2019-1-1 02:45 |

Bitcoin did not have a good year in 2018. It has dropped more than 82% since its all-time high registered back in December 2017 before the end of the year. In 2018, the market was in a bear trend that affected not only Bitcoin but also most of the virtual currencies in the space.

Now, 2019 is preparing interesting things for the most popular virtual currency in the market. Some of the most important things will be related with new investors entering the space and a better regulatory environment around the world.

One of the first things that the market will be witnessing is Bakkt, a platform created for institutional investors that was created by the Intercontinental Exchange (ICE), the parent company of the New Yor Stock Exchange. Bakkt will be offering a Bitcoin futures market.

Back in 2017, the Chicago Board Options Exchange (CBOE) and the Chicago Mercantile Exchange (CME) launched Bitcoin futures that were cash-settled. These futures contracts have a minimal effect on the short-term price of digital assets.

With the Bakkt platforms, individuals will be receiving real Bitcoin. This could have a significant impact on the price of the virtual currency since it can affect its circulating supply.

On the matter, Jake Chervinsky, a government enforcement defence and securities litigation attorney at Kobre & Kim, commented about this:

“Also noteworthy is the fact that Bakkt will custody and deliver real bitcoin. That means institutional inflows would reduce supply and thus (maybe) increase the price too. This is different from other regulated futures markets like CME and CBOE, which only deal in cash-settled futures.”

Clearly, the effect that it will have on Bitcoin depends on the number of investors interested in the most popular digital currency. However, as the market has been falling during the last few months it is uncertain whether the interest from institutional investors remains as high as before.

Another important event that crypto and Bitcoin investors should pay attention to is related to a Bitcoin Exchange-Traded fund. An ETF could be approved by the U.S. Securities and Exchange Commission (SEC) as soon as February 27, 2019. If the regulatory agency takes the decision to approve it, Bitcoin could also experience buying pressure on its price.

However, Hester Peirce, an SEC commissioner that is considered to be crypto-friendly warned investors that a Bitcoin ETF could take years to be approved. During 2019, analysts believe that Bitcoin could start to recover and be prepared for an even better year in 2020.

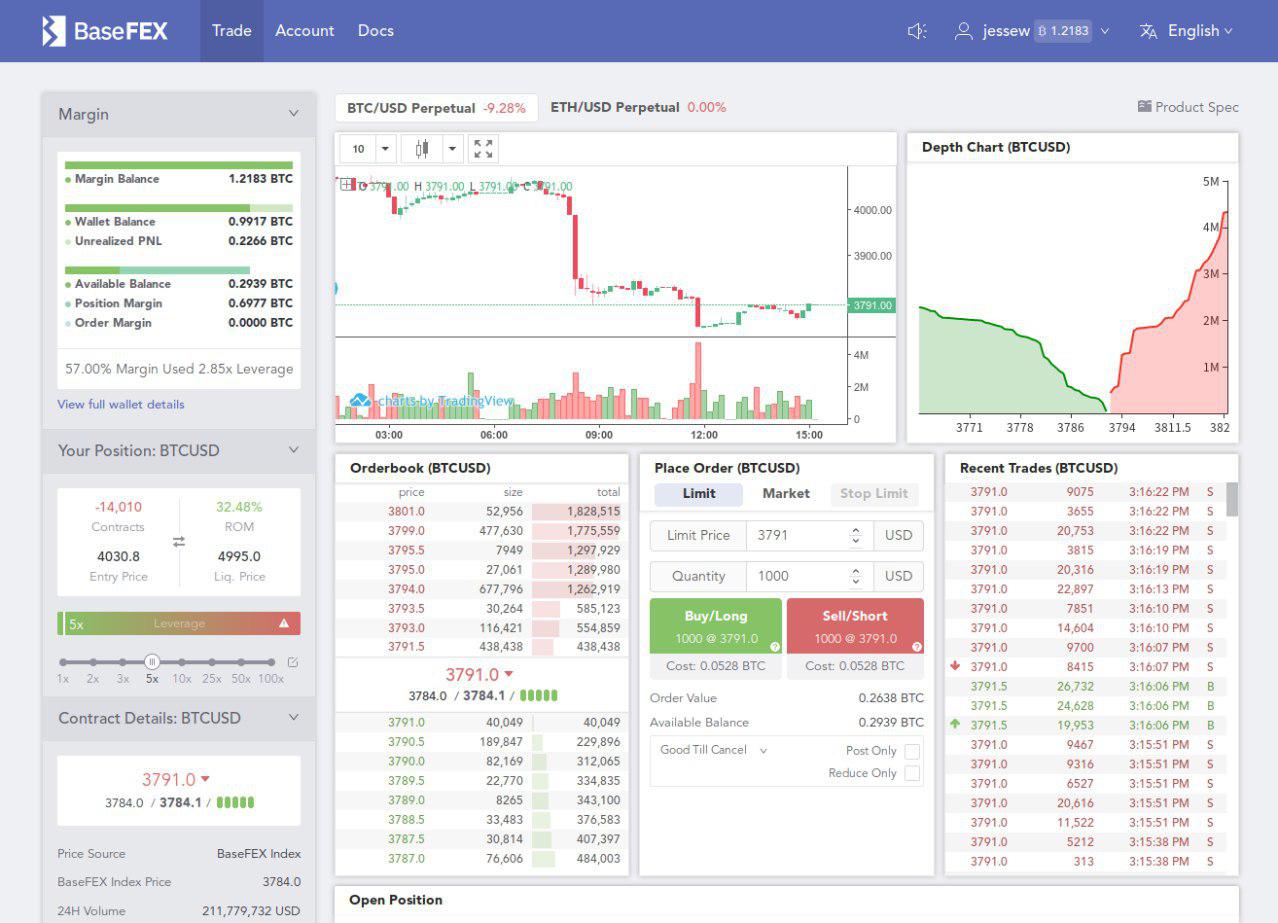

Currently, Bitcoin is being traded under $3,800 and it has a market capitalization of $66.23 billion.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|