2024-6-21 21:22 |

The tokenization of real-world assets (RWA) has seen a surge in interest, with financial giants like BlackRock, Fidelity, and JPMorgan taking the lead.

This trend signals a significant shift in the financial industry, showcasing the growing adoption of blockchain technology to enhance efficiency and accessibility in capital markets.

BlackRock, Fidelity, JPMorgan Tokenizing Real-World AssetsFidelity International’s recent announcement of joining JPMorgan’s tokenized network marks a significant milestone. As per Kaiko analysts, this move positions Fidelity alongside other major players in the tokenization sector. This collaboration highlights the increasing interest in leveraging blockchain for real-world applications.

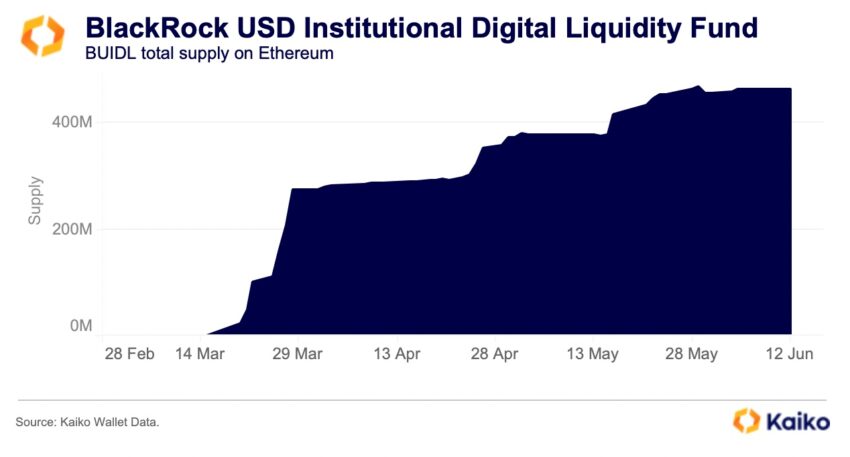

BlackRock’s BUIDL, a tokenized liquidity fund, exemplifies this trend. Launched in March, BUIDL has amassed over $460 million, surpassing several crypto-native firms like Maple Finance. Despite Maple’s recovery from the 2022 crypto lending collapse, its Cash Management Fund lags with around $16 million in assets, highlighting BUIDL’s success.

“Since its launch in March, BlackRock’s BUIDL has outpaced several crypto-native firms, including Maple Finance’s Cash Management Fund, which focuses on short-term cash instruments,” Kaiko analysts wrote.

Read more: How To Invest in Real-World Crypto Assets (RWA)?

BlackRock’s BUIDL Fund. Source: KaikoThe appeal of blockchain technology lies in its potential to transform capital markets. Maredith Hannon, Head of Business Development at WisdomTree, emphasizes this, noting that blockchain can address infrastructural challenges and unlock new investment opportunities. The technology’s ability to streamline workflows and improve settlement times is particularly compelling.

Central to this transformation are smart contracts, which automate transactions by executing predefined conditions without intermediaries. These self-executing contracts ensure transparency and efficiency, recording actions on a blockchain. For instance, in securities lending, smart contracts can automate operations, reduce errors, and create standardized identity credentials.

“Smart contracts offer opportunities to streamline and systematize many transactions that are multi-step or manual in today’s traditional financial markets. They can be used for sharing of identity and use credentials across financial firms, to eliminate counterparty risk and to validate whether an investor can hold a specific private equity fund based on their location or investor status,” Hannon wrote.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

Collaborations, such as those between Citi, Wellington, and DTCC Digital Assets on the Avalanche Spruce Subnet, demonstrate the practical applications of smart contracts. These initiatives showcase how tokenization can enhance operational efficiency and reduce counterparty risk.

However, transitioning to digital infrastructure involves challenges. Legal considerations, identity standards, and data privacy require careful evaluation in collaboration with regulators. The financial services industry must work together to build an identity infrastructure that supports broader tokenization adoption while ensuring security and compliance.

The post BlackRock, Fidelity, JPMorgan Dominate Real-World Assets Tokenization Trend appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Fidelity Token (FDT) на Currencies.ru

|

|