2020-9-1 17:51 |

Ether is yet again leading the market. The digital asset today made a new 2020 high as it rose to $474, a level last on July 19, 2018.

Today, Ether has jumped more than 10% and is seeing nearly the same level of ‘real’ trading volume as of Bitcoin, as per Messari. IntoTheBlock noted,

“On-chain data suggest that the recent rally was driven by new money flowing into Bitstamp. From the 2.07m ETH deposited yesterday into some of the top exchanges, 1.41m ETH belongs to Bitstamp.”

The crypto data provider also observed yesterday that some of the top centralized exchanges saw the highest ever since March 16 ETH deposited.

With a new 2020 high, Ether is clearly leading the market with bitcoin also on the move above $11,900.

Following $ETH, feels like $BTC is about to fly past $12,000.

— Koroush AK (@KoroushAK) September 1, 2020

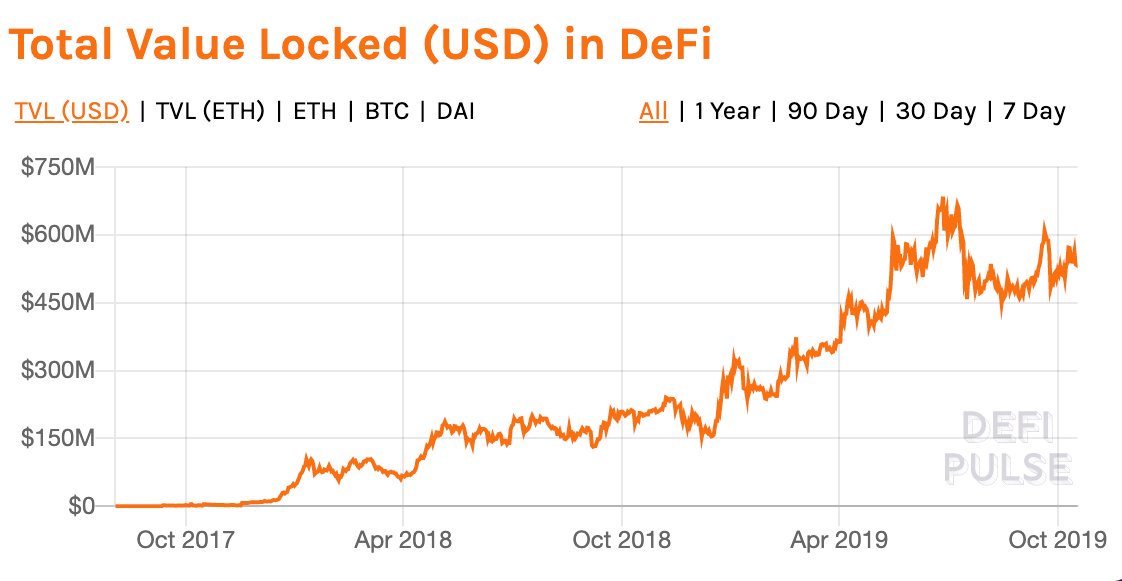

These gains are obviously the result of face-melting growth the DeFi sector is seeing, with the total value locked in it surpassing $9 billion, just two months after COMP was launched and the TVL was at just $1.6 billion.

The four projects in the DeFi space; Aave, Maker, Uniswap, and Curve Finance, have more than $1 billion locked with Synthetix close behind at $966 million, as per DeFi Pulse.

Also, as we reported, the Ethereum-based DEX Uniswap has been actually recording, for three days in a row, more volume than the popular centralized exchange Coinbase Pro. SushiSwap, a clone of Uniswap, also has $1.36 billion locked in just four days since its launch.

As a result of this much activity, the obvious happened – fees on the network skyrocketed yet again.

With gas usage at 79.5 billion, the average transaction fees have made yet another all-time high at $10.12, which is 36.75% higher than the last ATH hit on August 13. The median transaction fee has also reached a new peak of $5.49.

The same is the case for the gas price as the median gas price has hit a new ATH at 401 ETH while average gas price is at 386.5 ETH today, still 45% down from its June 11 peak. Trader and economist Alex Kruger said,

“This is a real problem as it makes farming and any onchain activity UNFEASIBLE for those who move small sums. This will end up pushing a great number of the community away.”

All of this has led to congestion on the second largest network, which has transactions per second at times falling to just 4, as per Blockchair.

In response to these flying fees, Ethereum co-founder Vitalik Buterin advised the community to use Layer 2 solutions like OMG Network and Loopring.

To those replying with "gas fees are too high", my answer to that is "well then more people should be accepting payments directly through zksync/loopring/OMG". Seriously, scaling to 2500+ TPS for simple-payments applications is here, we just need to… use it. https://t.co/J2KMJyLKv6

— vitalik.eth (@VitalikButerin) September 1, 2020

Ethereum miners, meanwhile, are enjoying this uptrend by earning over $500,000 in transaction fees in just an hour today, a new record high for a single hour, noted Glassnode.

The miners earned a total of $113 million in fees in August, which is a 38x increase from just four months back when it was only $3 million. As a matter of fact, it is a 1.8x increase from the previous ATH in January 2018. In comparison, Bitcoin miners earned just $39 million last month, almost 3x less.

Ethereum (ETH) Live Price 1 ETH/USD =$476.5339 change ~ 9.56%Coin Market Cap

$53.57 Billion24 Hour Volume

$4.84 Billion24 Hour VWAP

$45224 Hour Change

$45.5660 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~ETH~USD");The post Average Ether Fees Get Crazy High at Above as Price Pushes to a New 2-Year High first appeared on BitcoinExchangeGuide.

origin »Bitcoin price in Telegram @btc_price_every_hour

High Voltage (HVCO) на Currencies.ru

|

|