2026-1-30 13:37 |

Bitcoin is struggling to avoid a fourth consecutive monthly decline as the cryptocurrency market grapples with a fundamental shift in momentum that has left most investors underwater.

Data from CryptoSlate indicate that the largest digital asset declined by nearly 7% over the last 24 hours to $82,513.

According to CoinGlass data, long traders speculating on the BTC price were liquidated for more than $750 million during the shock price collapse. This is the highest level of losses for this cohort of traders since last November.

Bitcoin Price Liquidation in the Last 24 Hours (Source: CoinGlass)Consequently, BTC is on course to suffer its fourth consecutive red month as the crypto asset has shed more than 5% of its value this January.

This follows a 3.99% loss in December and a sharp 17% decline in November. BTC declined by 4% in October.

BTC loses 2-year moving averageMeanwhile, the poor price performance this year has led the flagship digital asset to fall below its 2-year moving average for the first time since 2022.

Bitcoin analyst Joe Consorti added:

“We've also lost the November 2025 lows, and are 7% away from losing the 2025 yearly low.”

Data from Alphractal highlights the significance of this shift, noting that the last time BTC traded below this level was in October 2023.

Bitcoin 2-Year Moving Average (Source: Alphractal)This breakdown revives a simple yet historically powerful signal. For many analysts, the loss of the 2Y SMA signals the beginning of a genuine capitulation cycle.

Historical data suggest that almost every time Bitcoin’s price has fallen below this average, the market has experienced further downside or entered a prolonged accumulation phase that lays the groundwork for the next bull cycle.

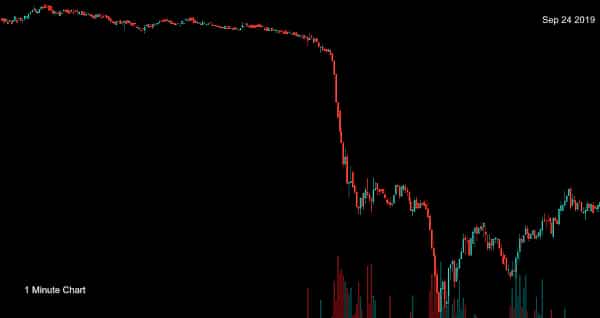

The October liquidation shock reset the cycleThe current regime dates back to Oct. 10, 2025, when the crypto market experienced one of its largest forced unwinds on record.

A surge of liquidations followed renewed tariff and export-control headlines from Washington, triggering rapid deleveraging across major venues and reducing market depth in the days that followed.

Bitcoin had set an all-time high above $126,000 earlier that month, but the liquidation episode helped yank the market out of its prior structure and reprice risk around macro headlines rather than internal crypto catalysts.

The liquidation wave totaled more than $19 billion, underscoring how much of the cycle’s upside had been financed by leverage rather than durable spot demand.

That shift matters because the market never delivered the kind of fast, confidence-restoring rebound that typically signals a trend resumption.

Instead, price action evolved into a grinding process of position reduction, with rebounds repeatedly stalling and reinforcing the sense that the market has moved from expansion into consolidation.

Related Reading Something broke for crypto in October, data shows how the market changed Dec 23, 2025 · Liam 'Akiba' Wright ETF flows stabilize, but the bid has not rebuiltThe most visible sign of the demand slowdown has been in US spot Bitcoin ETFs, which helped power earlier accumulation waves but have recently shifted into a more neutral posture.

Glassnode said US spot Bitcoin ETF net flows have returned to equilibrium, with the 30-day moving average hovering near zero after a period of sustained outflows.

The change suggests mechanical sell pressure has eased, but it also implies that the aggressive inflows that previously absorbed new supply have not returned.

Glassnode also framed the market as pinned near cost-basis levels, which now serve as inflection points. The firm set the short-term holder cost basis at approximately $96,500, a level that has repeatedly capped attempts to recover.

Below the market, Glassnode highlighted a stressed support band around $83,400, with a “True Market Mean” near $80,700 if weakness deepens.

Alphractal CEO Joao Wedson issued a stark warning regarding this specific zone, stating that Bitcoin “cannot lose $81,000 under any circumstances” based on on-chain analysis.

Bitcoin Mean Price (Source: Alphractal)Wedson cautioned that if this level breaks, a capitulation process similar to 2022 may unfold, with the next major support level significantly lower at approximately $65,500.

Related Reading Bitcoin's whipsaw to $105k wipes out $7B in leveraged positions Oct 10, 2025 · Assad Jafri Metals surge, and Washington injects policy riskCrypto’s internal cooling has unfolded alongside a macro tape that has rewarded traditional havens.

Gold and silver reached fresh records in early 2026 as investors rotated into hard assets amid policy uncertainty and geopolitical risk, a shift that has sharpened the contrast with Bitcoin’s sideways-to-lower grind.

Washington has become part of the price action as well. Senators introduced a draft market-structure bill in mid-January to clarify oversight and set guardrails for key products, including limits on interest-like rewards paid for holding stablecoins while still allowing activity-based incentives tied to usage.

However, the near-term problem is that policy progress has been uneven.

After the draft circulated, Coinbase’s chief executive, Brian Armstrong, said the company could not support the bill in its then-current form, delaying key Senate discussions and reinforcing investor caution regarding timelines.

In light of this, Bitwise CIO Matt Hougan said the legislative outcome creates two distinct pathways for pricing.

“If Clarity passes … I suspect the market will rally sharply,” he said, arguing that a framework investors can underwrite would pull forward expectations around stablecoins and tokenization.

However, Hougan said the market is more likely to demand proof of real-world adoption before it rewards prices if the legislation fails.

Related Reading Bitcoin is following a discreet lag pattern behind gold that puts a $130k target immediately in play Jan 14, 2026 · Oluwapelumi Adejumo A leverage-driven market, with liquidity signals flashing cautionEven with subdued price action, some analysts argue the drawdown looks more like a cyclical reset than a structural breakdown.

Glassnode described a consolidation regime driven more by absorption than by expansion, with leverage already unwound in some markets and spot participation still muted.

That framing aligns with the broader idea that recent lows have often been produced by leveraged positions being forced out, rather than by a clean collapse in long-term conviction.

Still, near-term liquidity gauges remain uncomfortable.

One widely watched indicator, the Coinbase Bitcoin premium index, has remained negative for an extended period in January, at around -0.16% in recent readings, indicating that US spot pricing is weaker than the global average.

Coinbase Premium Index (Source: CryptoQuant) Related Reading Panic selling Bitcoin on Coinbase triggers a Binance price gap that reveals a “messy” institutional market failure Jan 27, 2026 · Gino MatosAt the same time, the market’s pool of “dry powder” has shown signs of shrinking.

Data from CryptoQuant indicate a contraction in aggregate stablecoin supply, a dynamic that traders monitor because stablecoin growth tends to correlate with incremental buying capacity within the crypto ecosystem.

Put together, the setup leaves the market with two clean paths that traders are already mapping.

The Bull Case: A grind higher powered by a return of sustained spot demand that can lift prices back above the $96,500 short-term holder cost basis. The Bear Case: A continuation of the consolidation regime, with downside risk concentrated around the $83,400-$80,700 band. However, if liquidity fails to improve and the $81,000 floor identified by Alphractal gives way, defensive positioning could amplify the pullback toward the mid-$60,000 region.The post Bitcoin ready to record fourth straight red month and the $81,000 floor is suddenly everything appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|