2020-9-29 15:39 |

Bitcoin is back at near $11,000.

The leading digital currency has been making its way upwards since the mid of last week. Today, to mark the starting of a new week, Bitcoin went as high as $10,985, re-entering the $10,800 to $11,000 area of intense historical trading.

With the move, BTC has broken through its 30-day moving average — indicative of a strong uptrend and “that large funds are willing to actively purchase on the market.”

Currently, BTC is trading around $10,900 in the green with about $1 billion in ‘real’ trading volume.

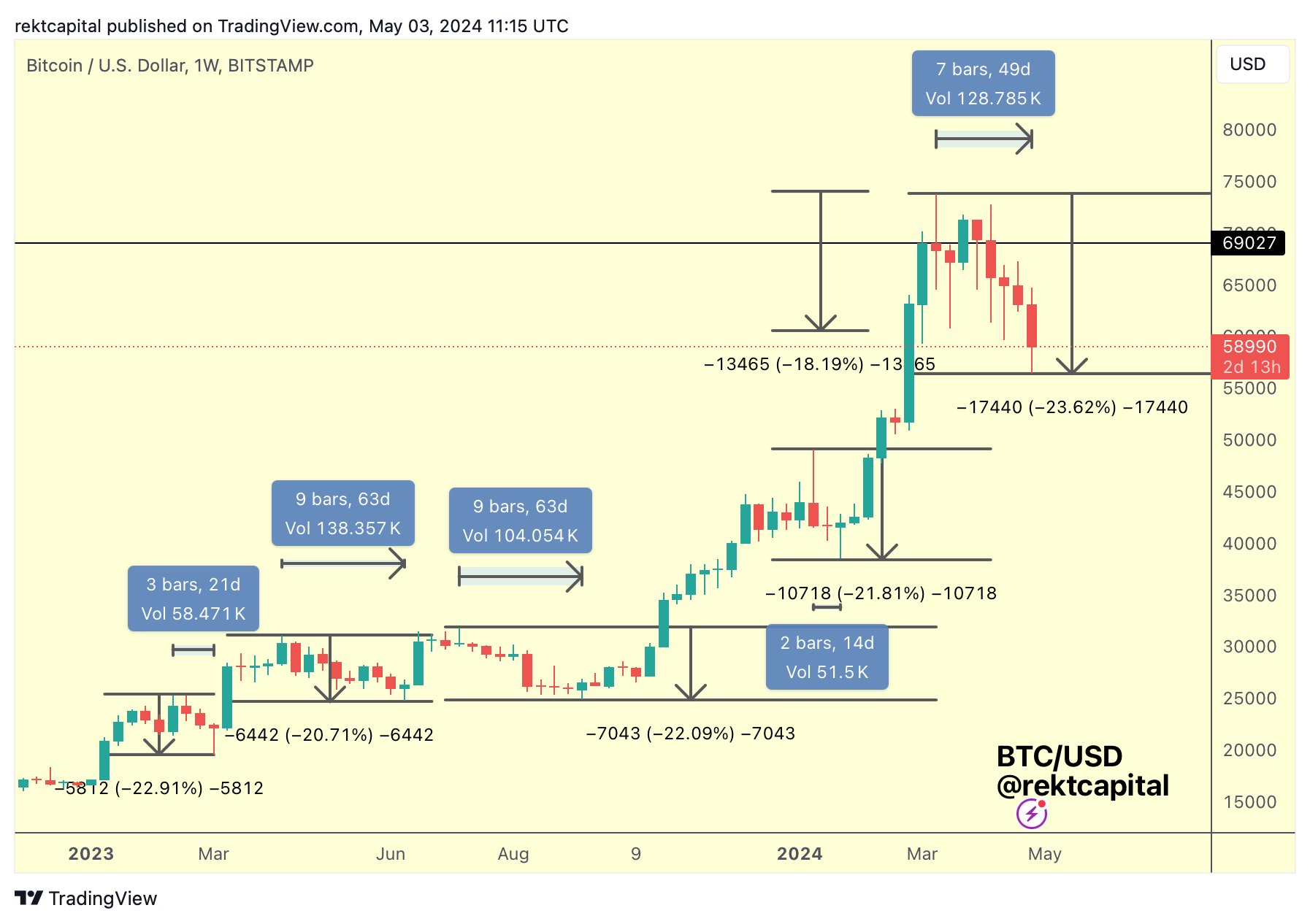

“Weekly close looks good and don't know why people continue to be overly bearish. Bitcoin got a short term pullback, and -20% is nothing unusual. Bitcoin continues to uptrend, and for the third week in a row has closed above the support zone of $9900 to $10,175,” noted trader Josh Rager, adding “$11ks next.”

taking this long if setup comes to fruition as dump attempt seemingly failed pic.twitter.com/dHGOglCdJW

— CryptoYoda (@CryptoYoda1338) September 27, 2020

As for the futures market, the Bitcoin futures curve has widened, albeit modestly, although “given the uncertain macro theme further upside remains somewhat uncertain,” said Denis Vinokourov of London-based broker.

The strong move came following the bullish weekend not only for BTC but also altcoins like KNC, REN, LINK, LEND, and ZRX, which according to Santiment, experienced similar factors like MVRV ratio in the ‘bounceback’ zone, ‘blood in the streets,’ ongoing accumulation, declining crowd interest, and strong fundamentals.

And today, a positive move in BTC price has the altcoins getting green again. Among the top cryptos, Cardano (ADA), with early 11% gains, and Polkadot (DOT) with 8.42%, are leading.

Today’s top gainers include Hegic (46%) and Swipe (40%), while Orion Protocol (76.5%) and Pixie Coin (62%) are the biggest losers.

Becoming Less VolatileThe third quarter is coming to an end this week. September did what it has been doing all those years and ended the month at a loss of -6.7%.

Interestingly, this month, bitcoin has been less volatile than Tesla. In Sept. bitcoin moved less than 1.25% in absolute value 52% of the days, unlike 6% of Tesla.

While the volatility of bitcoin continues to drop, investors are slowly moving to bot trading to capitalize on the price swings. Chinese brokerage service Pionex which has a monthly trading volume of $5 billion on its online brokerage platform, has over 80% of its 100,000 users running a trading algorithm.

The startup with Shunwei Capital and ZhenFund among its backers makes about $3 million by charging a 0.05% fee per transaction. The Singapore incorporated company has 80% of its trades fulfilled by the order books on Binance and Huobi.

“Trading bots let users overcome their humanity flaws and become a rational investor,” said founder Chen Yong.

Bitcoin (BTC) Live Price 1 BTC/USD =10,703.1915 change ~ -2.16Coin Market Cap

198.04 Billion24 Hour Volume

58.64 Billion24 Hour Change

-2.16 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD");The post Bitcoin Re-Entering the 'Intense Historical Trading' Area Following a Strong Uptrend first appeared on BitcoinExchangeGuide.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|