2024-8-2 00:45 |

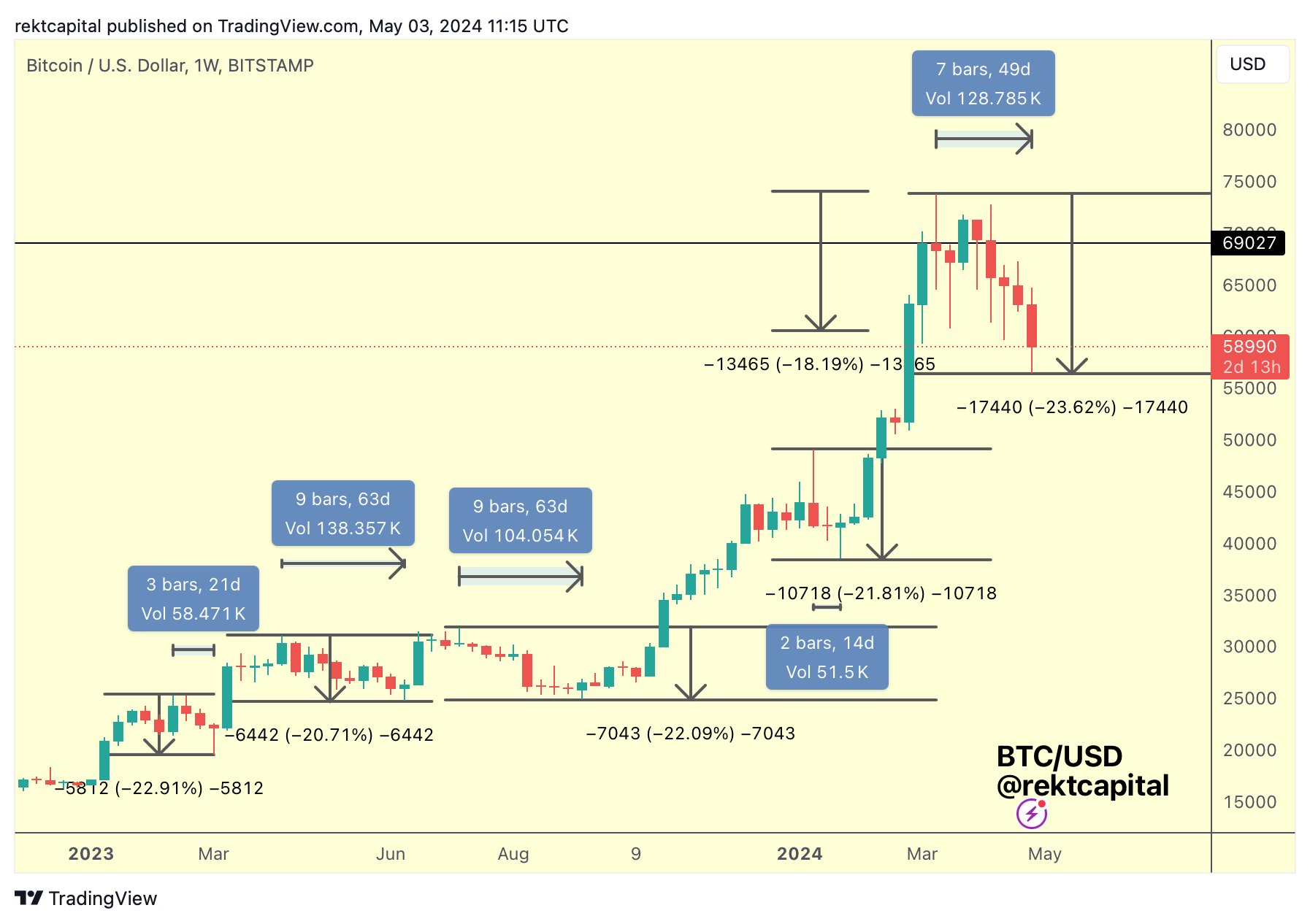

In a week marked by dramatic shifts, Bitcoin experienced a sharp decline after initially surging to $70,000, a three-month peak. The excitement was short-lived, however, as the cryptocurrency fell to a two-week low of $62,403, perplexing traders who had anticipated a post-halving bull run.

Source: Brave New Coin Bitcoin Liquid Index (BLX)

The descent in Bitcoin’s value aligns with a broader trend influenced by U.S. economic indicators that suggest a potential shift in monetary policy. On Thursday, the U.S. reported a significant drop in the July ISM Manufacturing PMI, far exceeding economists’ forecasts, and a spike in initial jobless claims to their highest point in a year. These developments hint at the onset of a monetary easing cycle by the Federal Reserve, traditionally a bullish signal for risk assets like Bitcoin.

Despite these indicators, Bitcoin’s value plummeted 5.5% between July 31 and August 1, reaching its lowest point in more than two weeks at $62,403. This downturn coincides with the distribution of 47,000 BTC from the defunct Mt. Gox exchange, and the US govt transferring Silk road era coins to a new address, stirring fears of a potential market sell-off.

Blockchain data from Arkham Intelligence revealed that a wallet tagged “U.S. Government: Silk Road DOJ” transferred 29,800 Bitcoin that were related to the Silk Road website to an unknown address with no previous transaction history. Subsequently, the address forwarded 19,800 BTC and 10,000 BTC to two separate addresses. Arkham analysts speculate that the 10,000 BTC transfer, valued at $670 million, might be a deposit to an institutional custody service. Historically, such movements have often preceded asset sales, however, there is no suggestion yet that the coins will be sold.

Market watchers also observed significant movements in other financial instruments. U.S. Treasury yields dipped to a six-month low amidst escalating Middle East tensions, while gold prices neared record highs, reflecting a flight to safety among investors.

The Trump EffectAmid these financial upheavals, political developments also loom large over the market. The uncertainty surrounding the U.S. presidential election, particularly with the rising prospects of Democratic nominee Kamala Harris against GOP nominee Donald Trump, adds another layer of complexity. The outcome could significantly influence the regulatory landscape for Bitcoin and other cryptocurrencies.

Trump has linked himself to the success or failure of Bitcoin and the crypto industry, which is proving to be a double edged sword. If he wins, crypto will benefit, but if the Democrats return to power, crypto’s future in the US is much less certain.

Trump has promised to create a US Strategic Bitcoin Reserve, an idea also championed by U.S. Senator Cynthia Lummis. At Bitcoin 2024, Lummis introduced a groundbreaking proposal aimed at revolutionizing the United States’ fiscal strategy. Dubbed the “strategic Bitcoin reserve” bill, Lummis’s plan suggests that the U.S. government should purchase 5% of the world’s Bitcoin supply and retain it for a minimum of twenty years. The strategic reserve is designed with a singular purpose: to mitigate the nation’s burgeoning debt.

As investors navigate this turbulent market, the resilience of Bitcoin futures and options markets suggests a cautious but not entirely pessimistic outlook. The Bitcoin futures premium and the 25% delta skew of options remain within neutral ranges, indicating that while optimism may have dampened, outright bearish sentiment is not predominant.

Bitcoin Dominance GrowsBitcoin’s dominance in the cryptocurrency market has grown, reaching a three-year high last week, as other cryptocurrencies like ETH faced significant challenges following the launch of the ETH spot ETFs. Even while ETH was dominating the headlines, it was Bitcoin’s price that held up best amidst the volatility.

Source: Trading View

ETH’s price action was and remains muted, while most altcoins have also shown weakness against BTC, further contributing to the rise in Bitcoin’s dominance to new three-year highs.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|