2019-1-1 21:57 |

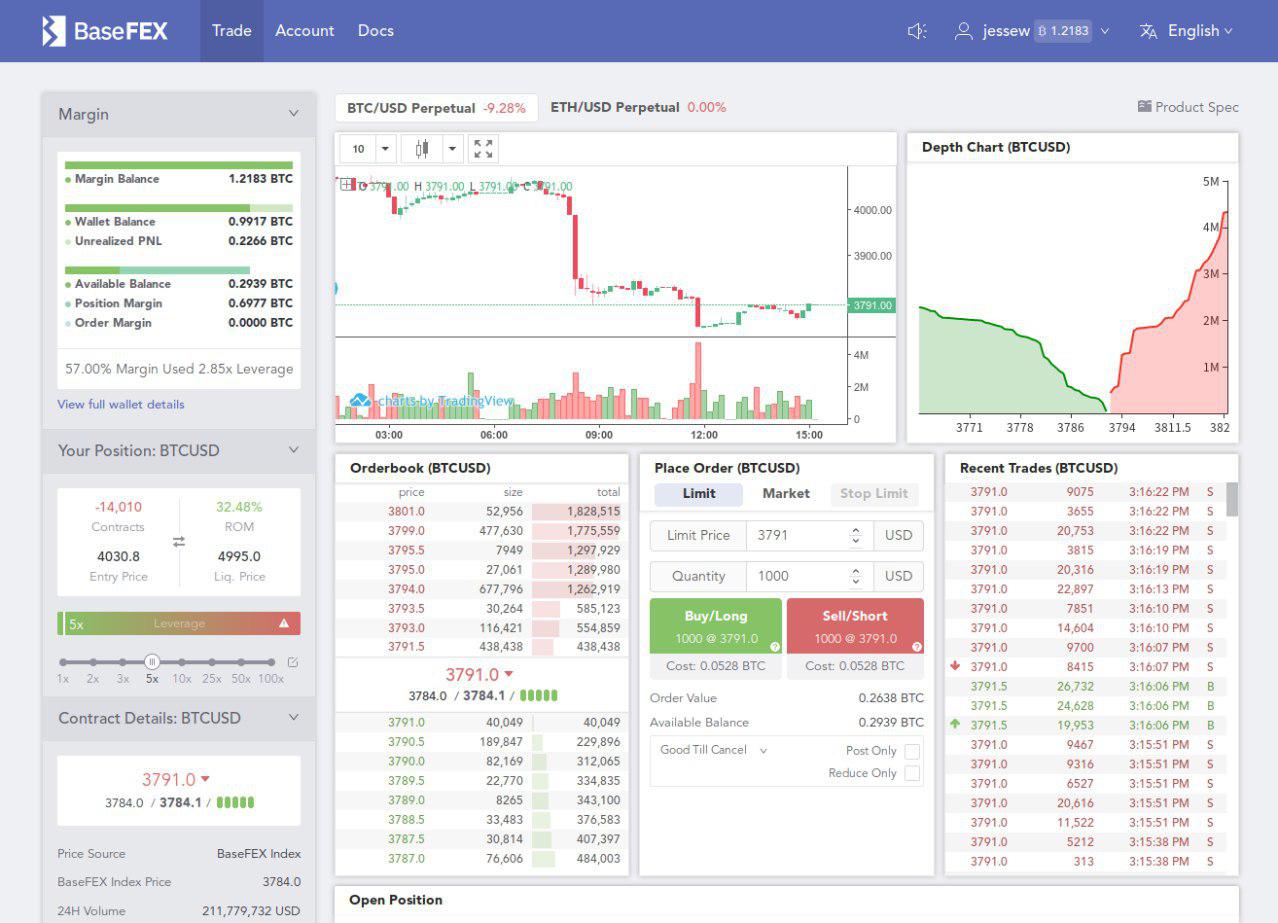

At press time, bitcoin is trading for just over $3,700. While the currency has managed to keep up a small bit of momentum in the past seven days to stay above $3,600, the currency has failed to meet the expectations of most die-hard investors and enthusiasts.

This will be our final price piece of 2018, so rather than spend time examining the currency’s present price and what could be keeping it here, let’s look at some of the biggest cryptocurrency news bits of the past 12 months.

Chart by FUNTRADER-Vera

We can’t write up this piece accurately without talking about Coincheck, the mother of all crypto hacks. The event took place in January and beatthe record set by Mt. Gox as the world’s largest cryptocurrency theft. Over $500 million in crypto funds (specifically NEM funds) disappeared overnight, and Coincheck’s operations remained relatively non-existent until just two months ago following an extended audit by Japan’s Financial Services Agency (FSA). The hack ultimately got the agency to become more involved in crypto operations in the first place.

Next, the year was marred by news that many of the internet’s biggest players – from Google to Facebook and Twitter – were banning ads pertaining to crypto and initial coin offerings (ICOs). Since then, entities like Facebook have been contemplating a change in their protocols, saying that they may allow certain kinds of ads in the future. Facebook is even looking into creating its own digital currency.

It’s been discovered that nearly $1 billion in investor funds have been stolen by cyberthieves this year, though much of that can been attributed to the Coincheck hack. However, roughly $500 million has also been stolen by fraudulent ICO ventures.

The Securities and Exchange Commission (SEC) has seemingly become more involved in cryptocurrency regulations, enforcing new registration laws that crypto companies must abide by if they’re to keep their businesses going. Most of the time, these companies are required to register their ICOs as securities, and those that don’t – such as AirFox and Paragon Coin – are forced to pay fees and incur penalties. It’s not a pretty sight, but it’s a surefire way to prevent malicious activity and bring a level of legitimacy to the industry.

Bitcoin has continued to drop violently in the year’s final weeks, falling from roughly $6,000 to under $4,000 at the time of writing. Many analysts attribute this to the bitcoin cash hard fork that occurred prior to Thanksgiving. It was a controversial move that pitted many industry leaders against each other, and Tom Lee – who has consistently predicted that bitcoin would end 2018 in the five-figure range – has announced he will no longer predict prices after several of his “educated guesses” failed to come true.

While it’s hard to know exactly what lies in store for us in the new year, all we can do is hope that bitcoin and its altcoins cousins don’t repeat the behavior they’ve exhibited over the past 12 months, and that the bulls return our favorite cryptocurrencies to glory.

Until then, happy new year, and happy trading!

Bitcoin Charts by TradingView

The post Bitcoin Price Watch: A Final Look Back at 2018 appeared first on NullTX.

origin »Bitcoin price in Telegram @btc_price_every_hour

Universal Currency (UNIT) на Currencies.ru

|

|