2024-1-10 14:30 |

Bitcoin mining stocks are under pressure as the spot Bitcoin drama continues. Most of them have remained in a tight range this week. Marathon Digital (MARA) retreated by over 3% in the pre-market to $24.96. It has retreated from last year’s high of $31.30.

Riot Platforms (RIOT) stock price has dropped from $19 to $15.50 while Hut 8 Mining (HUT) has slumped by over 37% from its December high. Other Bitcoin mining stocks like Cipher Mining, Bitfarms, and Core Scientific have also pulled back.

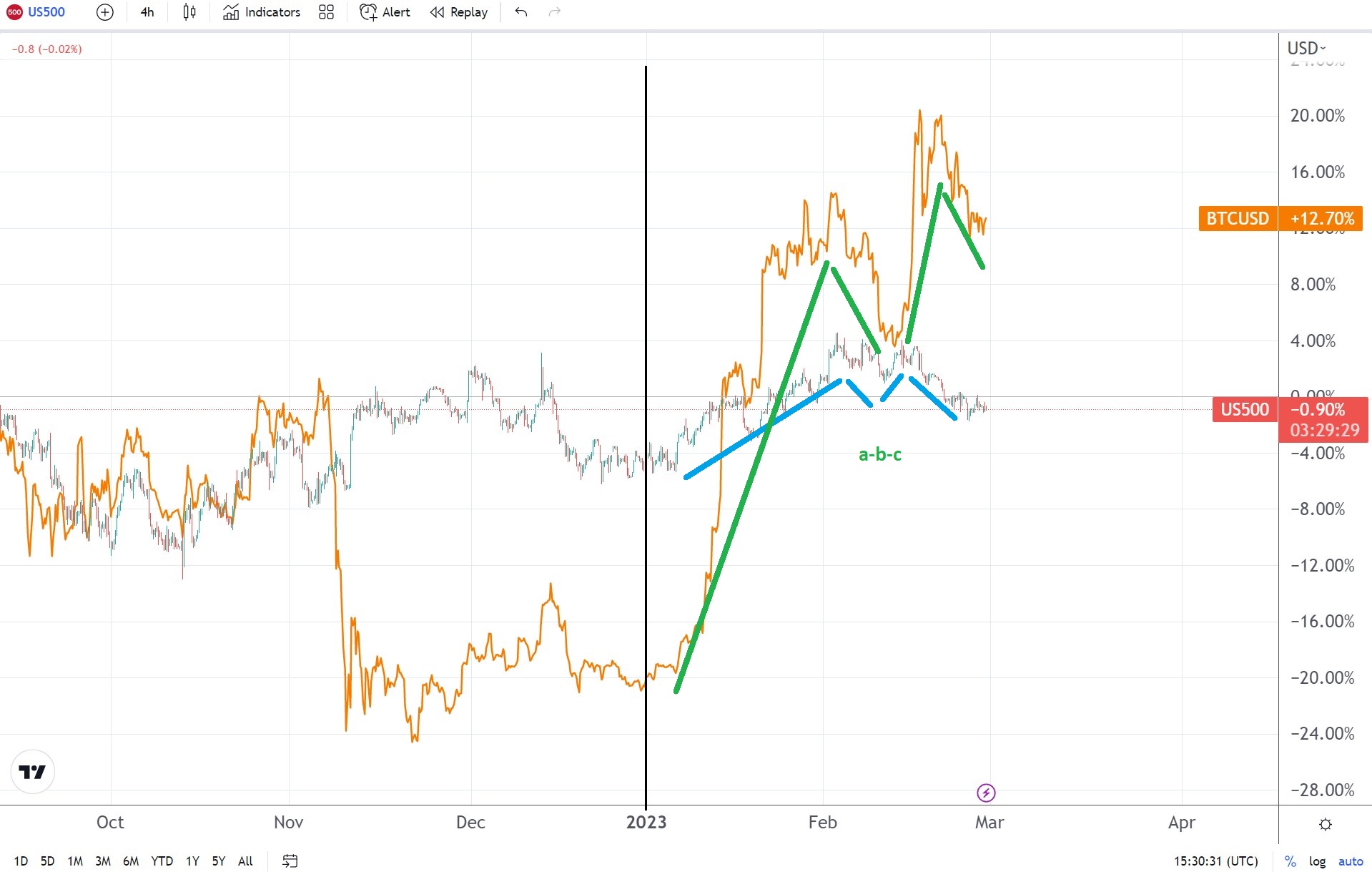

Buying the rumour, selling the newsBitcoin mining stocks have retreated because of a scenario known as buying the rumour, and selling the news. See, most of these companies surged in the run-up to the spot Bitcoin ETF approval. This price action also happened in Bitcoin, which surged to over $47,000 on Tuesday.

Therefore, these companies are retreating as some investors start paring back their holdings. In most cases, assets tend to rise ahead of a major event and then they pull back when the event happens.

A good example of this is what happened in 2023 when Ripple Labs won its lawsuit against the Securities and Exchange Commission (SEC). While Ripple’s XRP and Stellar’s XLM rose after that, they both pulled back and have never recovered.

Similarly, Litecoin’s price jumped after its halving in August and then retreated after that. Like XRP, it has never bounced back even as altcoins saw traction.

Therefore, there is a likelihood that Bitcoin price will pop after the SEC approves its ETF and then retreats. This will happen as some of the investors start selling their stake.

Are Bitcoin mining stocks good buys?MARA vs RIOT vs HUT vs CIFR stocks

Bitcoin mining stocks like MARA, HUT, and RIOT have a close correlation with Bitcoin. In most cases, as happened in 2023, they tend to rally when Bitcoin is in an uptrend and vice versa. In 2023, Bitcoin jumped by over 150% while these stocks rose by more than 300%.

Therefore, the long-term outlook for the stocks will depend on Bitcoin’s performance. Some analysts believe that Bitcoin has more upside in the long term. In a recent note, an analyst at Standard Chartered noted that Bitcoin could surge to $250k by 2025.

Bitcoin’s retreat will also be brief because the coin has other catalysts this year. For one, there are signs that the Federal Reserve will start cutting interest rates this year. In most cases, Bitcoin tends to do well when the Fed is cutting rates.

The other potential catalyst for Bitcoin is halving, which will happen in April. This event will likely lead to more upside as Bitcoin’s supply is set to retreat as demand from institutional investors rise.

Bitcoin will also be an important part of a balanced portfolio. Based on its historical performance, I believe that many fund managers will allocate a small portion of their funds to Bitcoin. If history repeats itself, Bitcoin will continue to outperform other assets like stocks and bonds.

Therefore, there is a possibility that stocks like MARA, HUT, and RIOT will retreat after the ETF approval and then bounce back later this year.

The post Is it safe to buy RIOT, MARA, HUT, CIFR stocks after the BTC ETF decision? appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|