2020-11-11 15:00 |

Ethereum has consolidated since hitting the $465 highs last week. It is neither up nor down in the past 24 hours. Still, analysts say that Ethereum is primed to move even higher in the weeks ahead. An analyst noted that the cryptocurrency is currently in the midst of a bullish pennant pattern, which could trigger a move above $500. Ethereum Primed to See Strong Rally Higher

Ethereum has consolidated since hitting the $465 highs last week. The coin currently trades for $445 and is neither up nor down in the past 24 hours.

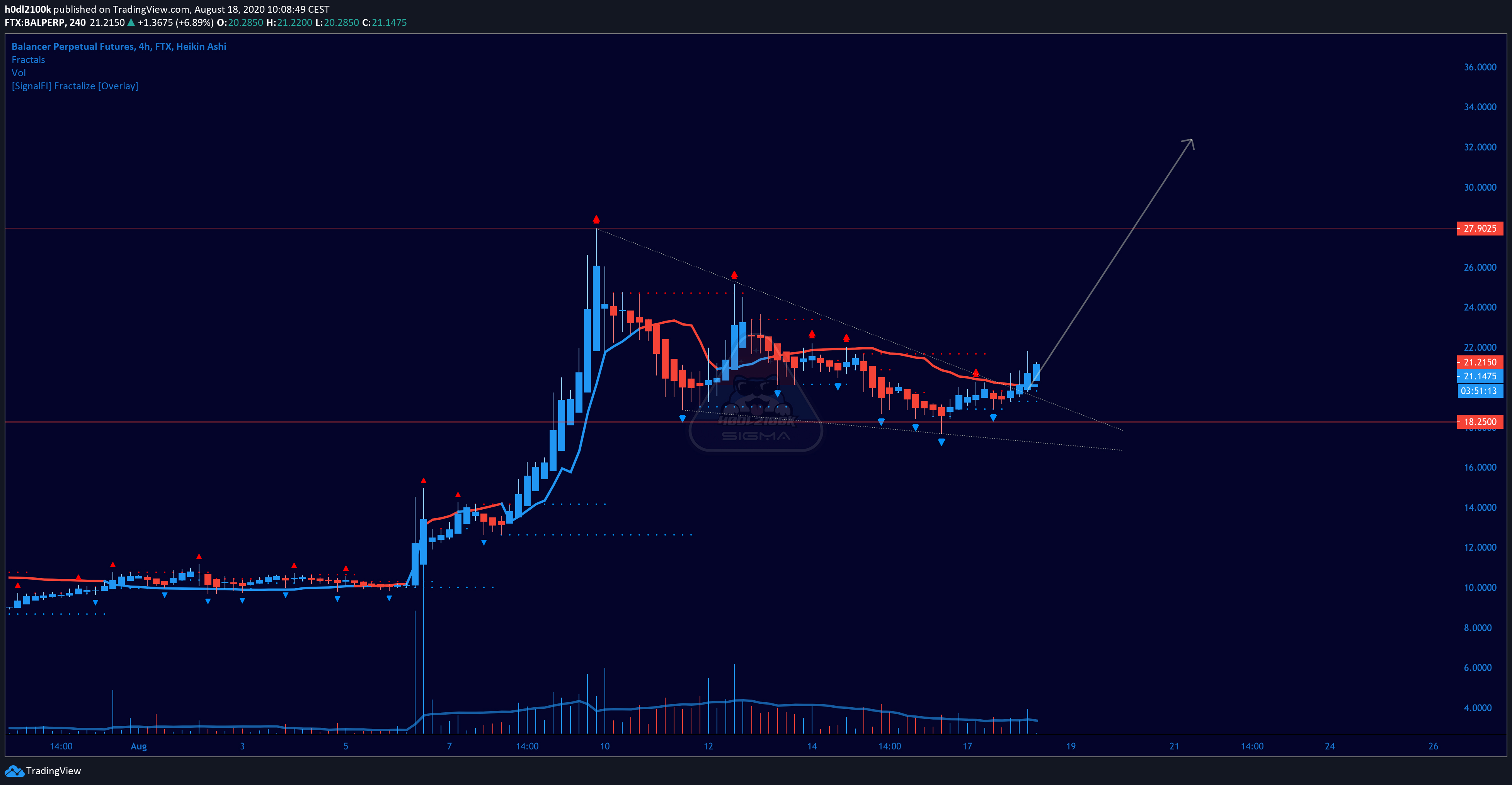

Still, Ethereum is primed to move even higher in the weeks ahead. One crypto-asset analyst recently shared the chart below, noting that ETH is likely trading in a bullish pennant.

This pennant suggests that once Ethereum breaks the upper range of the pennant, it will move to $500 and potentially beyond.

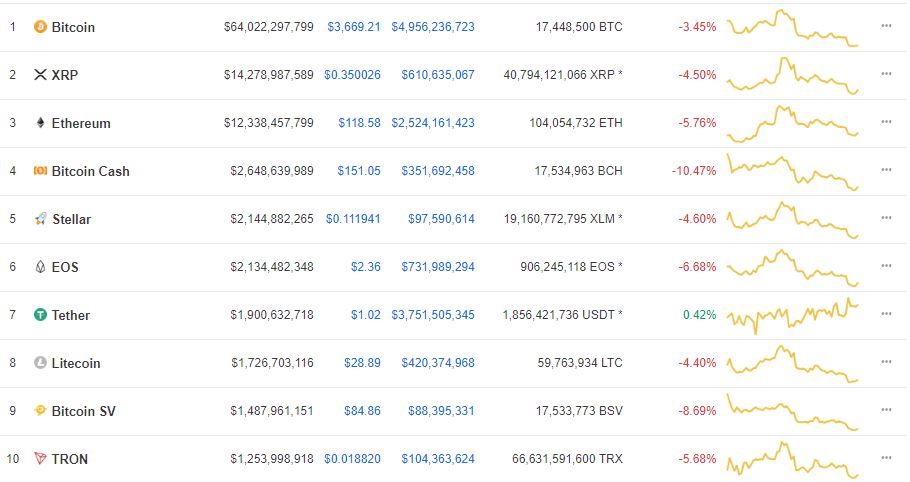

Chart of ETH's price action over the past few months with an analysis by crypto trader Crypto Rand (@Crypto_Rand on Twitter). Source: ETHUSD from TradingView.comEthereum is also expected to move toward $800 as it turns the $400 region into support. A leading crypto-asset analyst recently shared the chart seen below, which shows that there is little macro resistance until $800-900:

“Stop charting ETH against BTC it under performs USD. HTF trend is heavily bullish going into 2021, I really hope we get the chance to buy around $350 again at some point before we really start to see price clear $600 and $800… I have a large USD position to spend.” Chart of ETH's price action over the past three years with analysis by crypto trader Cactus (@Thecryptocactus on Twitter). Source; ETHUSD from TradingView.com Fundamentals Also BullishAustralia’s Reserve Bank recently announced it will be using Ethereum technology for its CBDC pilot test:

“The Reserve Bank today announced that it is partnering with Commonwealth Bank, National Australia Bank, Perpetual and ConsenSys Software, a blockchain technology company, on a collaborative project to explore the potential use and implications of a wholesale form of central bank digital currency (CBDC) using distributed ledger technology (DLT)… The project will involve the development of a proof-of-concept (POC) for the issuance of a tokenised form of CBDC that can be used by wholesale market participants for the funding, settlement and repayment of a tokenised syndicated loan on an Ethereum-based DLT platform.”

The Reserve Bank will also be partnering with ConsenSys, the Ethereum-focused development studio, to work on this project. Of course, this is not a sign that they will actually be using the formal Ethereum blockchain but is a validation of the technology that underpins it.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Bullish Pennant Predicts Ethereum Will Soon Shoot Towards $500 origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|