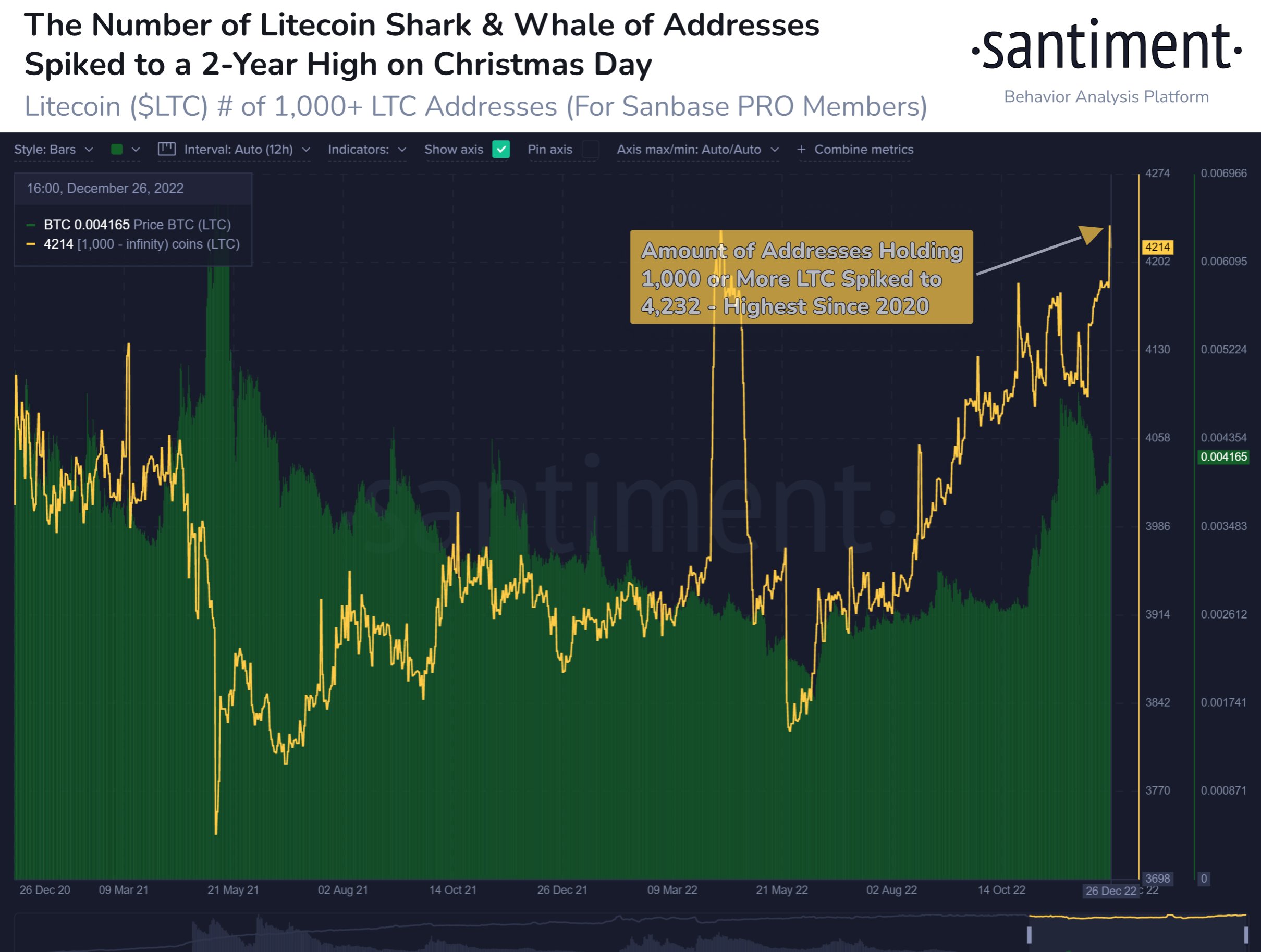

However, according to Santiment, retail investors have not yet joined the bandwagon, suggesting that LINK’s value still has room for further growth. One indicator that proves this is the Weighted Sentiment.

Weighted Sentiment measures the perception the broader market has about a cryptocurrency. When the reading is negative, it means the average remark online about the asset is bearish. On the other hand, when the reading is positive, it means most comments are bullish.

Today, Chainlink’s Weighted Sentiment is in the negative zone. This indicates that retail Fear Of Missing Out (FOMO) has not hit the token. Historically, when price increases and sentiment stays bearish, the crypto has not yet hit its peak.

Chainlink Weighted Sentiment. Source: SantimentSantiment, in a post on X earlier today, also agrees with this thesis, saying that little bullish expectations from the crowd are a good sign for LINK.

“It is encouraging that there is very little retail FOMO toward LINK. Markets move in the opposite direction of the crowd’s expectations, so the crowd’s disbelief will only help fuel this rally further,” the on-chain analytic platform highlighted.

Furthermore, BeInCrypto’s evaluation of Chainlink’s Coins Holding Time metric reveals a notable trend: most LINK holders are refraining from selling their tokens. Typically, a decline in holding time suggests increased selling activity as more coins are transacted or sold.

However, in LINK’s case, the metric has risen, signaling growing investor confidence. This increase reflects a notable bullish conviction, suggesting that holders are opting to retain their tokens instead of cashing out.

If sustained, such sentiment often lays a strong foundation for potential upward price momentum.

Chainlink Coins Holding Time. Source: Santiment LINK Price Prediction: Time for $30 to ShowFrom an on-chain perspective, Chainlink’s In/Out of Money Around Price (IOMAP) shows that 79% of LINK holders are currently in profit. Beyond identifying profitable addresses, the IOMAP highlights key resistance and support levels based on token volume.

Larger token clusters at specific price ranges signify stronger levels of support or resistance. According to IntoTheBlock data, the volume of tokens “in the money” between $22 and $25 outweighs the volume between $26 and $28. This indicates a strong support zone that could help propel LINK toward $30 in the short term.

Chainlink In/Out of Money Around Price. Source: IntoTheBlockHowever, this bullish outlook depends on sustained buying momentum. If selling pressure begins to outweigh buying activity, Chainlink’s price could break below the $20 mark. But for now, the balance of probabilities leans toward a Chainlink price increase.

The post Chainlink (LINK) Price Surges to 2-Year High with More Gains in Sight appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

ChainLink (LINK) на Currencies.ru

|

|