2018-10-27 22:30 |

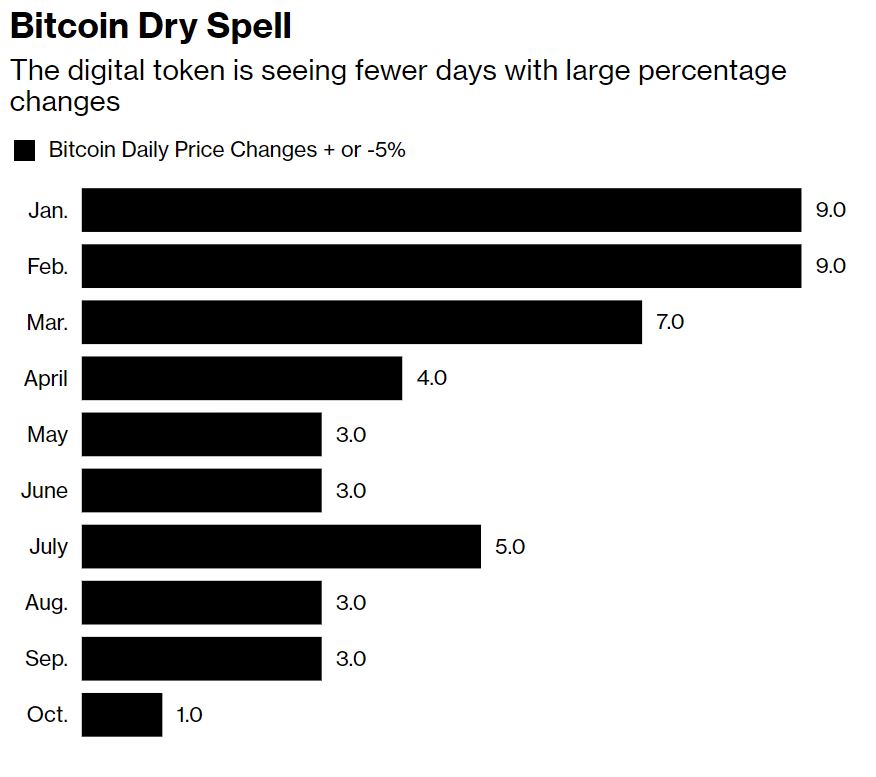

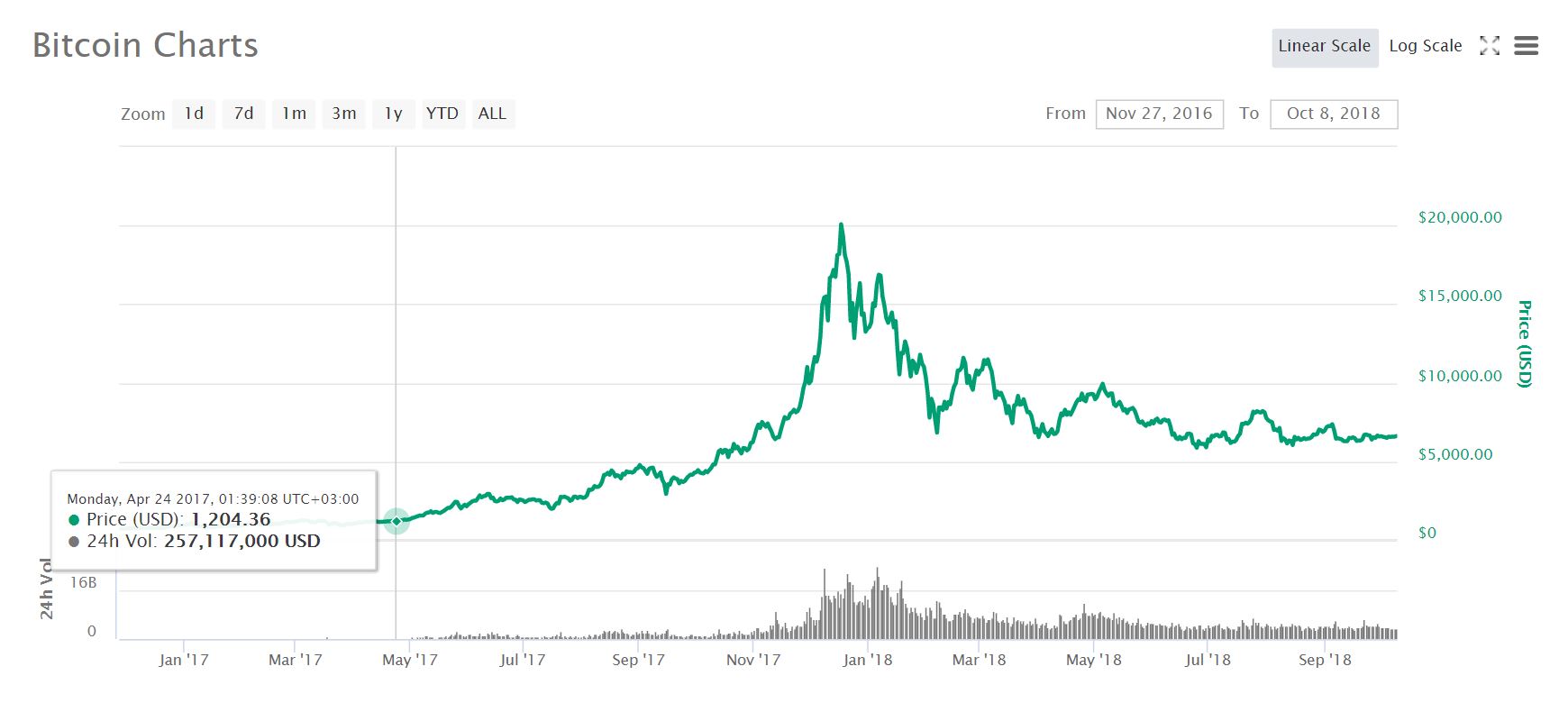

Bitcoin is experiencing an unprecedented period of low volatility, which could either be a sign that the lodestar cryptocurrency has found its price level, or has found a market floor in preparation for the next bull run.

The data was revealed on Oct. 25, 2018, by Pension Partners Director of Research Charlie Bilello who shared the chart on Twitter.

Bitcoin's annualized volatility over the last 10 trading days: 8%. That's an all-time low. $BTC.X pic.twitter.com/m0BOq0yjGv

— Charlie Bilello (@charliebilello) October 26, 2018

Bilello, whose company Pension Partners manages mutual funds and separate accounts revealed on his Twitter page that bitcoin is undergoing an unprecedented lack of movement.

The term “annualized volatility’ defines a calculation of an asset’s price movement range over a shorter period of time (in this case ten days) which is then extrapolated over 12 months. The main reason market analysts measure the annualized volatility of assets is to establish an investment risk rating which informs subsequent buy or sell decisions.

Long-Term Price Level or Floor?While the tweet did not speculate about the possible implication of the stability of a price that is notorious for being inherently unstable, many responses to Bilello’s post typically adopted one of two stances – that bitcoin has found its true price level and can now start behaving more like a conventional asset that financial markets are used to, or that bitcoin has found a price floor in preparation to break out for its next moonshot.

Related: Prominent Financial Advisor: Crypto Market Cap Will Hit $20 Trillion in Ten Years, Bitcoin to Face “Competition”The first point of view is somewhat undermined by the fact that the performance of “normal” assets is starting to resemble that of what bitcoin used to look like. On Oct. 25, 2018, Bloomberg reported that stocks of tech giants like Alibaba, Netflix, Facebook, Apple, and Alphabet are recording higher 10-day annualized volatility figures than bitcoin.

Speaking on this topic to Bloomberg, Timothy Tam, co-founder and CEO of cryptocurrency research firm CoinFi said:

“Volatility is coming into the traditional markets and when things correct, it’s going to be the outperformers like tech which are the most volatile.”

Unsurprisingly, the latter interpretation of the data seems to be more popular, especially given that many have maintained a strong believe through the course of the extended bear market period that bitcoin will experience another massive year-end breakout even bigger than that of 2017.

As the end of the year comes closer, the expectation is that bitcoin will, first of all, establish a price floor and then breakout over a few weeks, with some predictions tipping the asset to hit as much as $100,000 by the end of the year.

For now, it remains impossible to say exactly what the data portends or if it does indeed portend anything for the future of bitcoin.

The post Bitcoin’s Record Low Volatility Sparks Debate Over Stability Versus Breakout appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|