2018-12-20 19:52 |

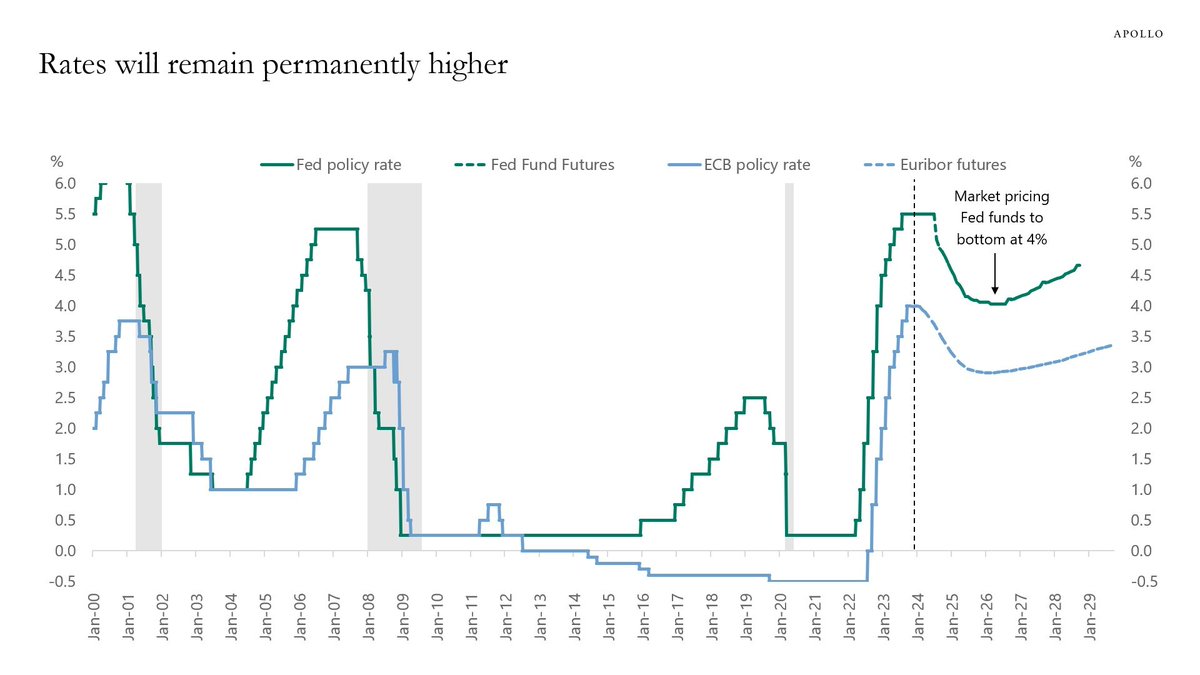

A few hours ago, the United States Federal Reserve increased its interest rate by a quarter of a point from 2.25% to 2.5%. Such an increase might seem small, but the move is the fourth increase this year and the ninth since it started normalizing lending rates in 2015. Central Banks usually increase interest rates to slow down the economy when there are signs of inflation (which is defined as a measure of when the buying power of currency starts to reduce).

Is the US Economy At Risk of Inflation ?There has been several calls of caution that have been made by analysts with respect to the US economy experiencing a stock market crash similar to, or greater than, the one experienced in 2008. One such analyst is J.P Morgan’s top quant, Dr. Marko Kolanovic, who had earlier on in the year pointed out that the likelihood of such a crash were low at least till the second half of 2019. He stated that the exact timing of the crash would be determined by the speed in which the Federal Reserve hikes interest rates and reverse bond purchases.

Current Stock Market Drop Due to the Current 0.25% Rate HikeeToro’s Senior Market Analyst, Mati Greenspan, explained to Ethereum World News that the drop in the US markets currently being experienced was expected given that the increase by the Federal Reserve had been anticipated. Mati however explained that this time round, the drop was different.

What really dropped the markets though, was that the Fed didn’t at all seem sympathetic to the current market turmoil. They indicate that they’re not about to hike rates aggressively unless the economy grows quicker.

However, they seemed unwilling to reduce the pace of their quantitative tightening. Meaning, that they will continue to reduce the size of their enormous balance sheet, which is still way overinflated from 10 years of quantitative easing.

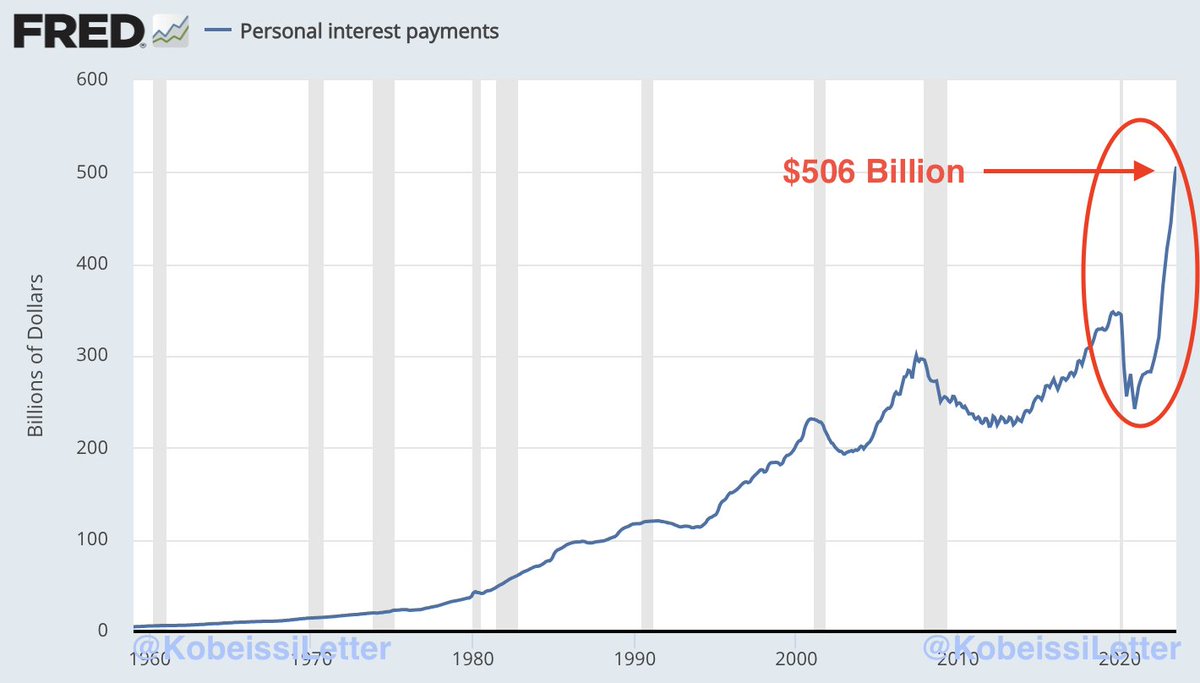

How Bitcoin (BTC) and Crypto Stands To BenefitThe increment of interest rates by the Feds indicate that their will be a domino effect on the US economy. This increase will affect regular borrowing such as home mortgages and credit cards. Interest rates for such services will be increased by the providing financial institutions.

The savvy and cautious investors in the US, will take this as an early sign of trouble in the economy and start hedging with BTC and other cryptocurrencies.

Controversial internet guru, Kim Dotcom, had cautioned the world against its over-reliance on the USD in a tweet that advised on how to hedge against a market crash using BTC and Gold.

Trust me. Buy crypto and gold.

Your USD will become worthless. With US economic collapse all old money currencies will crash. Times will get tough.

But you’ll be fine if you hedge some of your assets in preparation for the crash.

The big crash is coming 100%.

BTC and Crypto Massively DiscountedFurther looking at the value of Bitcoin and other Cryptocurrencies, they are massively discounted when compared to their All Time High (ATH) values back in December 2018 and January 2019. Many of the digital assets have experienced a decline in value of between 70% and 92% due to the current bear market.

Connecting the dots, BTC and crypto might experience a slow but constant entry of investors who are hedging early against a possible stock market crash in the United States.

What are your thoughts on the Fed Rate Increase? Will it signal a recovery in the crypto markets as new investors start buying? Please let us know in the comment section below.

Disclaimer: This article is not meant to give financial advice. Any additional opinion herein is purely the author’s and does not represent the opinion of Ethereum World News or any of its other writers. Please carry out your own research before investing in any of the numerous cryptocurrencies available. Thank you.

The post How Bitcoin (BTC) and Crypto Stands to Benefit from the Fed Rate Increase appeared first on Ethereum World News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|