2020-2-10 18:14 |

The coronavirus will likely slow down the entire Chinese economy, and analysts are cutting their economic forecasts for both February and for 2020. This may positively push Bitcoin upwards as a possible hedge.

The economic situation in China is set to worsen as analysts continue to downgrade its growth forecast for 2020. Economic activity has halted in many parts of the country, and the service sector has shuttered as Chinese citizens are being advised to stay home. The move will inevitably impact global supply chains, and Bitcoin may react.

Analysts Downgrade Their 2020 Economic Outlook for ChinaThis was supposed to be peak season for consumer spending in China with the Lunar New Year holidays. With efforts now focused on eradicating the coronavirus pandemic, the impact will be felt worldwide. Most major entities have thus downgraded their 2020 growth forecasts for China. [CNBC]

Citigroup economists expect China’s growth to slow from 5.8% to 5.5%. Economist Intelligence Unit argues that China’s growth will be 4.9-5.4%, down from 5.9%. Macquarie downgraded China’s 2020 growth from 5.9% to 5.6%. Moody’s maintains that China will keep up its 5.8% growth for 2020.Many other analysts have weighed in, and the consensus seems to be that the Chinese economy will take a severe hit due to the coronavirus. However, it won’t be enough to bring the entire economy to a standstill. There is some hope that the Chinese government’s most-recent stimulus package may be enough to keep the economy afloat for the time being.

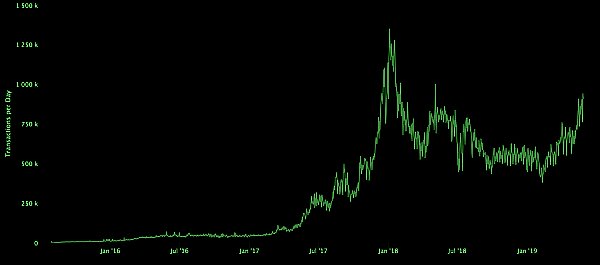

How Will Bitcoin Fare in This Uncertain Market?Throughout 2019, Bitcoin has repeatedly proven itself as a hedge against global uncertainty. Amid the U.S.-China trade negotiations last year, Bitcoin actually outperformed gold as a hedge against economic instability. Although markets are shakey over coronavirus fears, Bitcoin has had a surprising rally since the start of the year. The leading cryptocurrency recently broke the $10,000 mark and is currently up +3.24% on the daily.

Still, Bitcoin has never experienced an economic recession before in its short history. Given that the leading cryptocurrency tends to follow the S&P 500, generally speaking, some critics maintain that Bitcoin will tumble like the rest of the market if a recession comes. As of now, the jury is out on this question—but in the short term, Bitcoin seems poised to reach higher as we approach its halving event in May.

The post Bitcoin May React to China’s 2020 Economic Forecasts Being Cut for February appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Theresa May Coin (MAY) на Currencies.ru

|

|