2020-1-6 06:36 |

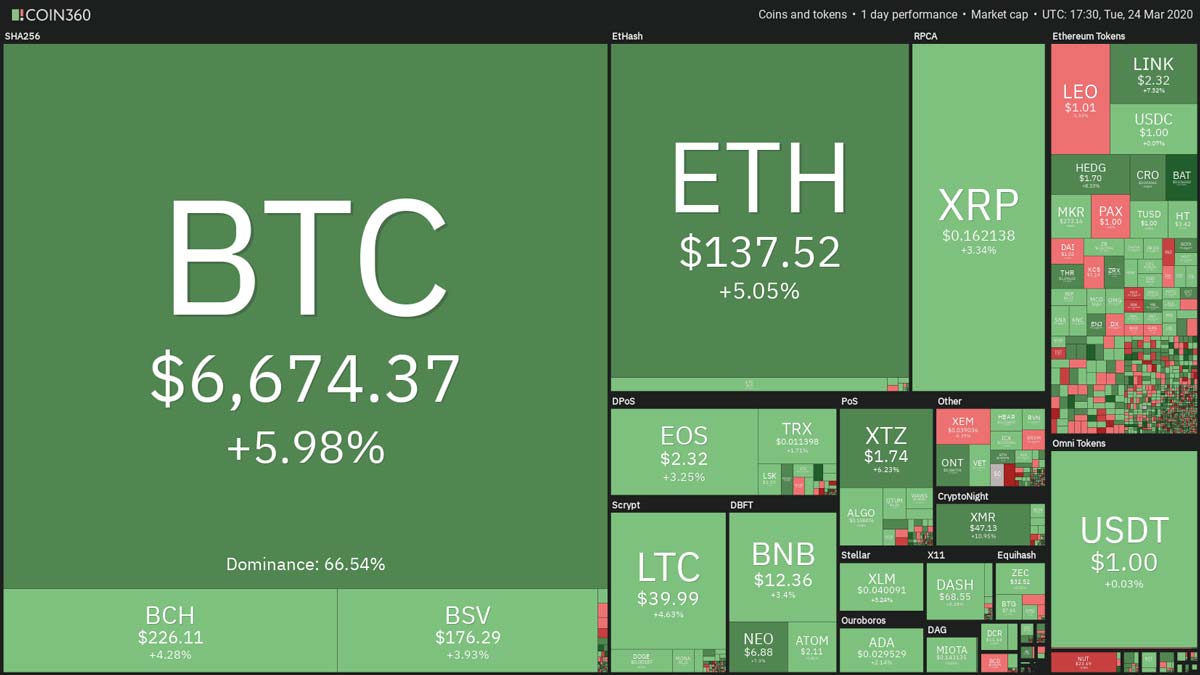

Bitcoin (BTC) bulls seem to be having quite the streak. For the third or fourth day in a row, the leading cryptocurrency has posted gains. As of the time of writing this, Bitcoin has broken to highs it hasn’t seen in two weeks, rallying as high as $7,580 just minutes ago. Related Reading: Early Bitcoin Adopter Throws Cold Water On Halving Narrative; Here’s Why While the momentum isn’t as strong as some analysts would like, more and more traders and starting to say that this price action confirms their ideas that a long-ish bull trend is about to play out, thereby ending the range-trading that has taken place for some five or six weeks. Bitcoin Ready to Stretch Higher Josh Olszewicz, an analyst at Brave New Coin, recently noted that an inverse head and shoulders chart pattern — a bullish pattern that is likely to mark a strong bottom for BTC — is playing out for Bitcoin. He remarked in a TradingView post outlining his trading idea that should BTC hit $7,525 (and it has), a move to the $8,100 to $8,700 range — an 8% and 16% rally, respectively — is likely to play out. As to why the rally will stop there, he cited a confluence of a few key resistances: the 200-day exponential moving average, the daily Ichimoku Cloud, a yearly pivot point, and the weekly 20 moving average. But that’s far from the end of the optimism. Cryptocurrency and forex trader Livercoin posted the below tweet on Saturday, showing that he believes Bitcoin has been trading like a textbook Wyckoff Reaccumulation-esque pattern over the past few days. The textbook pattern, should BTC follow it to a T, suggests that BTC will break higher and higher in the coming days, in an upward move that will bring the asset back to the high-$7,000s. Hi, I am Livercoin and I like wyckoff reaccumulation. $BTC #Crypto pic.twitter.com/JH2HouSFTG — Livercoin (@livercoin) January 4, 2020 The technicals are starting to favor Bitcoin from a longer-term perspective as well. Related Reading: This Scary Fractal Suggests Bitcoin Price Is On Its Way to $3,000 Long-Term Bull Case Reappearing Per previous reports from NewsBTC, CryptoHamster recently noted that Bitcoin’s on-balance volume reading — an indicator which “uses volume flow to predict changes in stock price” — is printing a clear falling wedge pattern, a chart pattern marked by falling prices (or in this case, a reading) and a tightening range. In this case, the falling wedge seems bullish, with the Bitcoin-related on-balance volume reading rallying, implying imminent continuation to the upside. Also, Su Zhu, the chief executive officer of forex and crypto fund Three Arrows Capital, recently remarked on Twitter that he believes Bitcoin’s price outlooking heading into 2020 is looking rather bullish. The prominent commentator specifically cited his analysis of the BTC/USDT trading pairs and their premiums to BTC/USD markets and the overall price action, which shows there are “clear signs of accumulation and money flow back into risk.” BTC/USDT premiums and price action show clear signs of accumulation and money flow back into risk. Would not surprise me to see 9K+ before end of Jan. — Su Zhu (@zhusu) December 28, 2019 Featured Image from Shutterstock. Chart from TradingView.com The post appeared first on NewsBTC. origin »

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|