2024-12-6 11:30 |

Data from CryptoQuant has revealed how institutional investors have been the drivers behind the latest Bitcoin surge above $100,000.

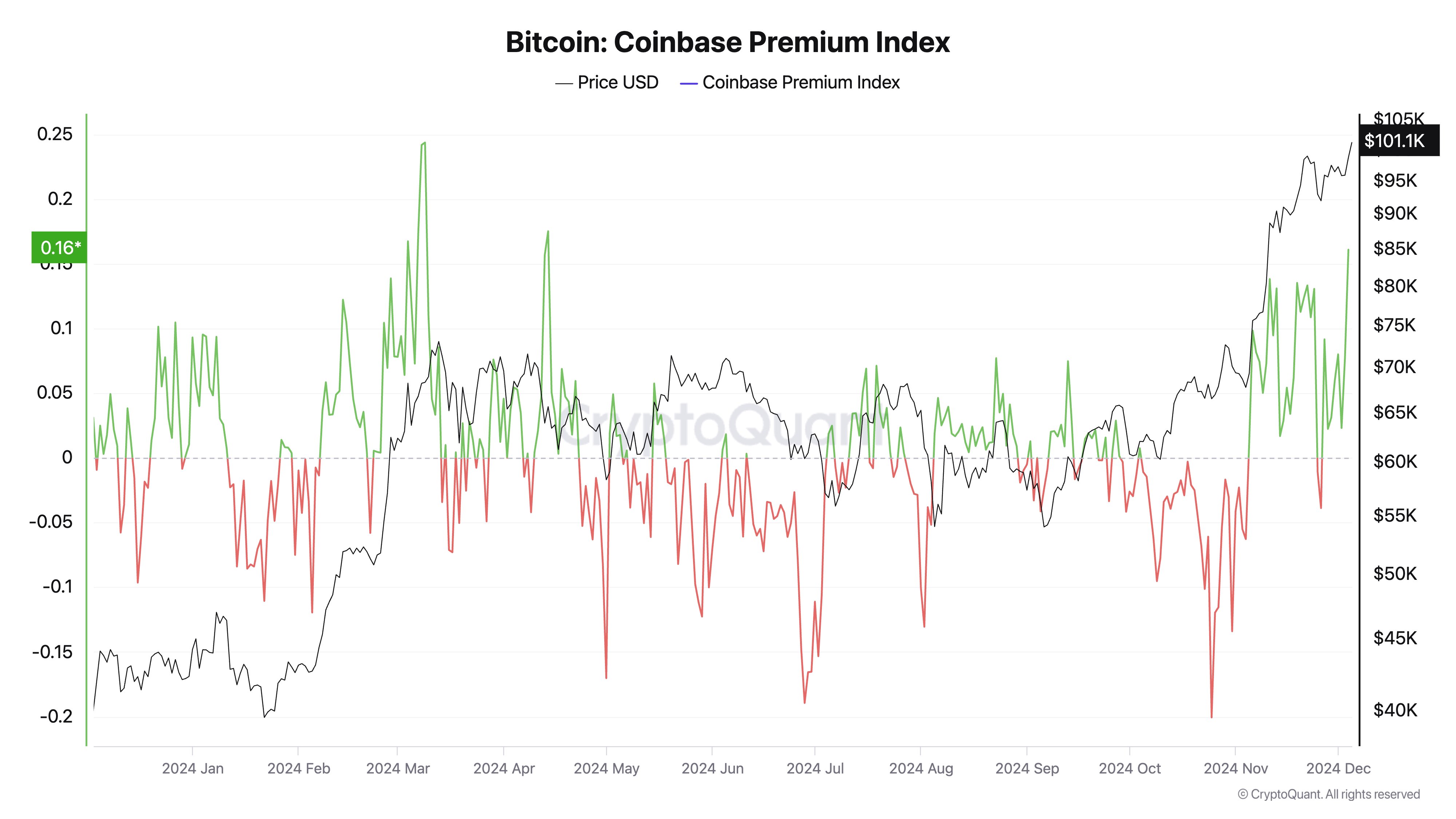

Bitcoin Coinbase Premium Index Has Been Positive RecentlyIn a new post on X, the on-chain analytics firm CryptoQuant has discussed the latest trend in the Bitcoin Coinbase Premium Index. The “Coinbase Premium Index” refers to a metric that keeps track of the percentage difference between the BTC price listed on Coinbase (USD pair) and that on Binance (USDT pair).

The indicator tells us about how the buying or selling behaviors differ between the user bases of these cryptocurrency exchange giants. Coinbase’s main traffic comprises US-based investors, especially large institutional entities, while Binance hosts users worldwide.

When the Coinbase Premium Index has a positive value, the asset trades at a higher rate on Coinbase than on Binance. Such a trend implies that American whales have been applying a greater buying or lower selling pressure than the global investors.

On the other hand, the negative indicator suggests that Binance users may be buying more than Coinbase users as BTC is going for a higher price there.

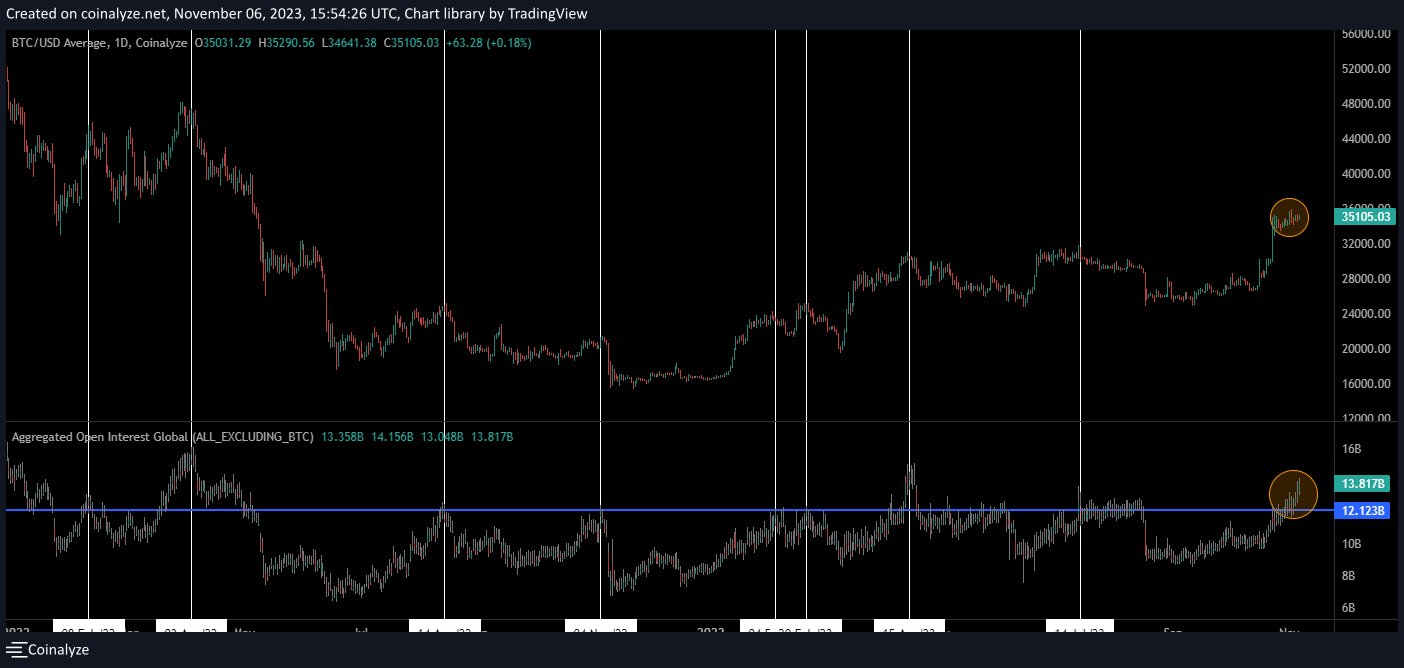

Now, here is the chart shared by the analytics firm that shows the trend in the Bitcoin Coinbase Premium Index over the past year:

As displayed in the above graph, the Bitcoin Coinbase Premium Index registered a sharp surge into the positive territory at the start of November and has since maintained inside this territory, save for a brief dip.

This trend naturally means that the buying pressure on Coinbase has consistently been higher than that on Binance. The asset’s price enjoyed a sharp rally during this period, so it would also appear that this accumulation from US-based investors has fueled the surge.

The chart shows that this pattern has also been witnessed on multiple instances throughout the past year, with positive spikes in the Coinbase Premium Index generally being bullish for Bitcoin.

The latest rally to the new all-time high (ATH) above $104,000 has also come as the indicator has registered another sharp green spike. Thus, American institutional investors seem to play a pivotal role in the market.

Given this pattern, the Coinbase Premium Index is naturally an indicator to keep an eye on shortly, as new changes may again foreshadow the fate of Bitcoin’s price.

BTC PriceAt the time of writing, Bitcoin is trading at around $100,800, up more than 6% over the past week.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|