2020-5-29 19:11 |

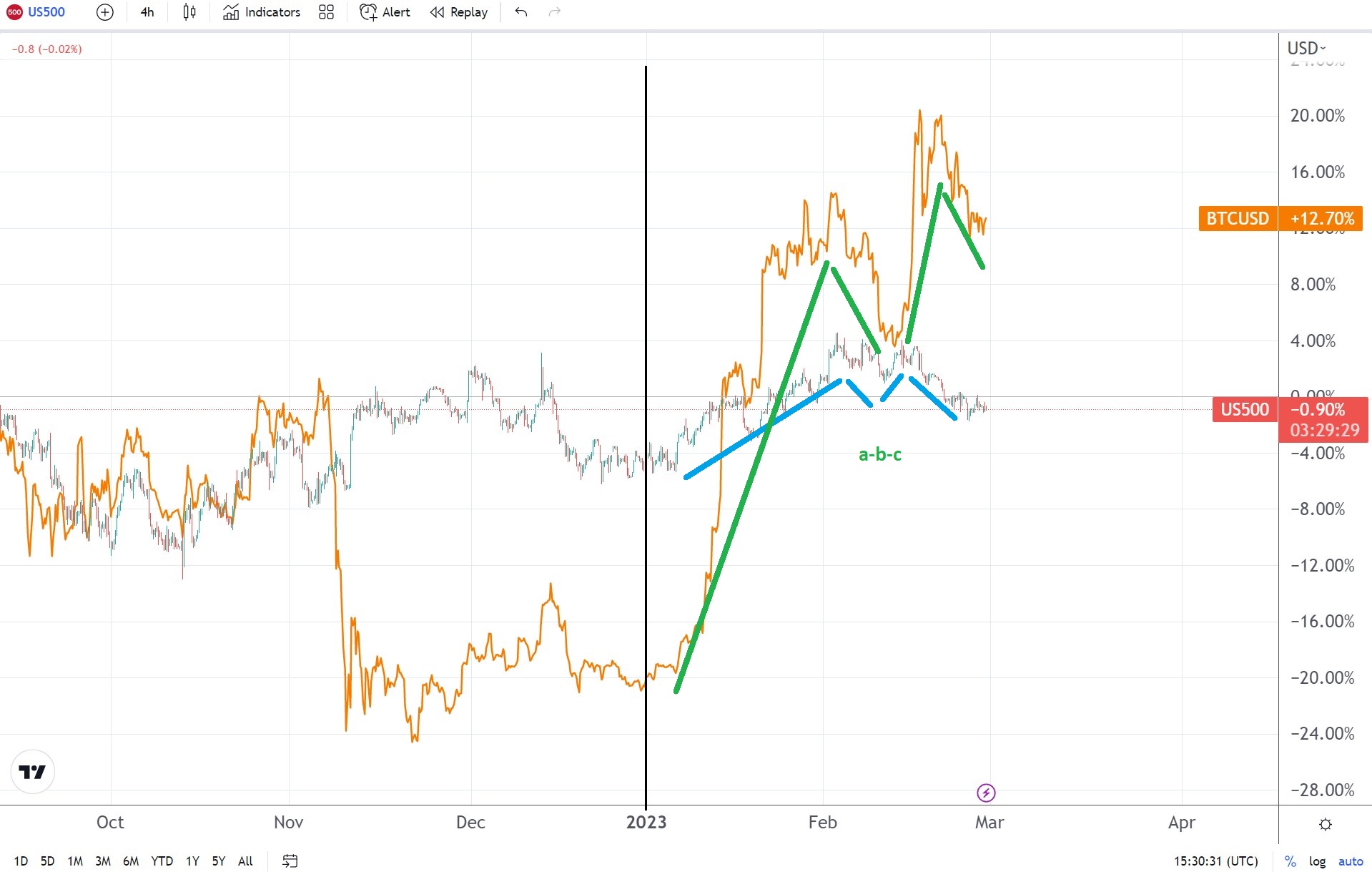

In the past two weeks, the price of Canaan (CAN) stocks have plunged 50%, from 5.97 on May 14th to $3. Yesterday, prices even fell below $3 briefly.

The Chinese bitcoin mining firm is yet again having a rough time but unlike the 65% decline in March which was the result of massive sell-off in the bitcoin prices and crypto market, this time it is happening while BTC is hovering around $9,000.

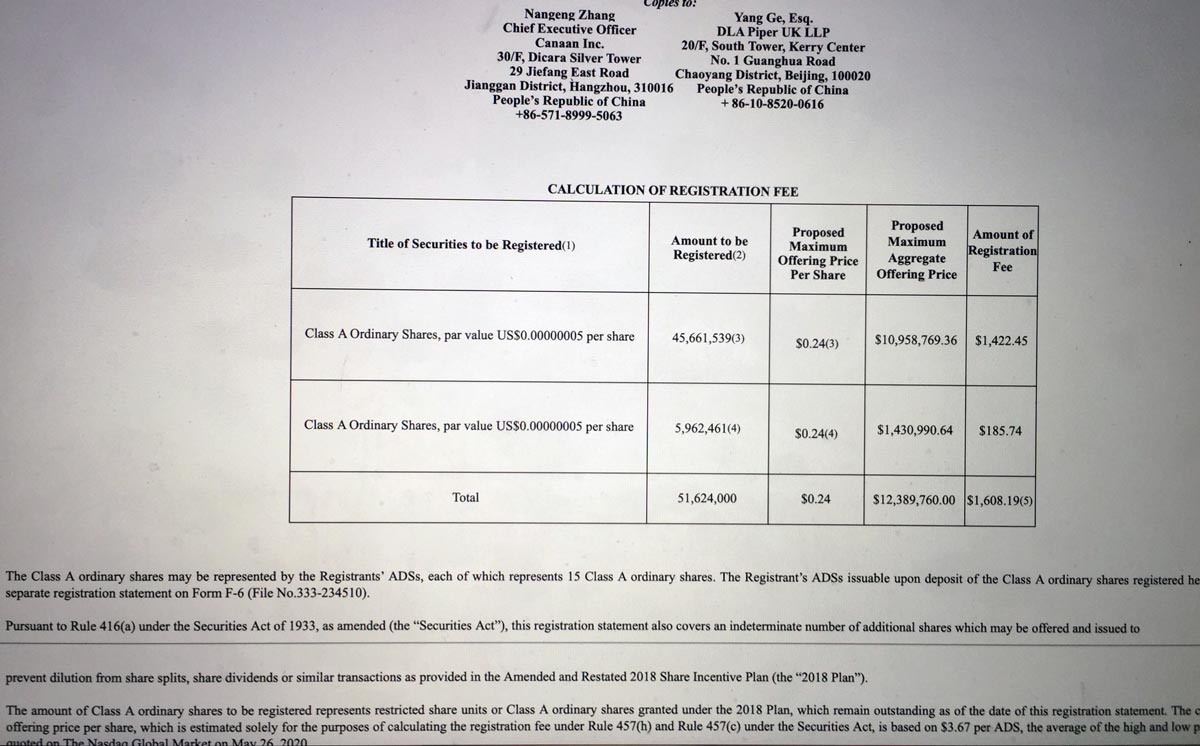

Given that, the 180-day IPO lockup period of Canaan has expired, investors might be abandoning the ship. Its management has also reportedly made SEC submission to sell more than 50 million Class A shares.

“The stock CAN is DOWN 2/3rd since IPO while Bitcoin is up 20 prc ! And even at such low price, management and founders running for exit,” wrote BTCKING555. “The worst is yet to come for Canaan.”

A Series of Bad NewsCanaan’s IPO has been somewhat of a disaster right from the start, raising only $90 million out of the projected $100 million, which was already cut down from the $400 million target. On November 20, 2019, it was listed on Nasdaq at a price of $9.

As per the unaudited Q1 2020 financial report published on May 22, the company reported losses of about $5.6 million.

The bitcoin hardware manufacturer also declared that it will not provide a business outlook for Q2 2020 because of the COVID-19 pandemic and “uncertainties surrounding the Bitcoin halving event.”

The company is also subject to a class-action lawsuit from Canaan investors alleging that the company made false and misleading statements and further failed to disclose that its clients were not in the Bitcoin mining industry. Also, that their financial health was worse than it was reported.

Moreover, the purported “strategic corporation” was just a transaction with a related party and the company removed numerous distributors from its website just before the IPO.

On top of all this is the fear of delisting from the Nasdaq stock exchange following the bill passed in the US Senate that will boost oversight of China-based companies that could also result in their removal from American stock exchanges.

Moreover, Nasdaq is set to unveil new restrictions on IPO to make it harder for Chinese companies to debut on its stock exchange. This could make it more difficult for other China-based bitcoin mining manufacturers like Bitmain to get listed on the platform. Last month, another Hangzhou-based Ebang, one of the leading manufacturers of bitcoin mining equipment filed for a $100 million IPO.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|