2021-5-9 06:30 |

The Toronto-based Bitcoin mining operation Bitfarms announced the company has been approved for a common stock listing on Nasdaq Global Market tier. The company is already listed on the Toronto Stock Exchange (TSX) and the firm’s Nasdaq listing will be listed under the ticker symbol “BITF.”

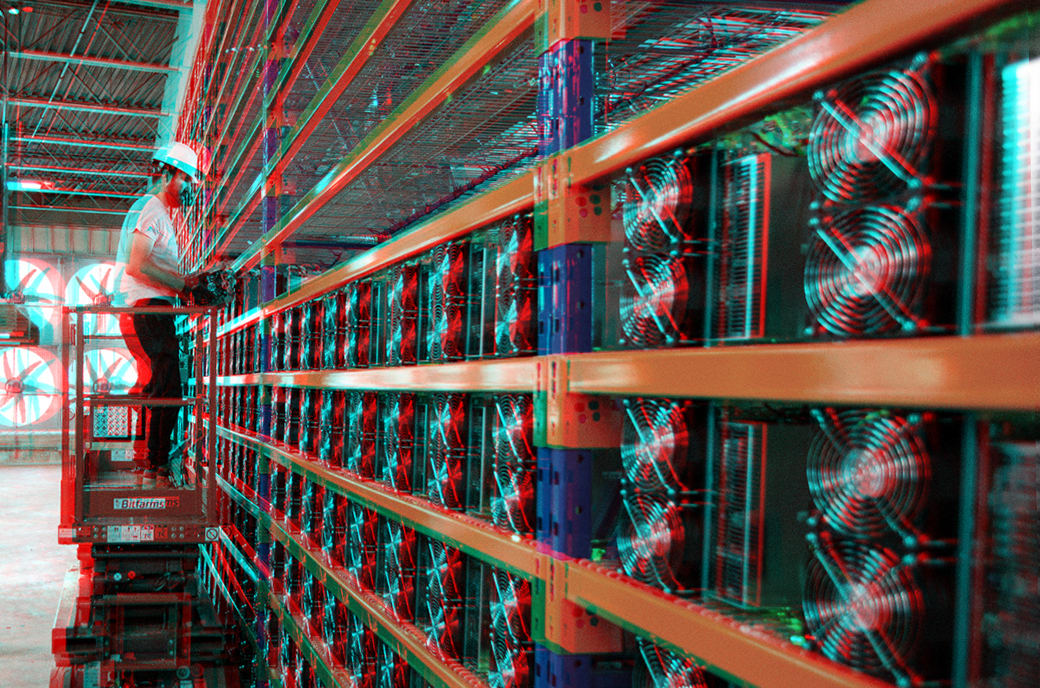

Bitcoin Mining Operation Bitfarms to be Listed on Nasdaq Global Market TierBitfarms has announced that it will be a publicly-traded Bitcoin miner listed on Nasdaq Global Market tier. The tier platform by Nasdaq is reserved for companies who have sustainable finances and pass requirements that go above and beyond Nasdaq’s lower tiers.

The company Bitfarms, which was invoked in 2017, says the Nasdaq Global Market tier acceptance “represents a powerful validation.”

“The approval for listing on The Nasdaq Global Market is an incredible achievement for Bitfarms and is the fruition of multiple years of work and dedication,” Emiliano Grodzki, Bitfarms’ chief executive officer said. “Over the last four years, we have managed to build and operate one of the largest Bitcoin mining operations worldwide. It is fitting that we will be listing on one of the most prestigious exchanges in the world and significantly expand the market reach of our company.”

if (!window.GrowJs) { (function () { var s = document.createElement('script'); s.async = true; s.type = 'text/javascript'; s.src = 'https://bitcoinads.growadvertising.com/adserve/app'; var n = document.getElementsByTagName("script")[0]; n.parentNode.insertBefore(s, n); }()); } var GrowJs = GrowJs || {}; GrowJs.ads = GrowJs.ads || []; GrowJs.ads.push({ node: document.currentScript.parentElement, handler: function (node) { var banner = GrowJs.createBanner(node, 31, [300, 250], null, []); GrowJs.showBanner(banner.index); } });

Mining Firm Must First Pass Confirmation of Eligibility for the Electronic Clearing and Settlement Through the DTCThe Bitfarms Nasdaq listing follows the company’s recent partnership with Foundry and the fleet’s expansion of 2,465 bitcoin miners. Bitfarms also plans to launch a mining facility in Argentina in order to obtain electricity rates at $0.02 per kilowatts per hour (kWh).

Two days ago, the firm announced the purchase of 6,600 S19j Antminers from Bitmain. The miners will give Bitfarms around 2.5 exahash per second (EH/s) this fall.

“The additional 660 PH that will be added to their mining operations will solidify their presence in the mining space, further establishing Bitfarms as one of the leading mining companies in North America,” remarked Irene Gao, Antminer sales director of NCSA region, Bitmain.

The last requirement the mining operation must pass is the confirmation of eligibility for the electronic clearing and settlement through the Depository Trust Company (DTC). If the approval is granted then Bitfarms will be able to list “BITF” on Nasdaq Global Market tier.

What do you think about Bitfarms approval to be listed on Nasdaq? Let us know what you think about this subject in the comments section below.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|