2025-7-12 00:00 |

The general crypto sector is brewing with excitement and optimism, particularly around Bitcoin, the largest digital asset, which recently witnessed a significant upside move to a new all-time high. Reports reveal that Bitcoin supply on exchanges has remained muted during the notable surge.

A Muted Bitcoin Exchange BalanceBitcoin investors and traders are demonstrating positive behavior in spite of its notable rally. Santiment, a market intelligence and on-chain data platform, reported the positive action of investors after investigating the number of BTC supply on crypto exchanges.

The on-chain platform stated that Bitcoin has surged to a market value of $113,923, marking yet another historic all-time high during the time of the post. Despite the fact that the bitcoin price has increased by +13.6% from its local bottom on June 22nd, Santiment highlighted that traders are not demonstrating a strong desire to return coins to exchanges for possible sale.

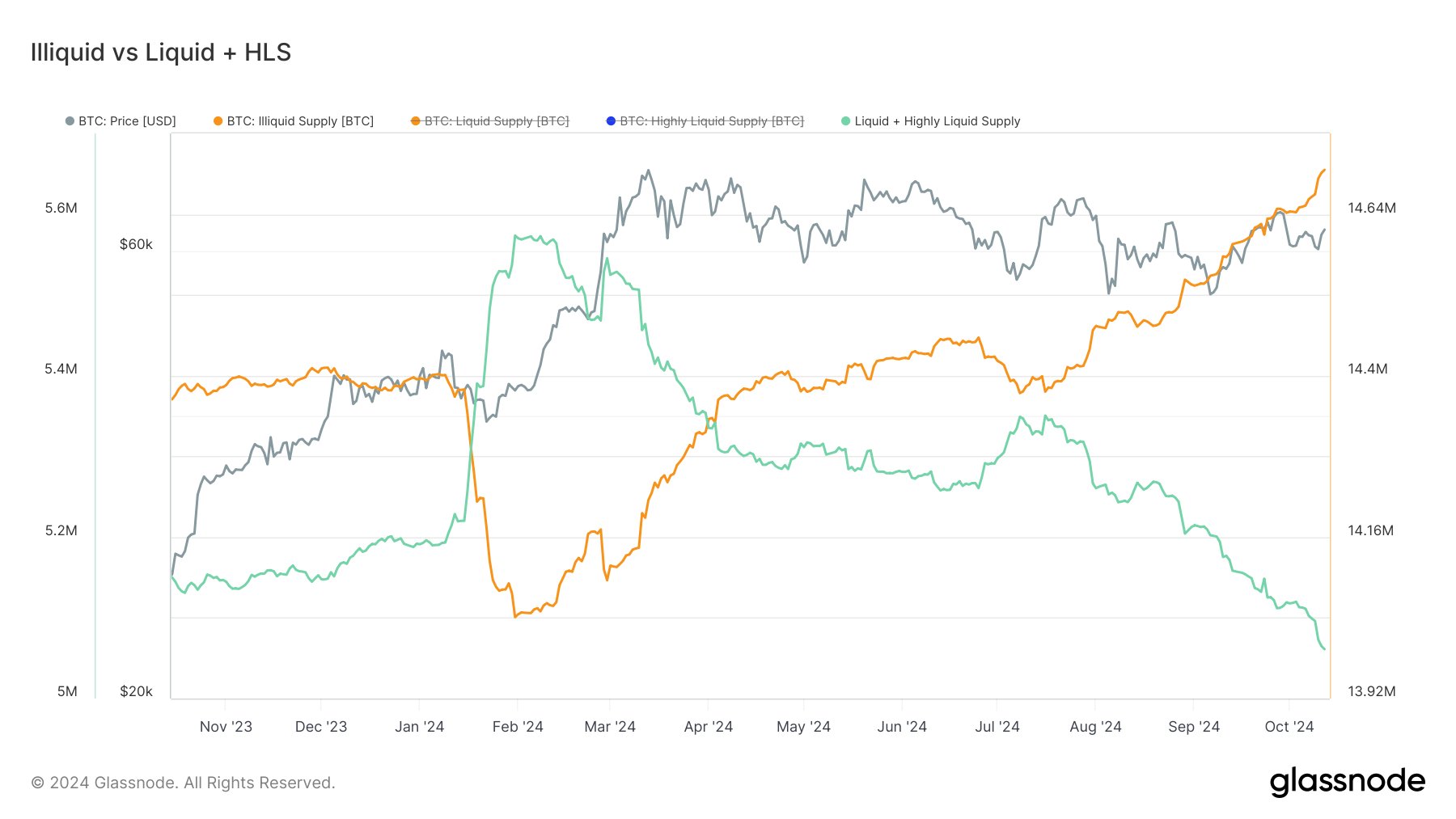

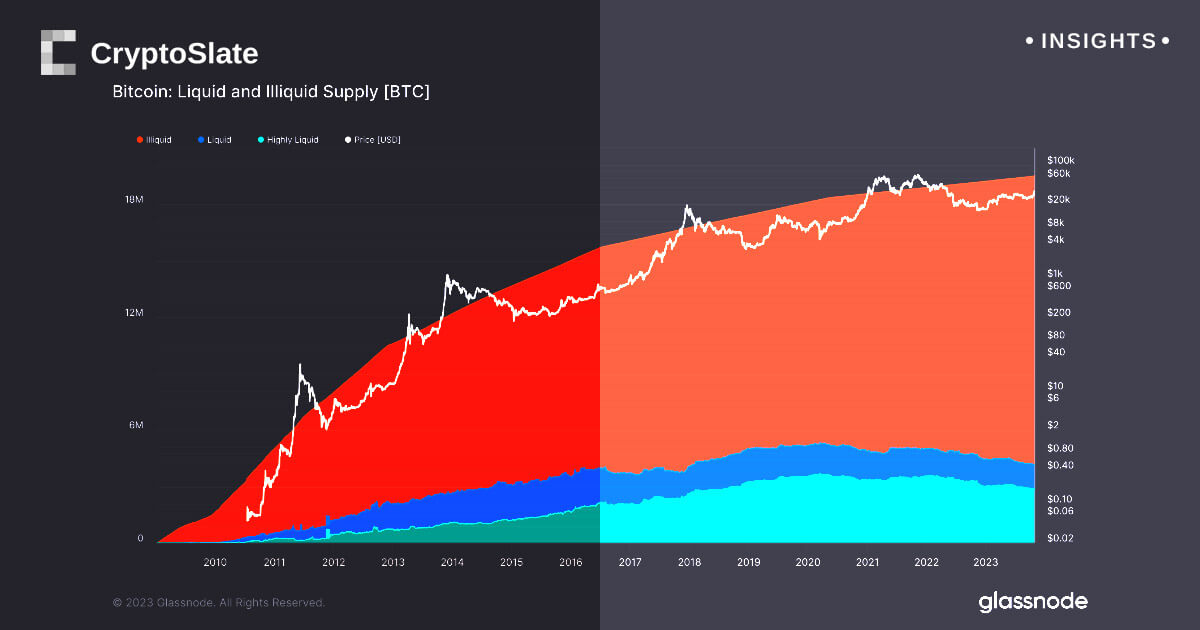

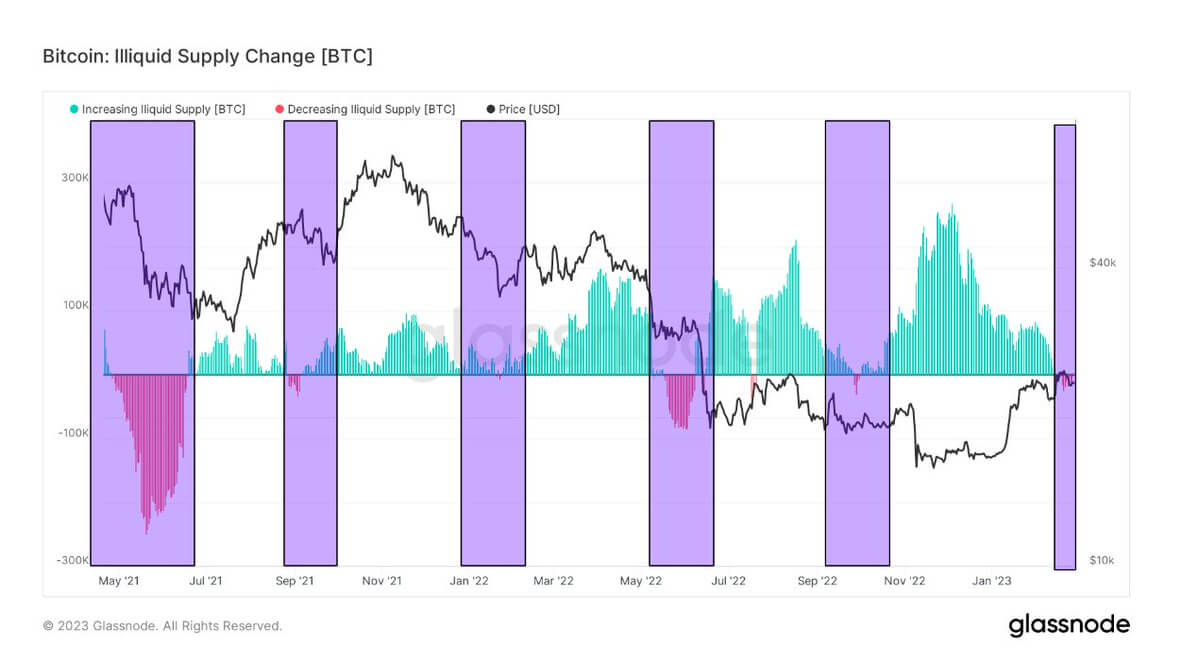

Investors are happy to keep their Bitcoin hidden away in cold storage or personal wallets rather than swarming to crypto exchanges to cash in on gains. According to the platform, this behavior is seen as a long-term trend among known exchange wallet addresses.

This action from exchange investors reiterates the story of strong holder belief. Thus far, this trend could be considered an encouraging signal to market watchers and traders, as selling pressure is still at bay.

Data from Santiment reveals that there has been a net decrease of 315,830 BTC on crypto exchanges over the past four months, representing an over 21% drop. It is important to note that the decline has been more pronounced, with a -61% drop when looking back five years, to July 2020, when 1.88 million BTC left exchanges.

In conclusion, Santiment noted that the overall trend is quite bullish. “Overall, the trend of coins staying off exchanges is a sign that the threat of sudden market plummets is more limited,” the platform stated. Furthermore, Santiment claims that long-term investors are becoming more satisfied with storing their coins safely in their storage.

Investors Are Aggressively Buying BTCDuring this bullish period, Bitcoin’s Spot Cumulative Volume Delta (CVD) has been trending downwards for several consecutive weeks. Popular on-chain analytics platform Glassnode revealed the persistent downtrend of the key metric, with the most recent buy-side increase occurring on Wednesday.

However, the platform claims that future CVD is more reactive, exhibiting an upward trend and strong buying interest. Since the all-time high tap, the chart shows that spot sold off while futures bought. Also, the funding is still modest, even momentarily negative.

The development implies that the BTC’s ongoing surge is being driven by leveraged rather than spot demand. Although spot markets are not providing much confirmation, Glassnode asserted that futures traders are leaning in. In the meantime, the low funding indicates that positioning isn’t congested yet, which Glassnode considers a structurally precarious setup unless spot interest returns.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|