2024-4-24 17:15 |

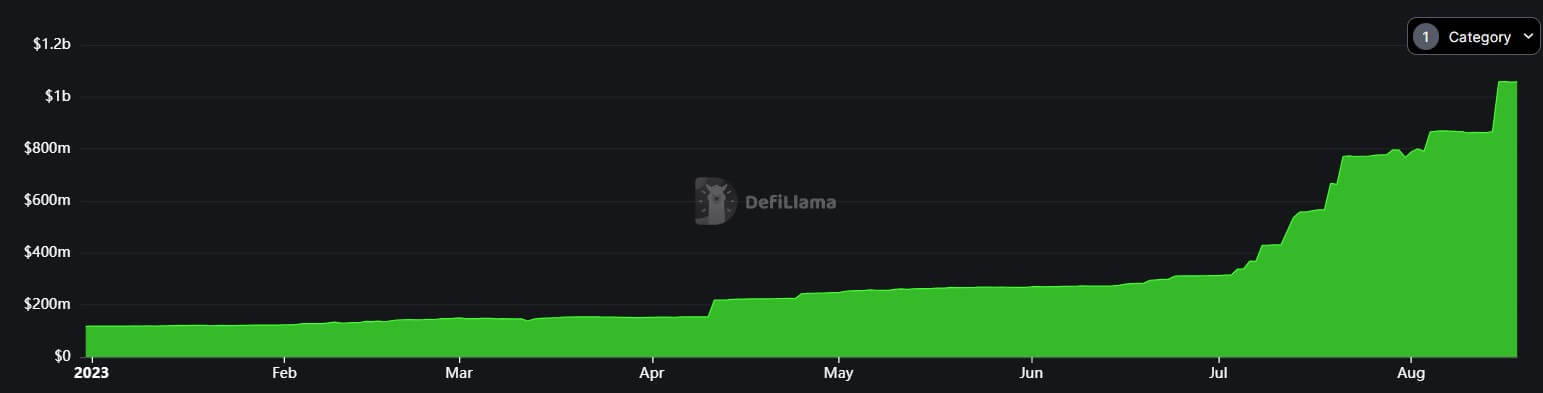

Real-world assets (RWAs) have entered the market, turning what was once considered illiquid assets into adaptive, accessible, and transferable tokenized assets. The paradigm shift towards RWA integration in the Web3 space has been swift, and the consequential impact has been significant.

The tokenization of RWAs can enable the integration of tangible physical assets like real estate and intangible non-physical assets like patents into any applicable industry. This digitization of assets has granted the ability to fractionalize ownership, facilitate democratized access, and enable greater liquidity to enter previously illiquid assets.

As the focus steadily zooms in on Web3’s capabilities, decentralization, and transactional security, RWA tokenization smoothly improves security and transparency via blockchain technology.

RWAs And Tokenizing Real EstateBy converting ownership rights of an asset into an equivalent tokenized form on the blockchain, tangible assets like real estate—and the real estate sector—become prime beneficiaries of newfound utility.

Companies like Blocksquare champion this innovative tech by tokenizing RWAs to deliver transferable value globally. By November 2023, Blocksquare had tokenized over $80 million in assets across 19 countries, indicating successful RWA tokenization and evidencing the significant part RWAs can have across multiple industries.

The Industry-wide Impact of RWAsHigh barriers to entry and liquidity access issues are rife throughout many industries, limiting growth and posing innovation bottlenecks at every turn. By leveraging blockchain tech, companies like Blocksquare aim to boost industry growth and overcome these limitations through RWA tokenization.

Real Estate Industry GrowthHistorically inaccessible to small investors and featuring slow ownership transferral processes, RWA tokenisation has already directly impacted real estate growth.

Blocksquare’s strides in real estate market innovation have enabled investors to overcome the aforementioned barriers to entry — even overcome liquidity issues by opening new pathways for liquidity to enter. This innovation gives us a glimpse of the capabilities of RWA tokenization, which is able to inject growth directly into a once stagnant and clunky real estate market.

Agriculture Industry GrowthWhile some have already attempted to do so, the concept of agricultural integration of RWA tokenization has been discussed since 2023. Involving the conversion of agricultural land into farmland NFTs or digital tokens, RWA tokenization in this industry has the potential to represent stakes in agricultural land.

As the foundational industry of our food and goods provisions, agricultural growth through tokenization enables fresh liquidity to enter the agricultural market — potentially boosting the sustainability of farmland and improving farmer/farm-owner annual revenues/livelihood.

Healthcare Industry GrowthIntegral to well-being and quality of life, integrating RWA tokenization in the healthcare industry could substantially affect the industry’s growth. From developing new treatments to accumulating the liquidity required for certain research, the tokenized approach in healthcare provides multiple benefits.

Facilitating medical innovation through RWA tokenization can expedite potentially life-transforming tech and treatment development, growing this essential industry even faster.

Blocksquare: Global Tokenization InnovationBlocksquare aims to optimize the potential for multifaceted industrial growth — not just a participant in the RWAs market but also a lead innovator. Its vision to power hundreds of platforms globally will empower investors in their regions through digitising real estate assets.

While Blocksquare’s approach primarily targets the real estate market through RWA tokenization, its white-label platform and Web3 protocol, Oceanpoint, unchain its potential to impact other industries in the future. This potential is further evidenced by Blocksquare’s official entry into the decentralized finance (DeFi) market through Oceanpoint.

Pairing its advanced blockchain infrastructure with its vision for the future of RWAs, Blocksquare’s ambition holds strong with its sights set industry-wide.

What Lies AheadAs the tokenization count of RWAs breaks into the millions, its impact on our future industry markets is steadily becoming more apparent. From real estate to agriculture to healthcare, the implications could seem limited only by the imagination and innovational limitations such as regulatory oversight.

With companies like Blocksquare pushing the limits of this innovative technology, the integration of RWA tokenization into different industries will only continue to increase. Combining untapped liquidity access with minimal investor entry barriers, one thing is guaranteed — growth.

origin »Bitcoin price in Telegram @btc_price_every_hour

Decentralize Currency Assets (DCA) на Currencies.ru

|

|