2020-8-18 17:38 |

Chainlink’s price is back to $15.14 representing a 19.74% decline in the last 24 hours which is a big contradiction to the double digits the coin has been gaining in the last two months.

The drop has now pushed it back to the 6th position, after Bitcoin Cash, one of the latest gaining altcoins reclaimed its higher market cap position against Chainlink.

In recent weeks while most coins have been trading sideways, LINK was making double-digit gains but it’s now only one among the top ten cryptocurrencies, that’s currently making double-digit losses.

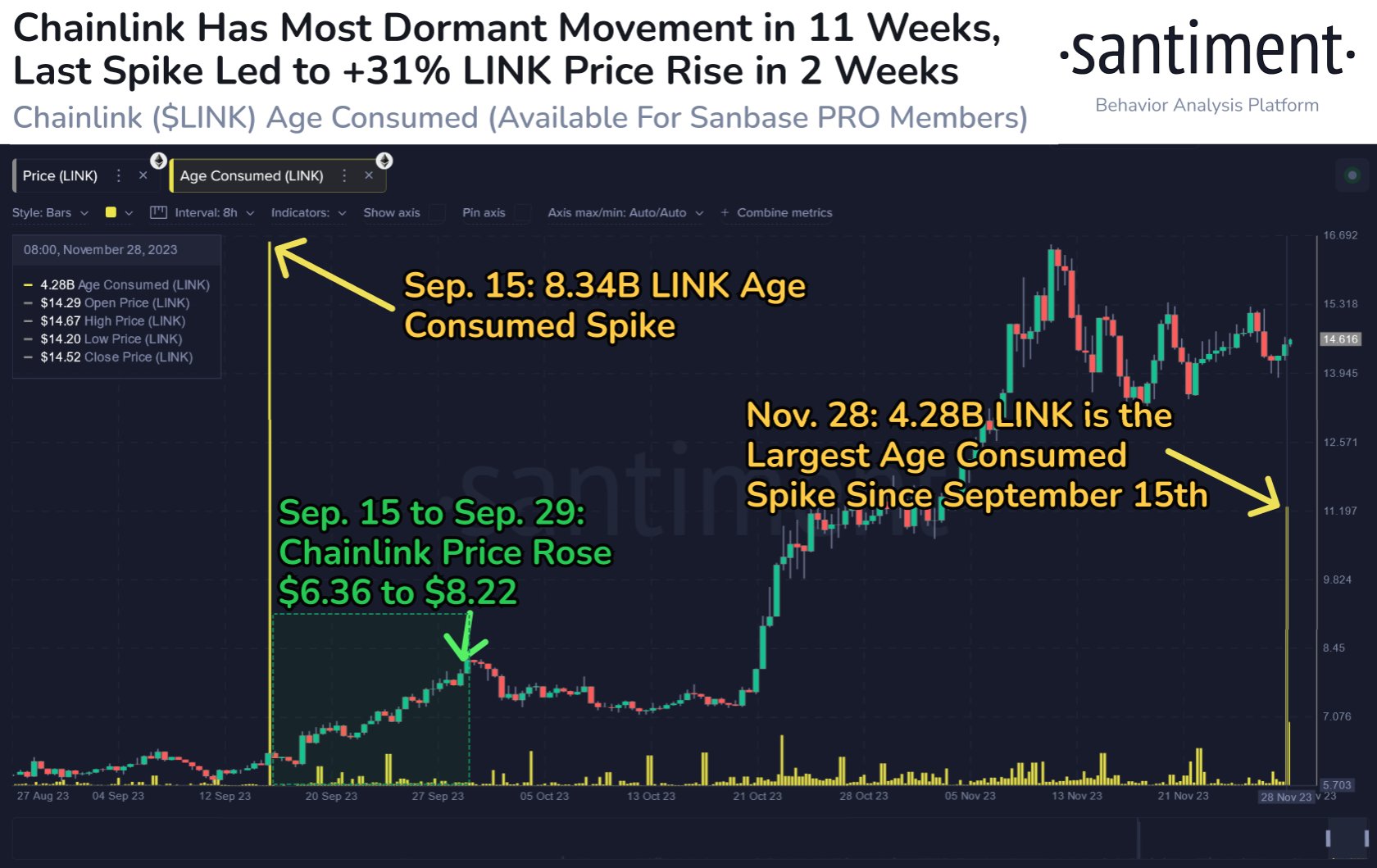

More LINK Has Exited Exchanges in the Last 6 MonthsOn-chain data analysis platform Santiment recently noted Chainlink’s independent and unprecedented pullback when BTC broke past $12K and rallied together with key altcoins like ETH, XRP, LTC, and BCH.

“$LINK experienced a pretty unpredicted drop, independent from the rest of the #crypto markets.”

According to Santiment, the volume of Chainlink tokens in 6 months has continued to drop as more LINK marines are moving their coins out of exchanges for long term holding.

“Notable is the 6-month drop of the percentage of #Chainlink tokens exchanges, declining from 8.6% to 6.9 during this time frame. This supports the narrative that the $LINK army just isn’t selling and more and more of the supply is being moved to offline wallets.”

The entry of Barstool Sports founder Dave Portnoy into the crypto market has contributed to the new LINK attitude, after the day trader bought $300K of LINK and has been since shilling Bitcoin and other altcoins.

“Portnoy is taking shilling crypto to a whole new level and fast. It seems improvised, but I bet he’s been preparing his crypto marketing campaign for a while.”

Are LINK Whales Dumping?LINK has one of the largest imbalances in the HODLing ratio, with much over 83% of the total supply being held by 100 addresses. While some of the marines think that this is a good sign for more highs for the coin, the recent dump has some people speculating that whales are liquidating and exiting.

Technical analyst Ali Martinez thinks that the data by Santiment suggests large investors are benefiting more from the LINK euphoria of retail investors.

“While retail investors grow euphoric about #Chainlink, large investors are realizing profits. @Santimentfeeds’s holder distribution charts show that the # of addresses holding 100K to 10M is on a steady decline since August 8. Roughly 64 whales have left the network.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Dropil (DROP) на Currencies.ru

|

|