2020-9-9 13:40 |

The benchmark cryptocurrency has retraced from $12,500 to around $10K over the past couple of weeks. Nevertheless, the hashrate of the bitcoin network — which is basically the amount of computing power dedicated to securing the network — has cranked a new all-time high.

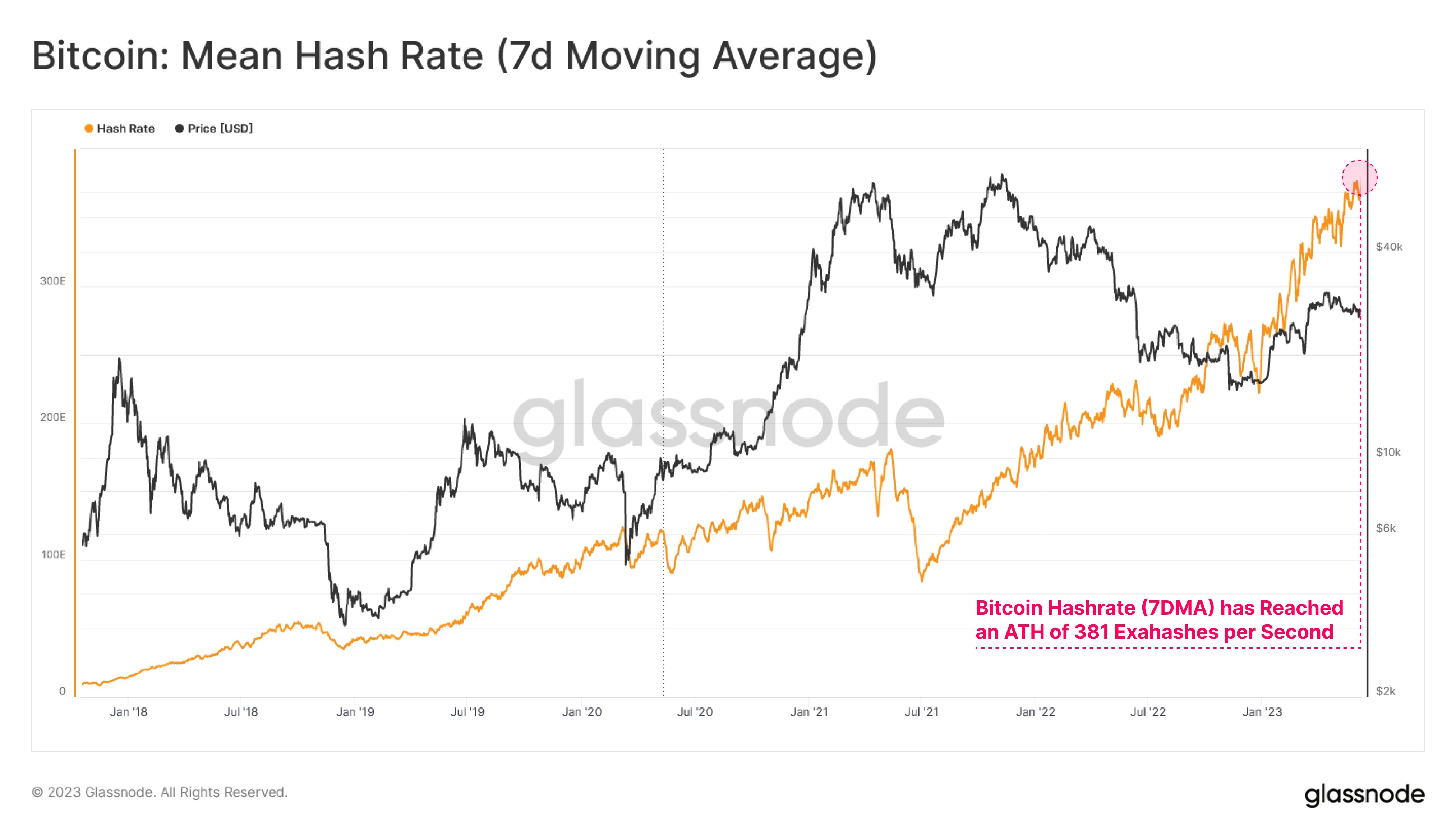

The increase in the hashrate despite the lull in prices demonstrates the confidence that miners have in the long-term trend of bitcoin. According to data put up by Glassnode, BTC’s hashrate broke above 150 exahashes per second (EH/s) for the very first time in history.

Hashrate Is Increasing As Bitcoin Price SlumpsDuring a market pullback, bitcoin mining can be less lucrative because the same operating costs are incurred. For example, if the hashrate remains constant but the bitcoin price plummets from $12K to $8K, the miner will only be able to sell his minted coins at $8K. This is a massive loss given that the same miner would have sold his coins at $12K at the same costs.

The bitcoin hashrate has experienced a rollercoaster this year, although the general trend has been positive. The hashrate started the year at around 105TH/s. It, however, plunged to 82TH/s during the March coronavirus-fuelled fiasco. The hashrate recovered but then took another dive below 100TH/s shortly after the May halving.

Fast forward to September, as the bitcoin price corrected, some expected the network’s hash power to fall in response to the lackluster prices. However, the hashrate has continued to climb at a time when the dormant cryptocurrency has shed $2,000 of its value in the space of days.

Is Bitcoin Price Breakout Imminent?The hashrate is indicative of the security of the bitcoin network. When the amount of computing power that miners are allocating to the network rises, it means that it is getting more and more difficult to 51% attack it.

Most times, an increasing hashrate raises a crucial question: if the hashrate is increasing, will the price of the cryptocurrency follow suit? Some community members have theorized that the hashrate always precedes the price. While this is not a guarantee, it is important to consider other variables like on-chain indicators and fundamentals that could influence the price of the bellwether crypto.

For instance, data shows that miners, who some believe may have been responsible for the ongoing downtrend, have significantly reduced their selling. Moreover, the top crypto’s on-chain signals are turning bullish. On-chain expert Willy Woo recently posited:

“Local on-chain switching bullish (looking at the next few weeks out), not calling this has bottomed, even though it may have. Playing the big swings it’s not a bad time to buy back in.”

Whether the price of bitcoin increases in tandem with the increasing hashrate remains a wait and see situation. What’s certain at the moment, however, is the fact that the bitcoin network is much more secure and difficult to attack.

origin »Bitcoin price in Telegram @btc_price_every_hour

Santiment Network Token (SAN) на Currencies.ru

|

|