2022-11-19 19:00 |

On-chain data shows the crypto exchange Binance has just received Bitcoin inflows of 130k BTC, a sign that may be bearish for the price of the crypto.

Binance’s Bitcoin Exchange Reserve Has Sharply Spiked Up Over Past DayAs pointed out by an analyst in a CryptoQuant post, Binance has received a massive Bitcoin deposit today.

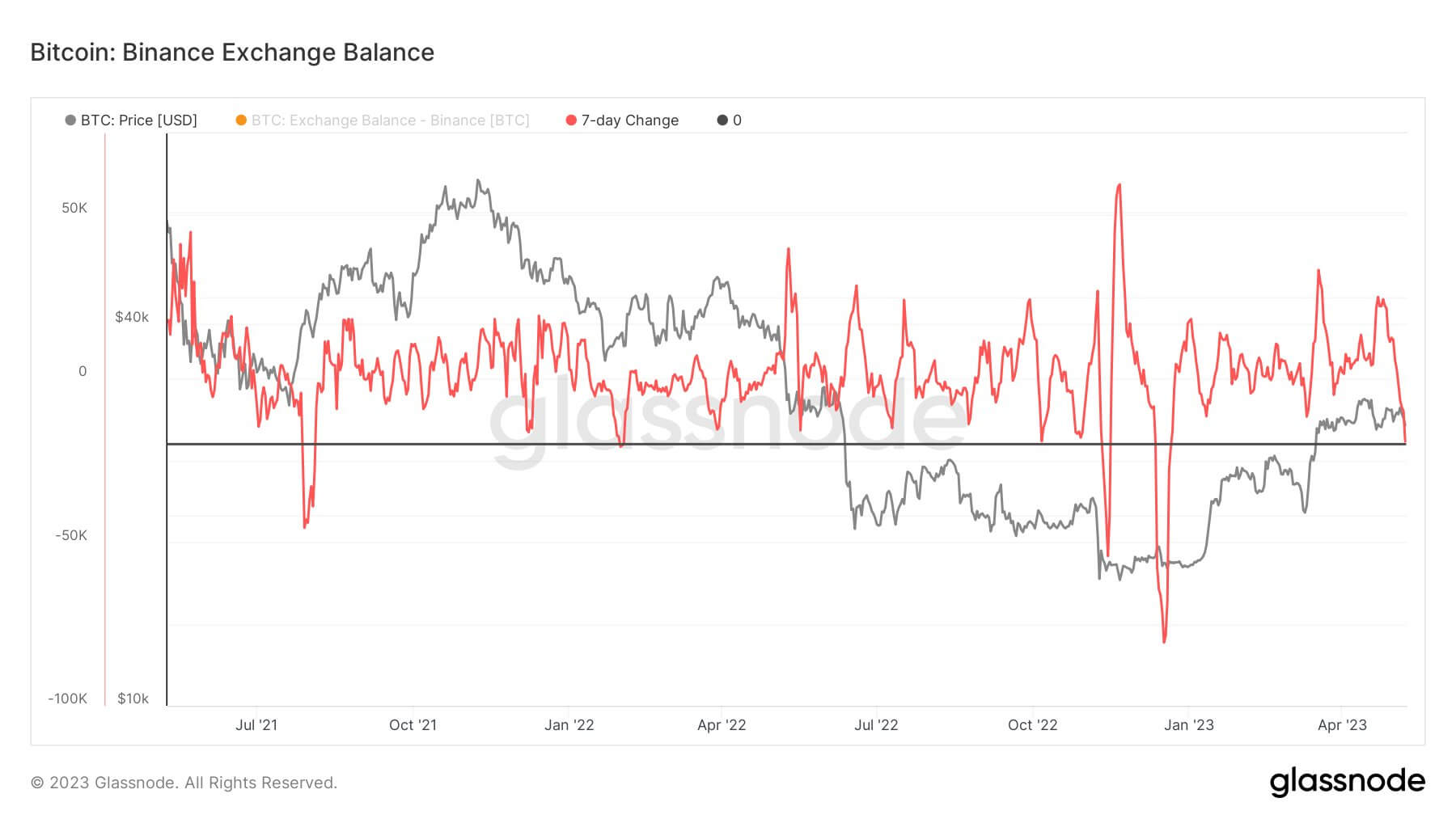

The relevant indicator here is the “exchange reserve,” which tells us the total amount of BTC currently sitting in the wallets of a centralized exchange.

When the value of this metric goes down, it means investors are withdrawing their coins from the exchange right now. Such a trend, when sustained, could be bullish for the crypto’s price as it might be a sign of accumulation.

On the other hand, rises in the indicator suggest holders are transferring their BTC to the exchange’s wallets currently. As investors could be depositing for selling purposes, this kind of trend can be bearish for the coin’s value.

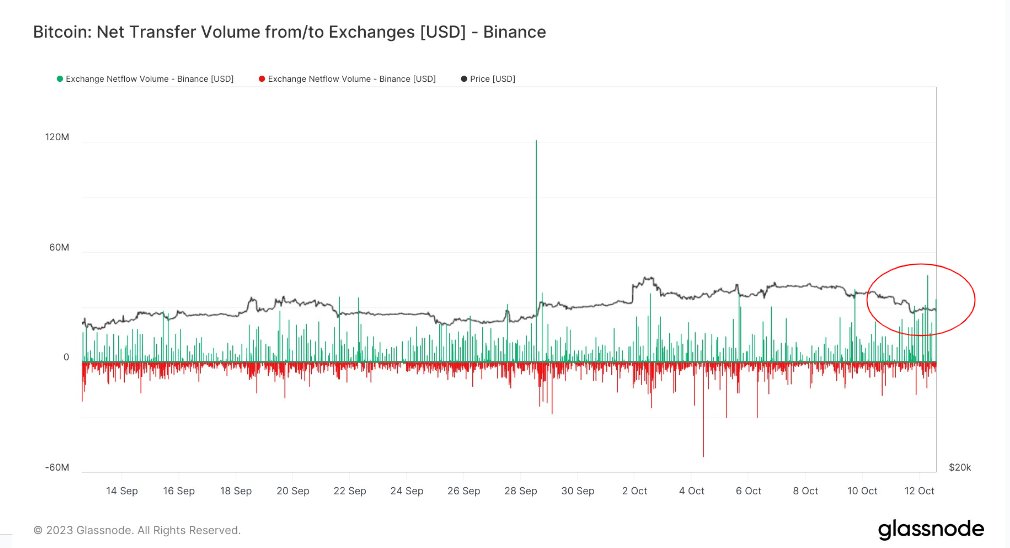

Now, here is a chart that shows the trend in the Bitcoin exchange reserve of the crypto exchange Binance over the last few years:

The value of the metric seems to have suddenly jumped up in recent days | Source: CryptoQuantAs you can see in the above graph, the Bitcoin exchange reserve for Binance sharply fell off earlier in the month.

These outflows occurred as the crypto exchange FTX went belly up, reigniting fear among investors around central custody, and causing them to rush to withdraw their coins from such platforms.

In the last few days, however, Binance’s BTC reserve has once again started to trend up, implying that whales might be making moves to dump.

And today, the indicator has very rapidly increased to a new high, as investors have made a massive deposit of 130k BTC to the exchange.

At the moment, it’s unclear whether this is an organic increase in Binance’s Bitcoin reserve, or if it’s because of the exchange making some internal wallet shuffles that have been mistakenly picked up as fresh deposits by CryptoQuant’s metric.

However, if it’s indeed a true spike, then the outcome from this could be bearish for the price of BTC.

BTC PriceAt the time of writing, Bitcoin’s price floats around $16.7k, down 3% in the last week. Over the past month, the crypto has lost 14% in value.

The below chart shows the trend in the price of the coin over the last five days.

Looks like BTC has continued to hold still in the last few days | Source: BTCUSD on TradingView Featured image from Jonathan Borba on Unsplash.com, charts from TradingView.com, CryptoQuant.com origin »Bitcoin price in Telegram @btc_price_every_hour

Binance Coin (BNB) на Currencies.ru

|

|