2020-4-22 00:03 |

The Bitnomial Exchange has obtained approval from the Commodity Futures Trading Commission (CFTC) on Monday, April 20th to operate as a Designated Contract Market (DCM) which means the exchange can now offer Bitcoin Futures and Options contracts settled in real Bitcoin.

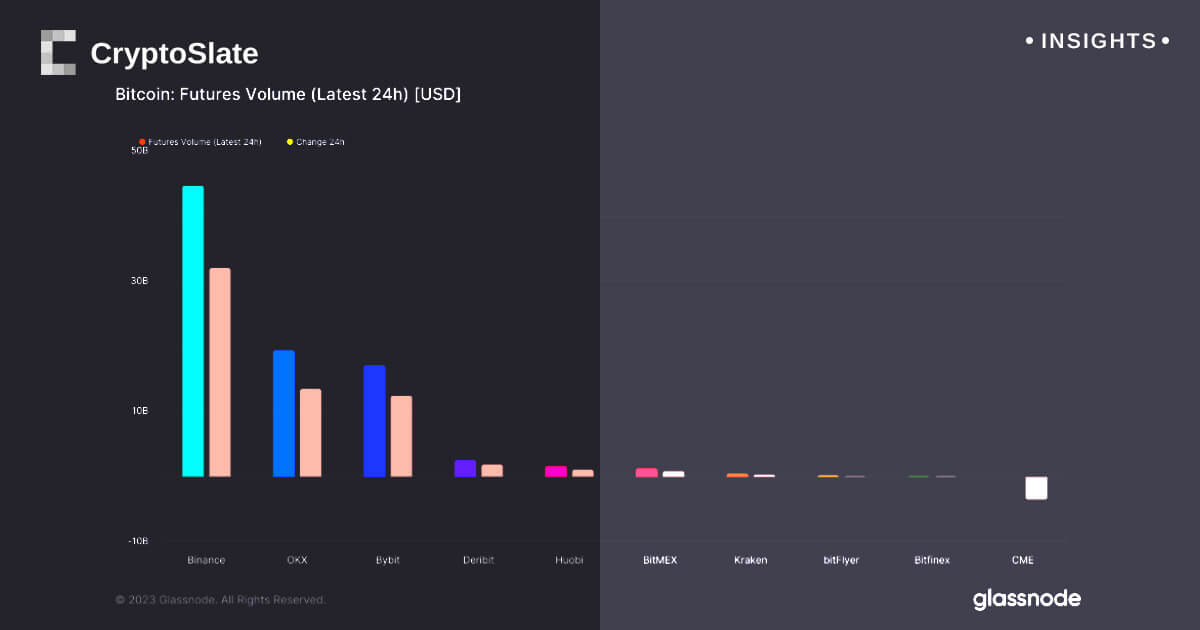

Bitnomial joins the ever-growing list of companies that offer Bitcoin Futures contracts, such as CME, LedgerX, Bakkt, CBOE, and ErisX. Not to mention these other mixes of hedge funds and crypto exchanges that offer futures: Medallion Hedge Fund, Huobi, OKEx, Binance, and BitMEX.

However, it's important to note that CME and Bakkt are the main players who attract the majority of the volume, while CBOE has ended its contract offering in early 2019 while ErisX attracts very little volume among its competition.

Bitnomial is following the likes of Bakkt, where instead of settling the futures contracts in Fiat equivalent. Investors would then be offered physical Bitcoin at the time of settlement.

As per the order, issued by CFTC on Monday, the exchange went through a strict inspection and technical evaluation of its operations before it got the nod from the regulatory body.

The press release read:

“The approval allows Bitnomial to tackle a confluence of generational shifts in financial markets: First, a new generation of customers are emerging as savvy with trading, technology and delivery. Second, innovative new unregulated derivatives are booming with daily volumes topping $45 [billion] but maybe illegal for many U.S. traders.”

Bitnomial Trying to Tap “New Growth Areas”Bitnomial also commented that they would be focusing on “new growth areas,” referring to customers currently untapped by existing futures contracts providers. The platform has opened user signups for its futures contracts, while it's also planning to launch user acceptance testing by April 27th.

The firm's CEO – Luke Hoersten – also revealed that they would offer a number of futures products on their platform including quarterly futures, micro futures, and options. The contracts will be settled on-chain instead of book-entry and would trade at a margin of 37 percent.

A physically settled Bitcoin futures contract is still scarce in the United States and it's believed that Bitnomial is trying to capture a largely untapped market in the ecosystem of the crypto futures.

Bitnomial also got the backing of Jump Capital, whose CEO – Peter Johnson – believes Bitnomial futures product would be a boon for the industry and explained:

“[Bitnomial's] products are also reliably tied to the underlying asset price via the option for physical delivery.

We’re excited to be partners with a company that is committed to meeting the highest regulatory standards and increasing the accessibility of crypto derivatives to U.S. traders.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|