btcusd / Заголовки новостей

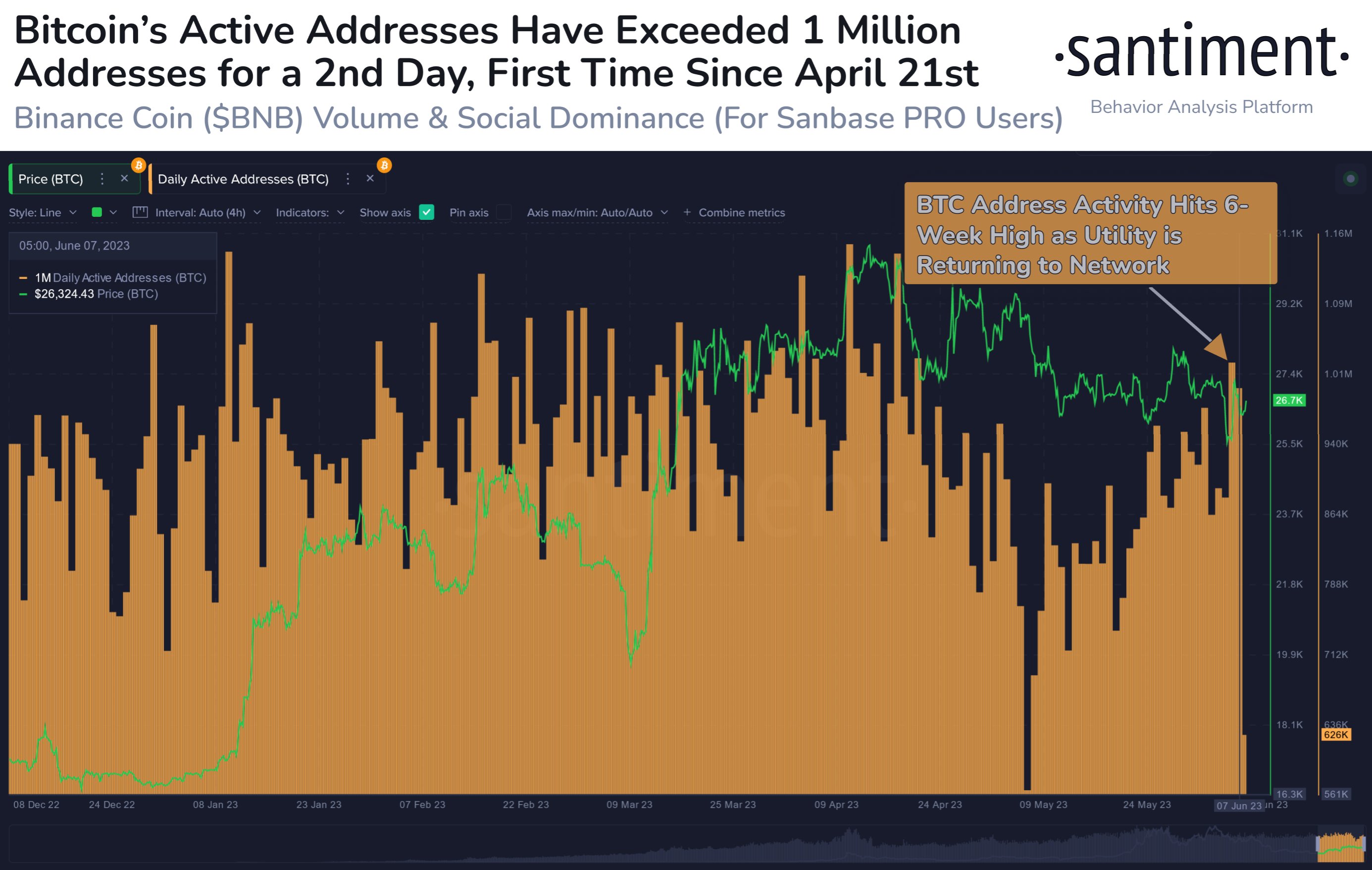

Bitcoin Active Addresses Spike, What Does This Mean?

On-chain data shows that Bitcoin active addresses have registered a spike recently. Here’s what this may mean for the market. Bitcoin Active Addresses Spike Following Uptick In Volatility According to data from the on-chain analytics firm Santiment, utility on the network has picked up quite drastically recently. дальше »

2023-6-10 19:00

|

|

Bitcoin Bearish Signal: Dormant 1,433 BTC Moves After 10+ Years

On-chain data shows a large amount of Bitcoin older than 10 years has suddenly moved today, a sign that could be bearish for the price. Bitcoin Dormant From More Than 10 Years Ago Has Abruptly Moved As pointed out by an analyst in a CryptoQuant post, this movement of dormant coins may be a sign of selling. дальше »

2023-6-9 21:00

|

|

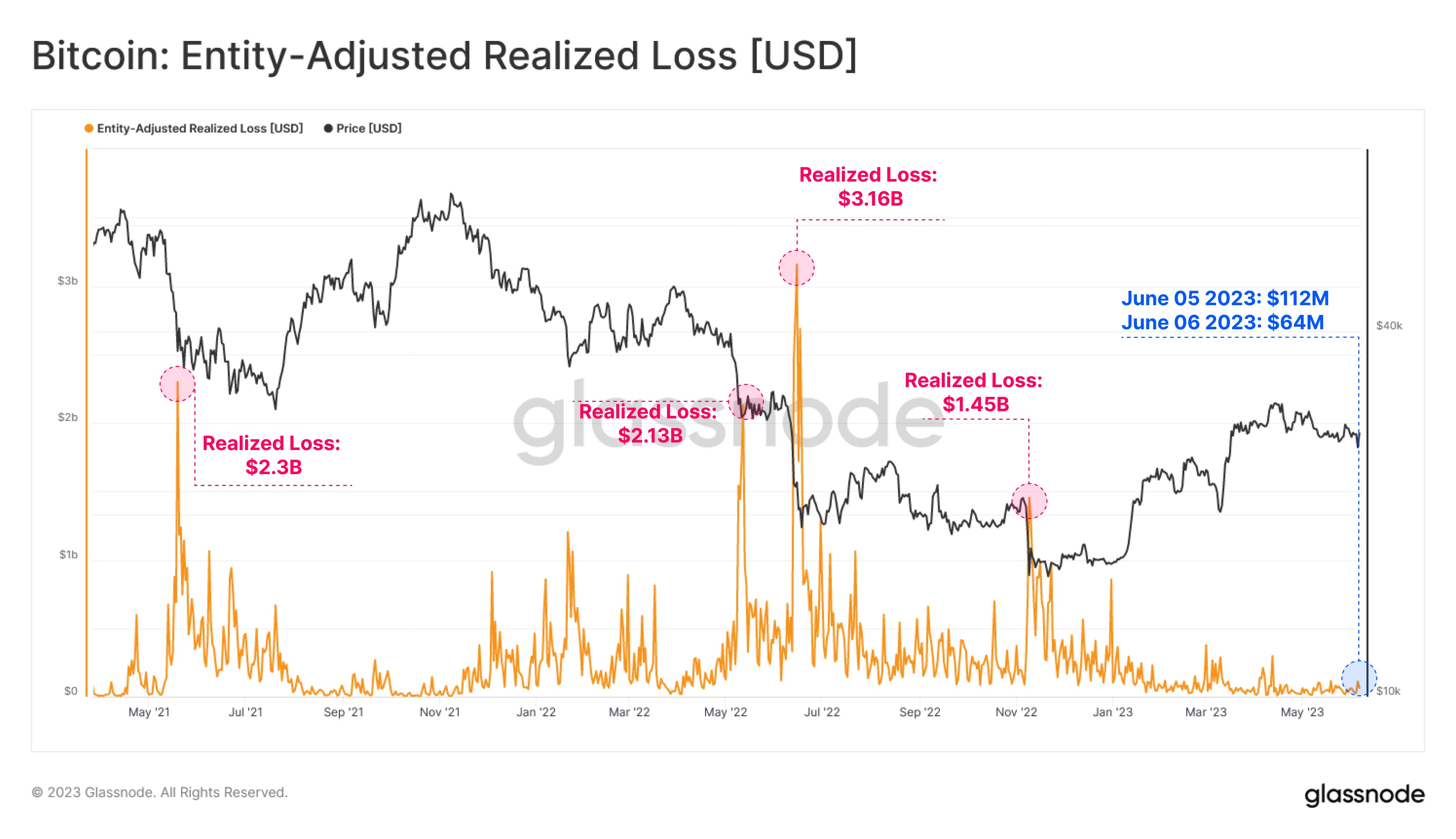

Bitcoin Realized Loss Remains Low Despite Volatility, What Does This Mean?

On-chain data shows the Bitcoin realized loss metric has stayed at a low value recently, despite the volatility that the coin has experienced. Bitcoin Realized Loss Continues To Be At A Relatively Low Value According to data from the on-chain analytics firm Glassnode, investors realized just $112 million in losses during the recent plummet in the cryptocurrency’s value. дальше »

2023-6-7 19:00

|

|

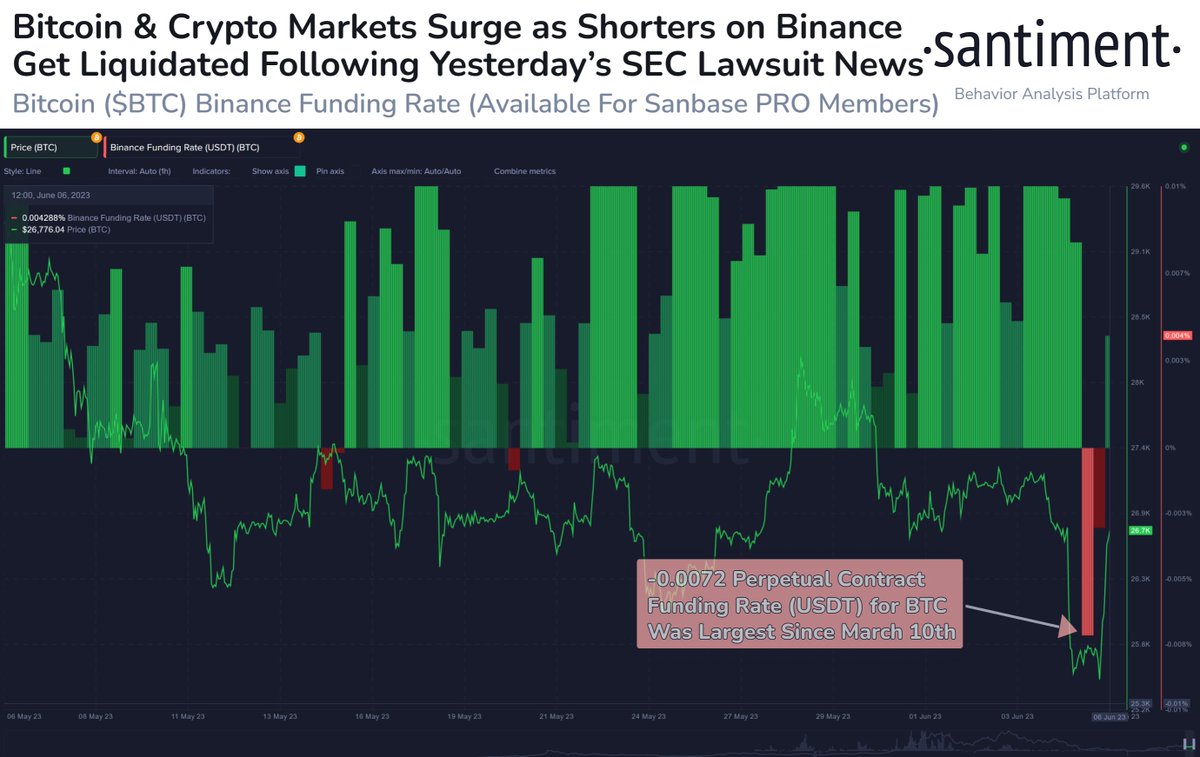

Bitcoin Shorts Squeezed As Price Shows Recovery

Data shows the Bitcoin shorts that had amassed after the recent crash have now been squeezed following the recovery in the asset’s price. Bitcoin Shorts Take Beating As Price Shows Sharp Rebound According to data from the on-chain analytics firm Santiment, the funding rate on Binance had become deeply negative after the crash. The “funding […] дальше »

2023-6-7 18:30

|

|

Bitcoin Crash To $25,800 Sends 6.5% Of Supply Into Loss

On-chain data shows yesterday’s Bitcoin crash from $27,300 to $25,800 alone sent 6. 5% of the supply into a state of loss. Bitcoin Supply In Profit Shrunk Down To 62. 5% Following The Price Plunge According to data from the on-chain analytics firm Glassnode, a further 1. дальше »

2023-6-7 00:00

|

|

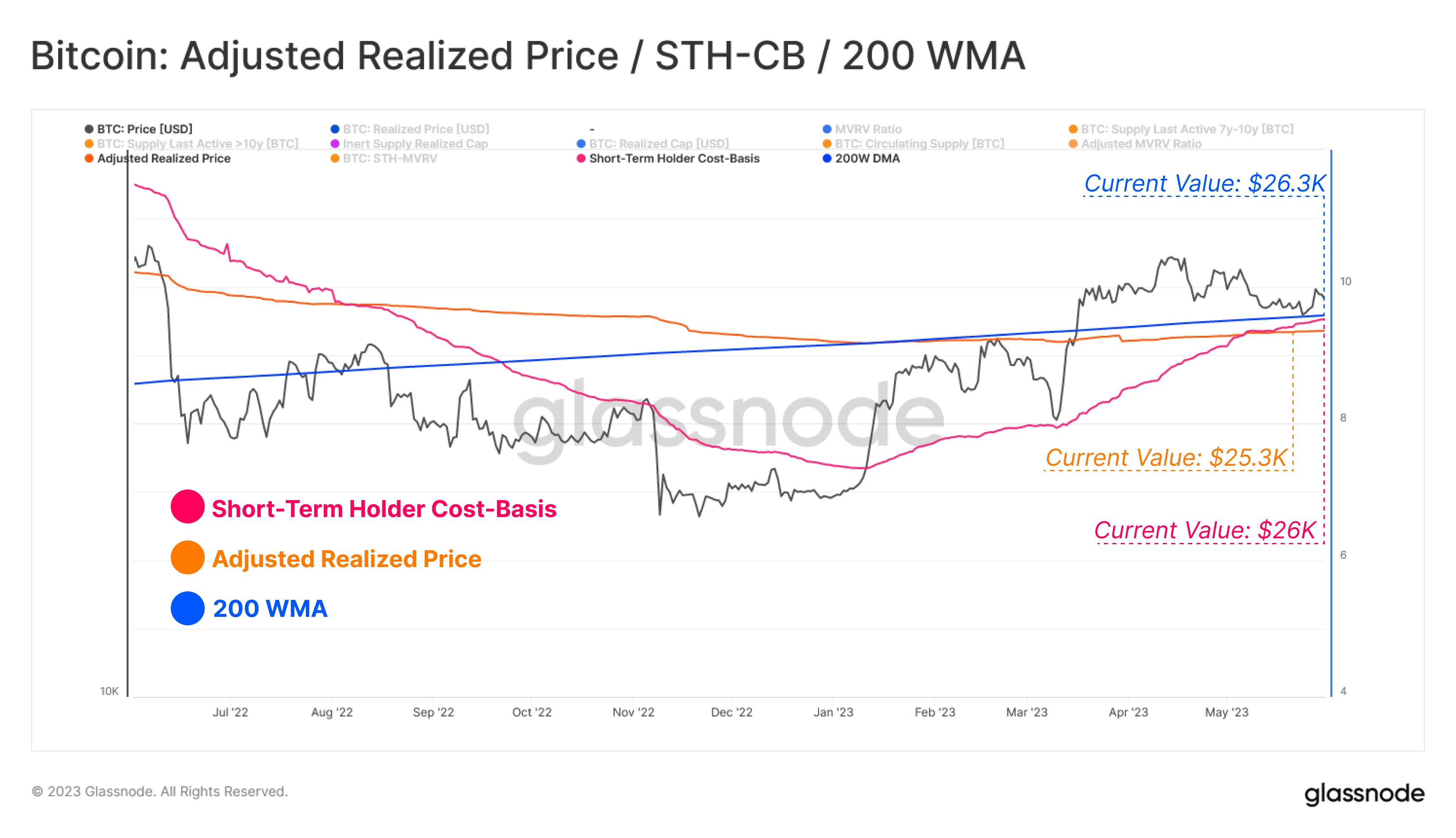

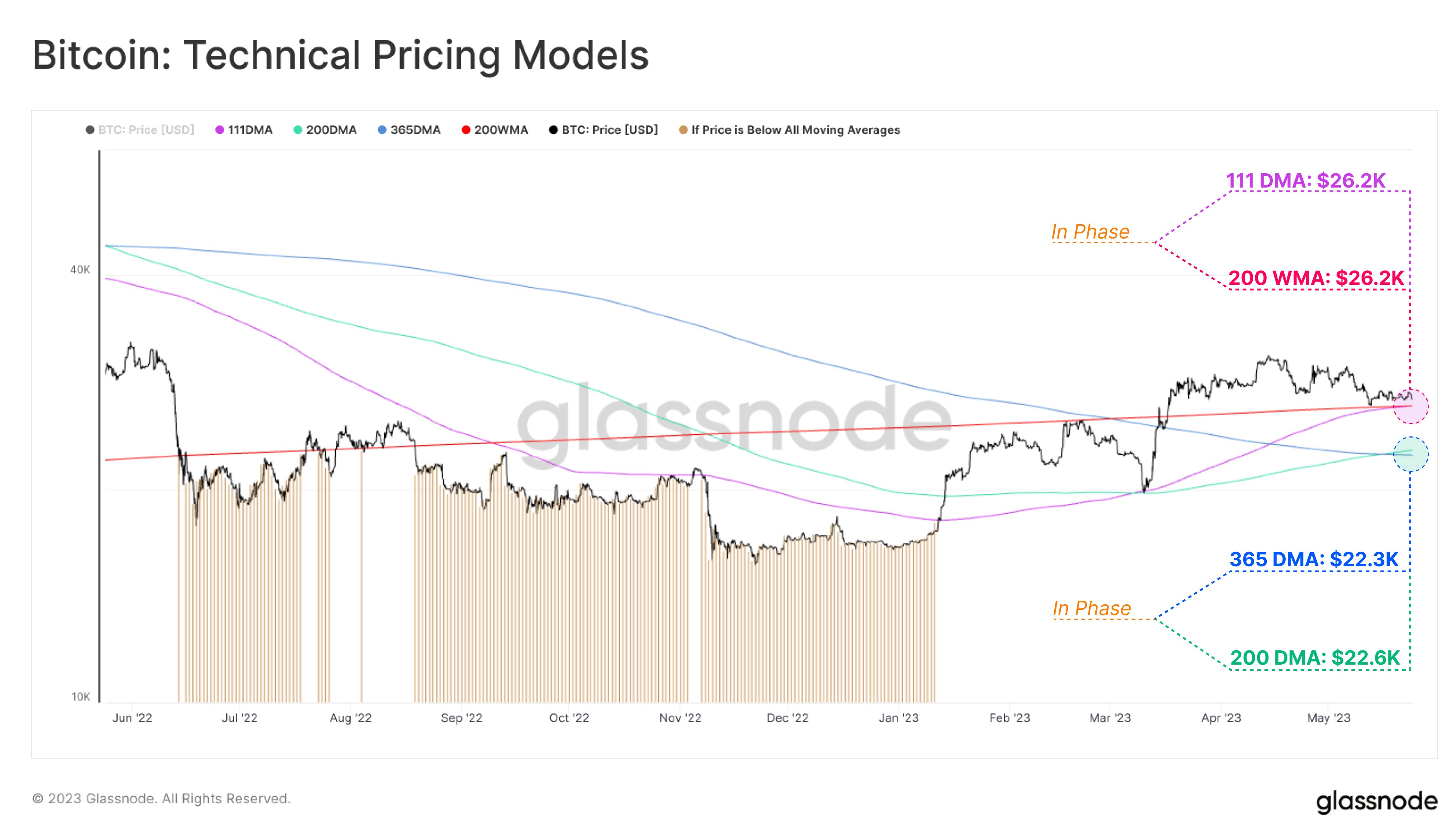

Here Are The Pricing Models Bitcoin Must Stay Above For Rally To Go On

Here are the pricing model lines that Bitcoin might have to stay above if the bullish momentum of the cryptocurrency has to continue. These Bitcoin Pricing Models Are Currently Near The Spot Price In a new tweet, the on-chain analytics firm Glassnode has pointed out how the three pricing models, the adjusted realized price, the short-term holder cost basis, and the 200-week MA, are all close to the asset’s value right now. дальше »

2023-6-3 20:30

|

|

Current Bitcoin Cycle Has Broken This Fee Pattern For The First Time

Data shows the current Bitcoin cycle is the first one in the history of the cryptocurrency to deviate from an established pattern of transaction fees. The Latest Bitcoin Cycle Has Seen Less Cumulative Fees Than The Previous One According to data from the on-chain analytics firm Glassnode, the cryptocurrency has seen cumulative fees of just […] дальше »

2023-6-3 17:00

|

|

Bitcoin Miners Receive Inflows Of 7,000 BTC, What Does It Mean?

On-chain data shows that Bitcoin miners have recently received net inflows of about 7,000 BTC. Here’s what this may mean for the asset. Bitcoin Miner Netflow Has Registered A Large Positive Spike As an analyst in a CryptoQuant post pointed out, Poolin mining pool seems to have been behind most of the recent inflows. дальше »

2023-5-30 19:30

|

|

Bitcoin Rally Hopes Still Alive, If This Metric Is To Go By

If the historical pattern in this on-chain indicator is anything to go by, hopes for the continuation of the Bitcoin rally may still be alive. Bitcoin SOPR Ratio Has Been Going Up In Recent Weeks As an analyst in a CryptoQuant post pointed out, the SOPR ratio has been above 1 recently. дальше »

2023-5-30 21:00

|

|

Bitcoin Shows Recovery: Did This Historical Line Act As Support Again?

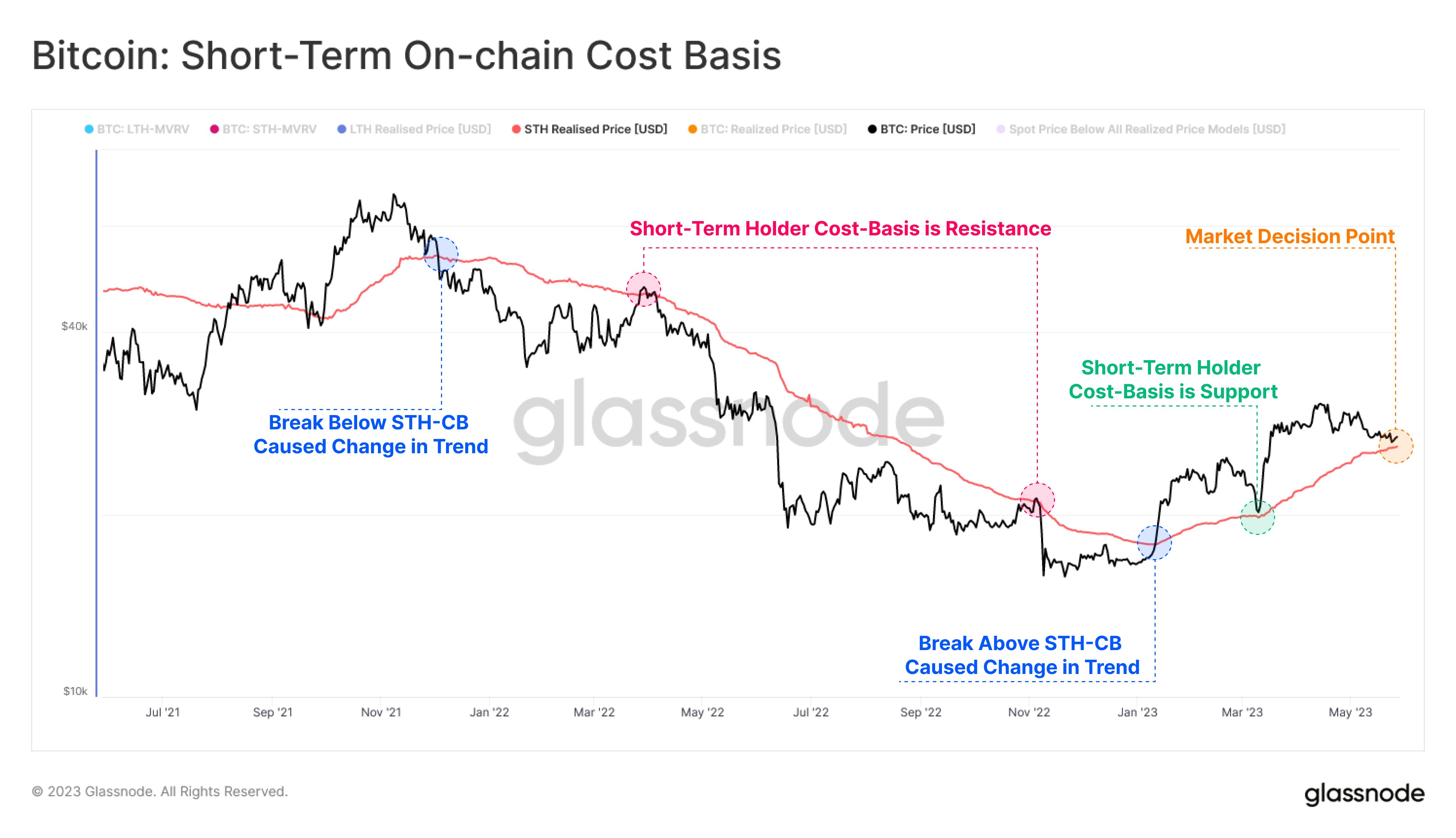

Bitcoin on-chain data suggests a historical support line may have helped the coin once again as the asset has recovered toward $28,000 today. Bitcoin Short-Term Holder Cost Basis May Still Be Active As Support According to data from the on-chain analytics firm Glassnode, the BTC price approached the cost basis of the short-term holders recently. дальше »

2023-5-29 15:30

|

|

Bitcoin Bearish Signal: NUPL Finds Rejection At Long-Term Resistance

On-chain data shows the Bitcoin Net Unrealized Profit and Loss (NUPL) has found rejection at the long-term resistance zone recently. Bitcoin NUPL Has Observed Some Decline In Recent Days As explained by an analyst in a CryptoQuant post, the BTC NUPL metric has failed to clear a major resistance. дальше »

2023-5-25 20:00

|

|

Bitcoin Hangs At $26,200: Why This Is A Crucial Support Level

Bitcoin has plunged during the last 24 hours and now finds itself at the $26,200 level. Here’s why this level is important for the asset. Bitcoin 200 WMA & 111 DMA Are Both At $26,200 Right Now In a new tweet, the analytics firm Glassnode has talked about how the different technical pricing models for Bitcoin may be interacting with the asset’s price currently. дальше »

2023-5-25 17:00

|

|

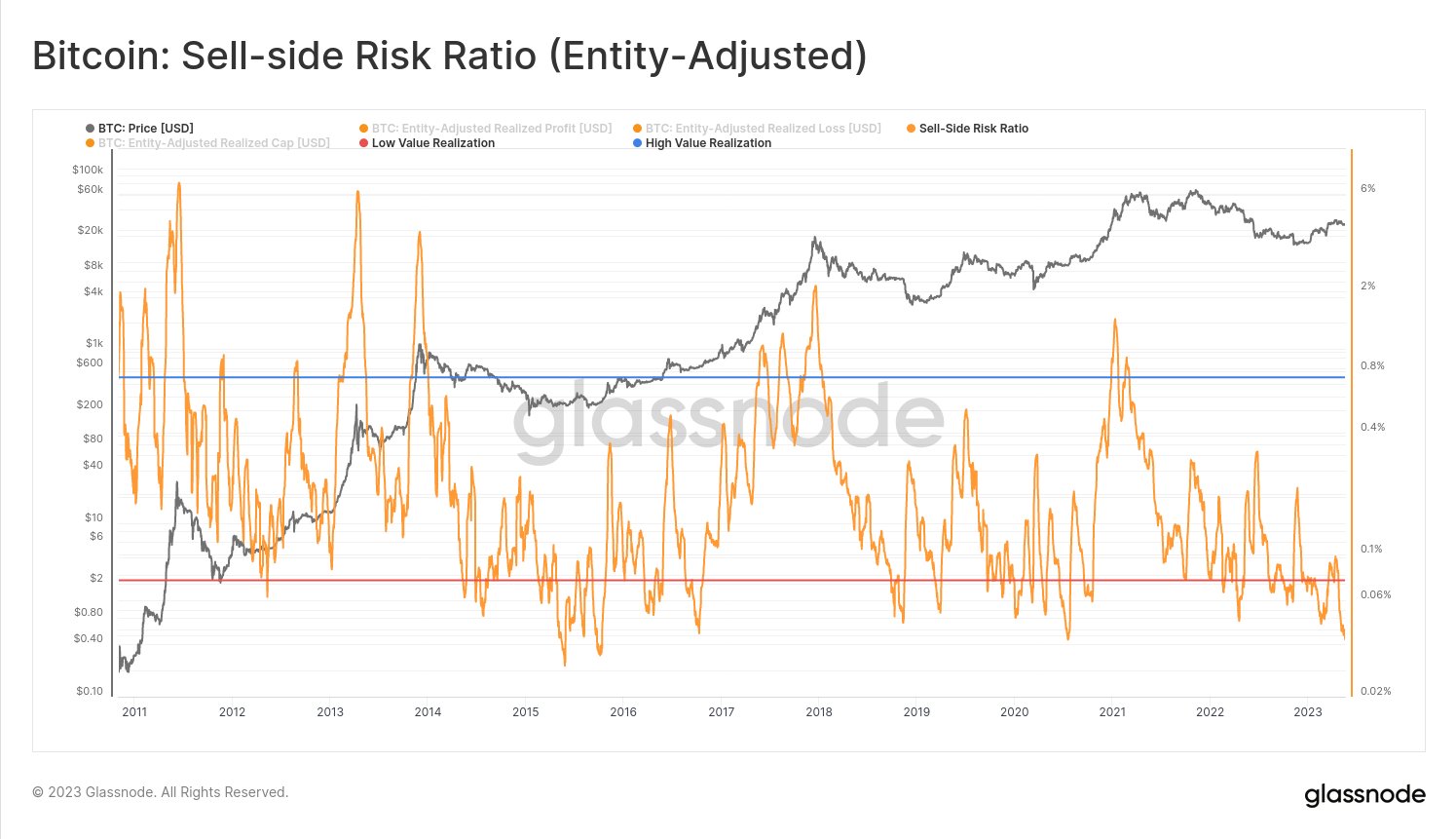

Bitcoin Sell-Side Risk Ratio Nears All-Time Lows, Big Move Soon?

On-chain data shows the Bitcoin sell-side risk ratio has approached all-time lows recently, a sign that a big move could be coming for the coin. Bitcoin Sell-Side Risk Ratio Has Observed A Plunge Recently As pointed out by the lead on-chain analyst at Glassnode in a Tweet, BTC sellers may have become exhausted recently. дальше »

2023-5-25 21:03

|

|

How Does Current Bitcoin Rally Compare With Historical Ones?

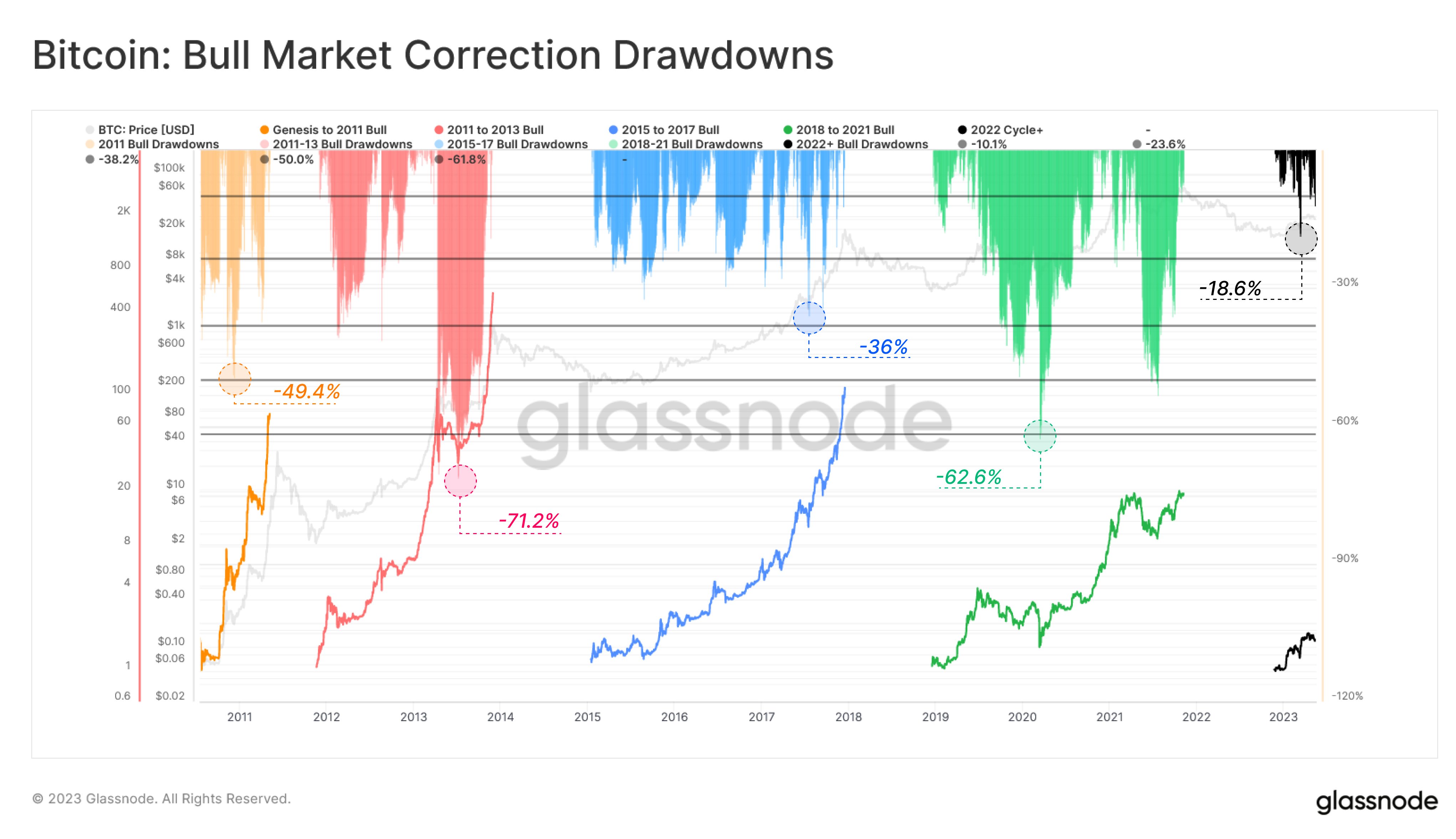

Here’s how the current Bitcoin rally stacks up against the previous ones in terms of the drawdowns it has experienced so far. The Current Bitcoin Rally Has Seen A Peak Drawdown Of -18. 6% So Far In a recent tweet, the on-chain analytics firm Glassnode compared the latest Bitcoin rally with the ones seen throughout the entire history of the cryptocurrency. дальше »

2023-5-23 20:30

|

|

Bitcoin Volatility Shrinks To Historical Levels, Violent Move Incoming?

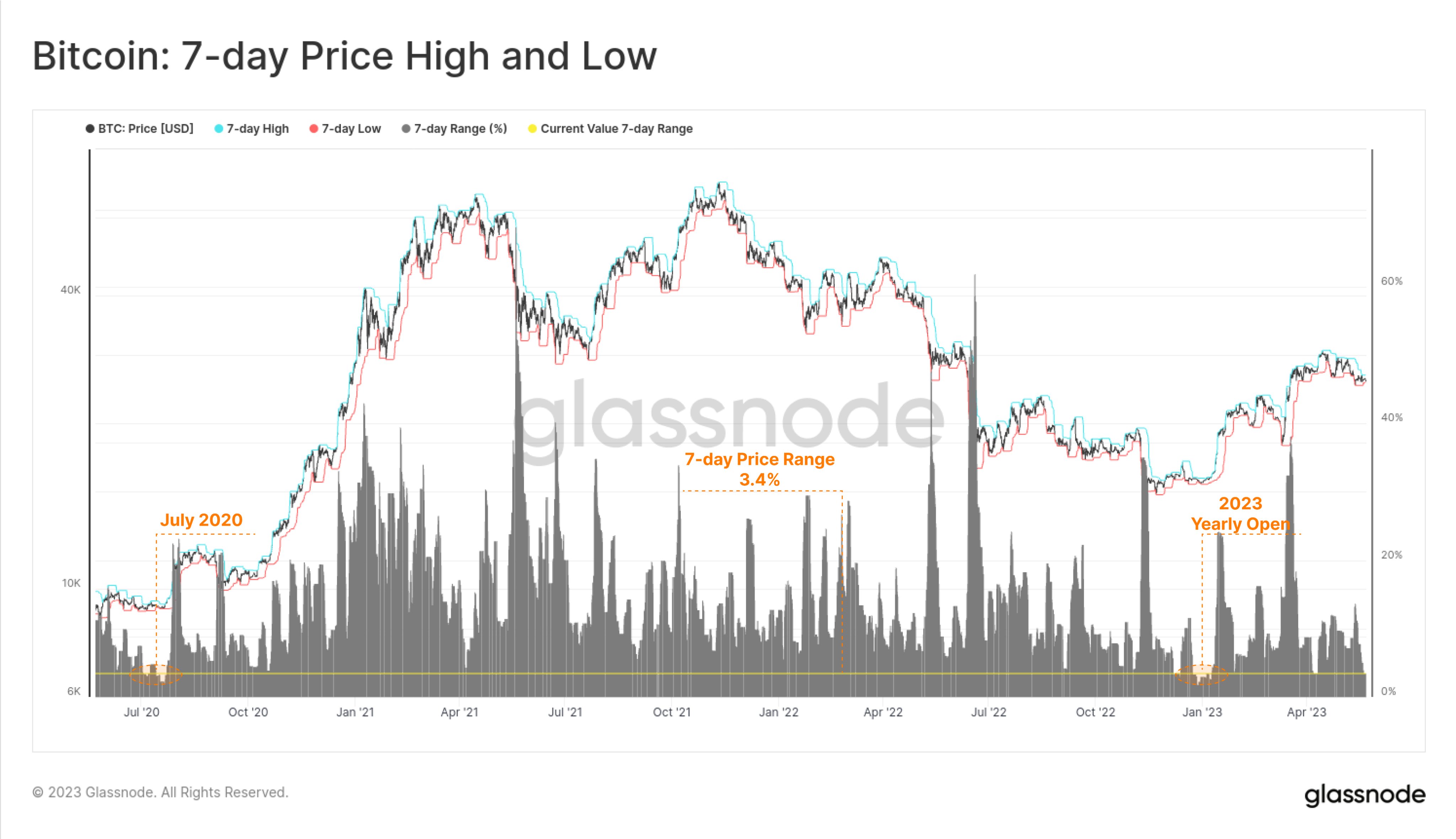

Data shows that Bitcoin volatility is currently at historically low levels, something that has led to violent price moves in the past. Bitcoin 7-Day Range Has Compressed To Just 3. 4% Recently According to data from the on-chain analytics firm Glassnsode, the current 7-day price range is comparable to levels seen back in January of this year. дальше »

2023-5-22 15:00

|

|

World Bitcoin Pizza Day 2023: Iconic Day in Crypto Journey

Coinspeaker World Bitcoin Pizza Day 2023: Iconic Day in Crypto Journey Bitcoin Pizza Day has now grown to become a symbolic day for the entire cryptocurrency space and is celebrated with several events every year. дальше »

2023-5-22 12:43

|

|

Bitcoin Plunges Below $27,000 As Miners Show Signs Of Selling

Bitcoin has now dipped below the $27,000 level as on-chain data shows the miners have possibly been selling the asset recently. Bitcoin Miner Reserve Has Taken A Sharp Plummet Recently As pointed out by an analyst in a CryptoQuant post, miners have taken out about 1,750 BTC from their wallets during the past day. дальше »

2023-5-20 16:36

|

|

This Bitcoin Metric Is At A Crucial Junction, Will Bulls Find Victory?

On-chain data shows a Bitcoin indicator is currently retesting a crucial level that could decide the direction the market takes from here. Bitcoin Short-Term Holder SOPR Has Plunged To A Value Of 1 As pointed out by an analyst in a CryptoQuant post, the short-term holders are currently selling at their break-even mark. дальше »

2023-5-17 01:00

|

|

Bitcoin Active Addresses Sharply Decline Despite Transaction Demand, Why?

Data shows that Bitcoin active addresses have sharply dropped despite the high transaction demand; here’s why this may be happening. Bitcoin Active Addresses Have Seen A Sharp Plunge Recently According to the latest weekly report from Glassnode, the active addresses are around cyclical lows of 566,000. дальше »

2023-5-16 06:00

|

|

Has Bitcoin Rally Already Hit Top? Here’s What Puell Multiple Says

On-chain data shows the Bitcoin Puell Multiple has hit pretty high levels recently. Here’s what this may mean for the current rally. Bitcoin Puell Multiple Has Risen To High Levels In Recent Days As pointed out by an analyst in a CryptoQuant post, the Puell Multiple is currently at even higher levels than those seen during the 2021 bull run top. дальше »

2023-5-16 22:20

|

|

Bitcoin Miners Continue To Sell, Bearish Sign?

On-chain data shows that Bitcoin miners have continued to sell recently, something that could be bearish for the cryptocurrency’s price. Bitcoin Miners Have Been Shedding Their Reserves Recently As pointed out by an analyst in a CryptoQuant post, there has been some intense pressure from miners in recent days. дальше »

2023-5-15 17:30

|

|

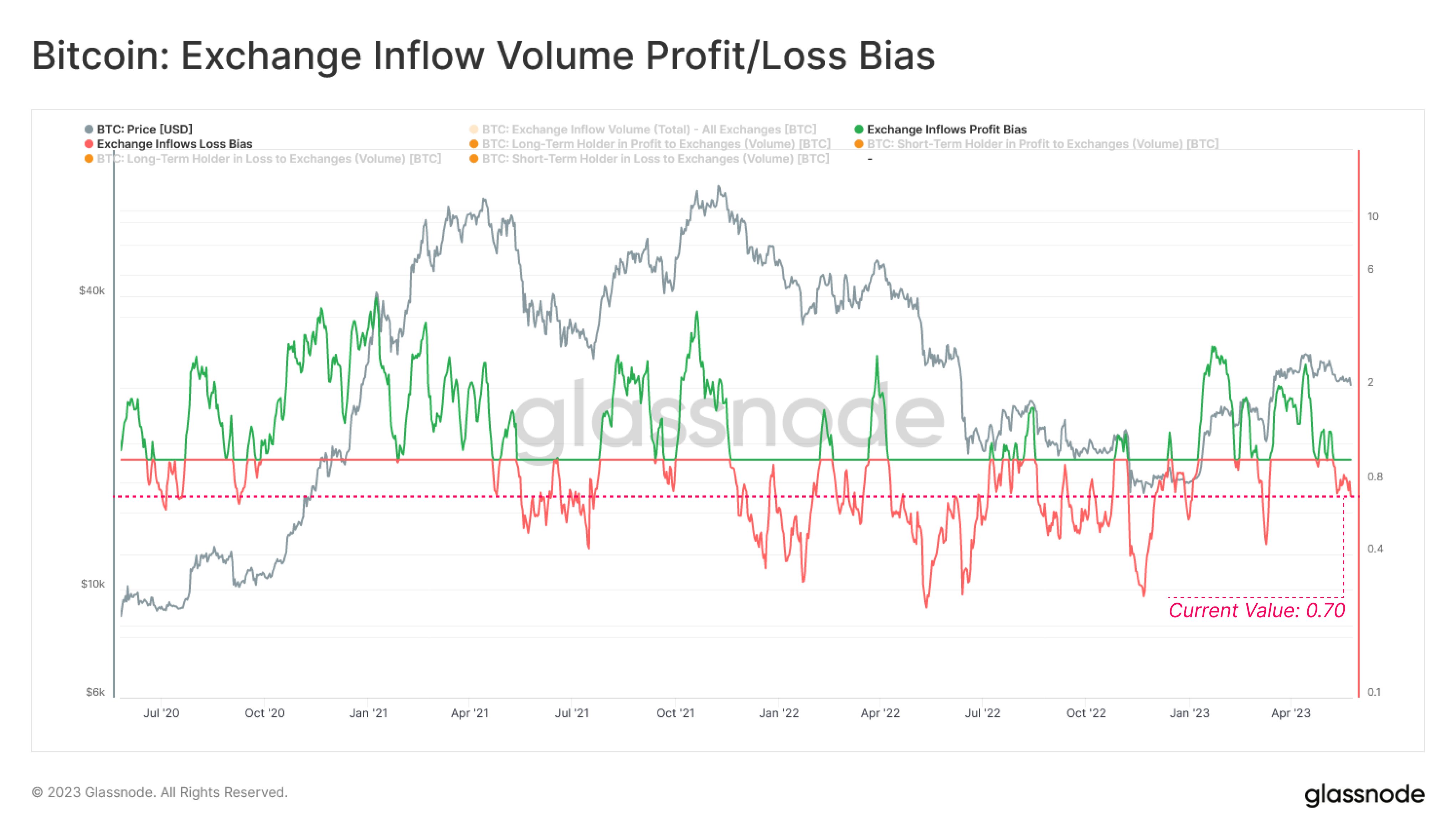

Bitcoin Plunges Below $27,000, Which Holder Groups Are Selling?

Bitcoin has plunged below the $27,000 mark during the past day. Here are the market segments that are possibly participating in this selloff. These Bitcoin Investors Have Been Spending Their Coins Recently In a new tweet, the on-chain analytics firm Glassnode has broken down the prices at which the average coins sold today were bought. дальше »

2023-5-13 21:07

|

|

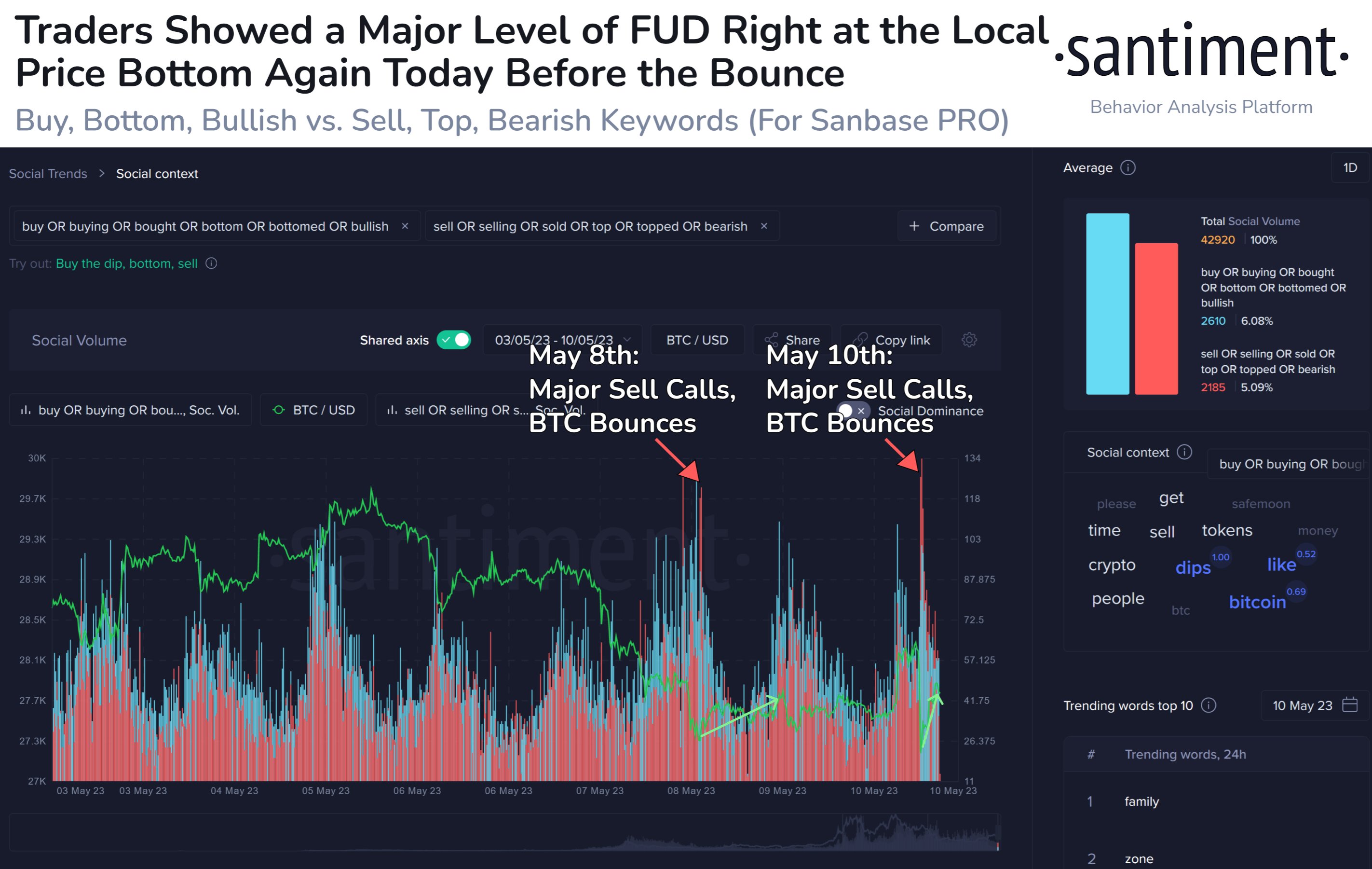

Bitcoin Rebounds From $27,100 After Spike In Bearish Sentiment

Data shows the Bitcoin sentiment had turned quite bearish just before the asset’s price had rebounded up from the $27,100 level. Bitcoin Recovers Shortly After FUD Takes Over Market According to data from the on-chain analytics firm Santiment, investors showed high levels of fear around the time of the local bottom during the past day. дальше »

2023-5-11 17:00

|

|

Bitcoin Funding Rates On BitMEX Turn Deep Red, Here’s Why This Is Bullish

Data shows the Bitcoin funding rates on the cryptocurrency exchange BitMEX have turned quite negative recently. Here’s why this may be bullish. Bitcoin Funding Rates On BitMEX Have Plunged To Deep Red Values As pointed out by an analyst in a CryptoQuant post, BTC felt a bullish boost the last time this pattern was observed. дальше »

2023-5-10 15:00

|

|

Bitcoin Plunge Under $28,000 Only Temporary? This Metric Suggests So

Bitcoin has now plunged under the $28,000 level, but the data of an on-chain indicator may suggest that this drop could only be temporary. Bitcoin Short-Term Holder SOPR Has Dropped Just Under The 1 Level As pointed out by an analyst in a CryptoQuant post, the current values of the metric have generally served as ideal buying opportunities during rallies in the past. дальше »

2023-5-9 15:30

|

|

Bitcoin To Drop Further? Whales Show Signs Of Dumping

On-chain data shows the Bitcoin exchange whale ratio has spiked recently, something that could lead to further downside in the asset’s value. Bitcoin Exchange Whale Ratio Has Sharply Surged Recently As pointed out by an analyst in a CryptoQuant post, the exchange whale ratio is currently at its highest level since September 2019. дальше »

2023-5-9 17:40

|

|

Bitcoin Rally May Not Have Hit Top Yet, Here’s Why

The historical pattern in this Bitcoin on-chain indicator may suggest that the ongoing rally hasn’t reached its top yet. Bitcoin 1-Year Inactive Supply Has Continued To Go Up Recently According to a post from the on-chain analytics firm CryptoQuant, the 1-year inactive supply hit a high back in March of this year. дальше »

2023-5-4 22:00

|

|

$24,400 May Be Next Major Level Of Support For Bitcoin, Here’s Why

Historical data of an on-chain indicator may suggest that the $24,400 level could be a major level of support for Bitcoin right now. Bitcoin STH MVRV Would Hit 1. 0 If Price Declines To $24,400 According to this week’s edition of the Glassnode report, the 1. дальше »

2023-5-4 17:30

|

|

Bitcoin Accumulation: HODLers Are Buying 15,000 BTC Per Month

On-chain data shows the Bitcoin HODLers are currently displaying net accumulation behavior, as they grow their holdings by 15,000 BTC per month. Bitcoin Long-Term Holders Have Been Accumulating Recently According to data from the on-chain analytics firm Glassnode, these investors were previously aggressively distributing during the bear market lows. дальше »

2023-4-27 18:00

|

|

This Highly Profitable Bitcoin Cross Has Just Formed Again

On-chain data shows that a Bitcoin cross that has proved quite profitable has once again formed for the cryptocurrency. Bitcoin Realized Price Of Short-Term Holders Overtakes Long-Term Holders As an analyst in a CryptoQuant post explained, the realized price of the 1 to 3 months holders has just exceeded that of the 6 to 12 months investors. дальше »

2023-4-26 22:25

|

|

Bitcoin Bearish Signal: NVT Golden Cross Enters Overbought Zone

On-chain data shows the Bitcoin NVT Golden Cross has entered into the overbought region, something that could be bearish for the price. Bitcoin NVT Golden Cross Has Been Going Up Recently As pointed out by an analyst in a CryptoQuant post, the most recent touch of this zone led to a drop in the price of the cryptocurrency. дальше »

2023-4-26 18:10

|

|

Bitcoin Market At Decision Point: aSOPR Retests Crucial Level

The Bitcoin market may be close to a decision point as on-chain data shows the Adjusted Spent Output Profit Ratio (aSOPR) is retesting the 1. 0 level. Bitcoin aSOPR Has Declined Towards A Value Of 1. дальше »

2023-4-26 21:00

|

|

What’s Behind The Recent Bitcoin Drop? Here’s What On-Chain Data Says

Bitcoin on-chain data hints that selling from the miners may have been behind the latest plunge in the asset’s price below the $28,000 mark. Bitcoin Miners Have Shown Signs Of Selling Recently As pointed out by an analyst in a CryptoQuant post, miners had been putting on some selling pressure on Bitcoin while the decline had happened. дальше »

2023-4-24 14:40

|

|

Bitcoin Exchange Outflows Spike, Bullish Sign?

On-chain data shows the Bitcoin exchange outflows have seen a significant spike during the past day, a sign that may be bullish for the price. Bitcoin Exchange Outflows Have Observed A Large Spike Today As pointed out by an analyst in a CryptoQuant post, a total of 2,138 BTC has been taken out of exchanges during the last day. дальше »

2023-4-21 16:00

|

|

Quant Explains Bitcoin Funding Rates Pattern That Precedes Uptrends

A quant has explained how a specific Bitcoin funding rates pattern has preceded uptrends in the asset’s price during recent months. The Bitcoin 72-Hour MA Funding Rates Pattern That May Kick Off Uptrends As explained by an analyst in a CryptoQuant post, the price has started rising recently whenever the metric has been near zero inside the negative zone. дальше »

2023-4-20 19:00

|

|

Bitcoin Bearish Signal: Supply Older Than 7 Years On The Move

On-chain data shows a large amount of Bitcoin supply dormant for more than 7 years ago has moved recently, a sign that may be bearish for the price. Bitcoin Supply Aged Between 7 And 10 Years Old Has Been Transferred Recently As pointed out by an analyst in a CryptoQuant post, the movement of such an old supply has generally led to a drop in the price of the cryptocurrency in the past. дальше »

2023-4-20 14:10

|

|

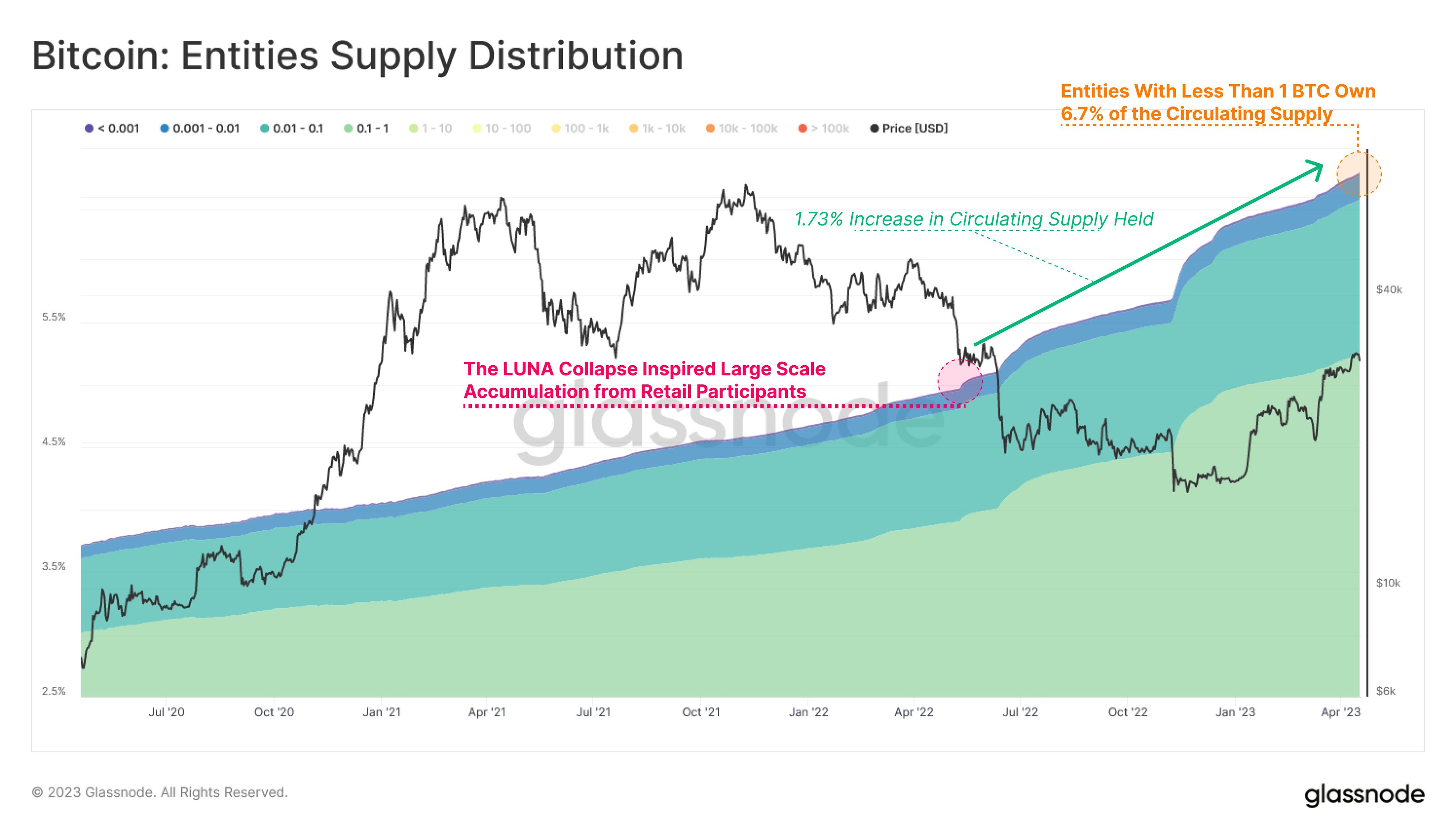

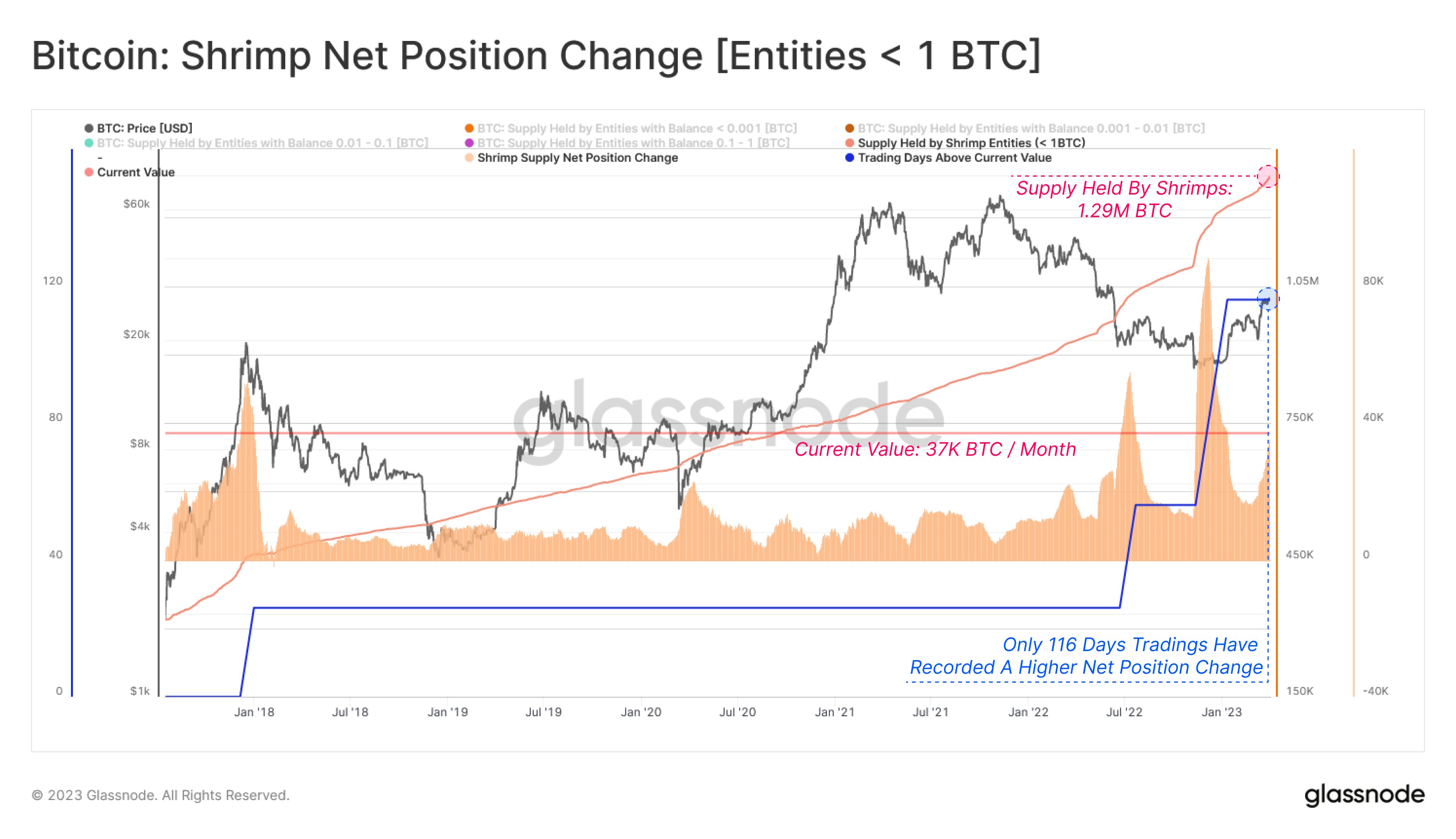

Bitcoin Shrimp Supply Continues To Rise, Why This Is Good

On-chain data shows the Bitcoin shrimp supply has continued to rise recently, which can be positive for the BTC ecosystem. Bitcoin Shrimps Now Hold 6. 7% Of The Entire Circulating Supply According to data from the on-chain analytics firm Glassnode, the BTC shrimps have added 1. дальше »

2023-4-20 02:00

|

|

Bitcoin Korea Premium Index Shows Signs Of Selling, Pullback Soon?

On-chain data shows the Bitcoin Korea Premium Index has been displaying signs of selling pressure, something that could result in a pullback. Bitcoin Korea Premium Index Has Turned Red In Recent Days As pointed out by an analyst in a CryptoQuant post, the selling pressure has been rising in the sector recently. дальше »

2023-4-19 21:00

|

|

Bitcoin (BTC) Price Tanks by $1,000 Over Last Hour amid Huge Liquidations

Coinspeaker Bitcoin (BTC) Price Tanks by $1,000 Over Last Hour amid Huge Liquidations More than $25 million in Bitcoin futures have been liquidated over the last hour with longs contributing to 98% of the total liquidations. дальше »

2023-4-19 14:42

|

|

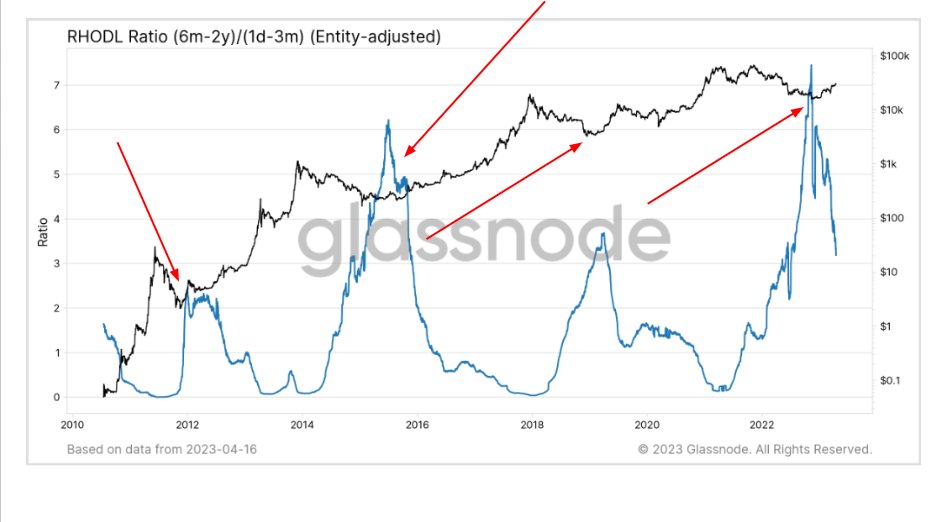

Is Bitcoin Truly Done With Cycle Lows? Here’s What This Metric Says

Is Bitcoin truly done with the bear market bottom or is there more to come still? Here’s what the “RHODL ratio” has to say about it. Bitcoin RHODL Ratio Has Been Declining In Recent Days As pointed out by an analyst on Twitter, the leg for the next bull run could be here according to the RHODL ratio. дальше »

2023-4-18 19:30

|

|

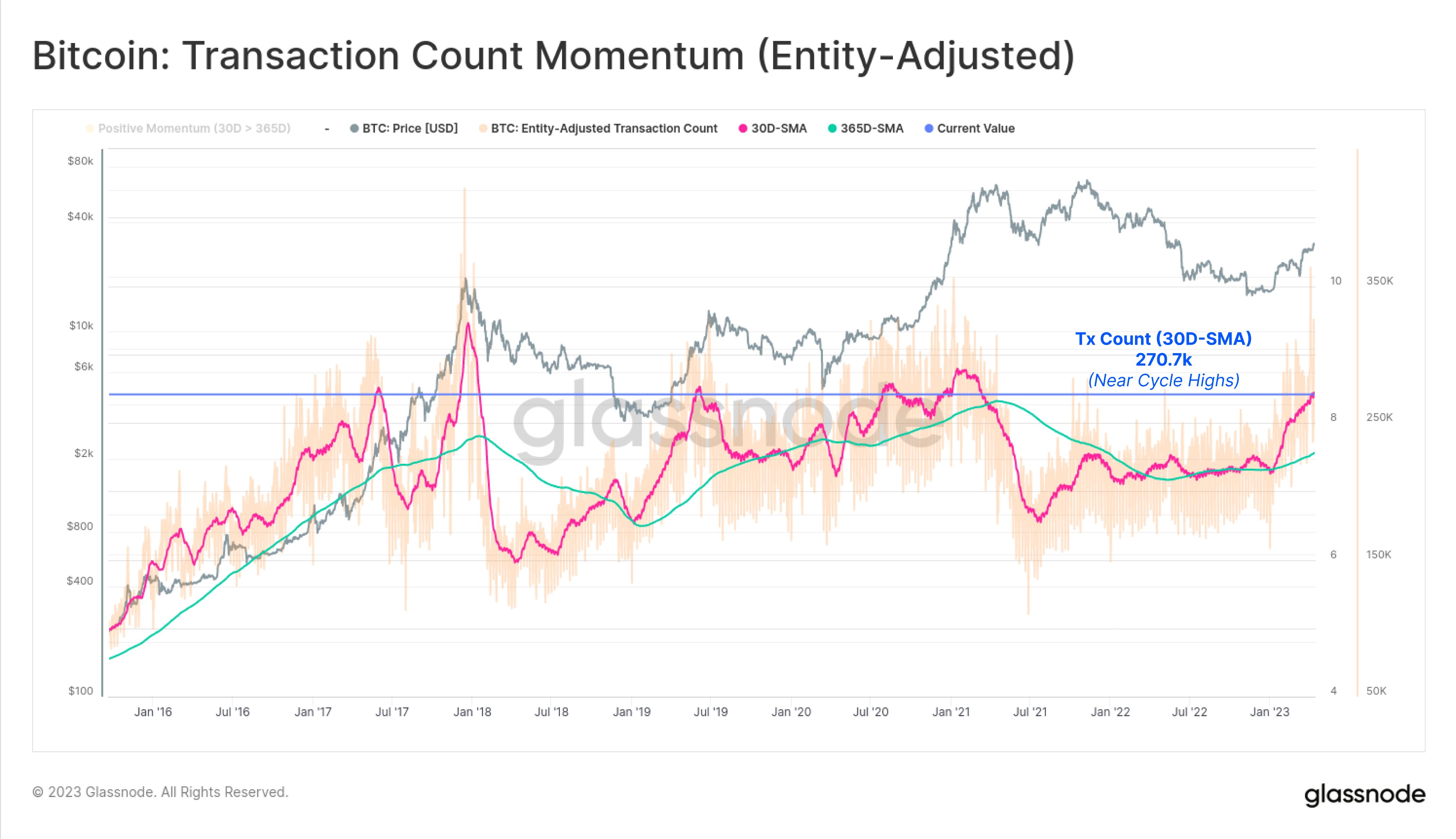

Bitcoin 30-Day Transaction Count Near Cycle Highs, Bullish Sign?

On-chain data shows the Bitcoin network has been observing a rising amount of transactions recently, something that may be bullish for the price. Bitcoin 30-Day SMA Transaction Count Is Near Cycle Highs Currently According to data from the on-chain analytics firm Santiment, more than 270,000 transfers per day are occurring on the BTC network right now. дальше »

2023-4-17 15:30

|

|

Bitcoin Futures Index to Debut in Argentina in May

Coinspeaker Bitcoin Futures Index to Debut in Argentina in May A Bitcoin futures index in Argentina is a huge relief as the country is currently struggling with high inflation. Bitcoin Futures Index to Debut in Argentina in May дальше »

2023-4-12 17:00

|

|

Bitcoin Market Shows Signs Of Euphoria, Will $30,000 Be Lost?

Data shows that Bitcoin investors are showing a high amount of hype around the break above $30,000, something that may end up backfiring. Bitcoin Investors Are Showing High Levels Of Euphoria Currently According to data from the on-chain analytics firm Santiment, euphoria in the market is currently significantly more than what was observed following the break above the $25,000 level last month. дальше »

2023-4-12 20:00

|

|

Bitcoin Korea Premium Index Turns Red, Decline Incoming?

Data shows the Bitcoin Korea Premium Index has taken a negative value recently, something that could lead to a drawdown in the asset’s price. Bitcoin Korea Premium Index Has Declined Into Negative Values Recently As pointed out by an analyst in a CryptoQuant post, past instances of this trend have resulted in pullbacks for the price of the cryptocurrency. дальше »

2023-4-8 19:00

|

|

Bitcoin Loss Taking Spikes, Why This Could Be Bullish

On-chain data shows Bitcoin loss-taking transaction volume has spiked recently. Here’s why this could turn out to be bullish for the asset’s price. Bitcoin Loss-Taking Volume Has Been More Than The Profit-Taking One Recently According to data from the on-chain analytics firm Santiment, traders are currently taking losses at twice the rate of profits. дальше »

2023-4-7 17:00

|

|

Bitcoin Older Than 5 Years Abruptly Moves, Bearish Sign?

On-chain data shows a large amount of Bitcoin sitting dormant since between 5 and 7 years ago has moved recently, a sign that may be bearish for the price. 5+ Years Old 1,005 BTC Has Been Recently Moved On The Bitcoin Blockchain As pointed out by an analyst in a CryptoQuant post, there is a possibility that this move could cause a drop in the price of the asset. дальше »

2023-4-6 18:00

|

|

Bitcoin Retail Buying Spikes, Adoption Accelerating?

On-chain data shows that Bitcoin retail investors have been aggressively buying the asset recently, a sign that adoption may accelerate. Bitcoin Shrimps Have Been Aggressively Accumulating Recently According to data from the on-chain analytics firm Glassnode, only 116 days in the entire history of the cryptocurrency have seen stronger accumulation from retail traders. The relevant […] дальше »

2023-4-5 21:25

|

|

Here’s Why Bitcoin Could Break At Least $33,000 In This Rally

Bitcoin may be able to break the $33,000 mark in the current rally if this historical pattern of an on-chain indicator is anything to go by. Bitcoin Realized Price-To-Liveliness Ratio Has A Value Of $33,200 Currently According to the latest weekly report from Glassnode, BTC is currently in a range that has historically been associated with a macro transitional phase. дальше »

2023-4-5 17:00

|

|