2021-8-20 16:03 |

The Lightning Network is the reason Bitcoin will be legal tender in El Salvador. The main chain couldn’t serve a whole country without a fast and reliable payment channel built on top of it. It’s as simple as that. However, is the Lightning Network invulnerable to attacks? Is its architecture as bulletproof as Bitcoin’s main network? Not according to technical expert Shinobi, who qualifies it as “a toy” and urges us to stop acting like it’s “the shape of the future.” Ouch.

Writing thing about Lightning. Lightning people will probably get mad.

— Shinobi (@brian_trollz) August 3, 2021

At Bitcoinist, we tried to explain how the Lightning Network works. We gave you reasons why it will continue to grow. We compared its energy consumption to the rest of the world. And now, it’s time to criticize it. Because we’re a fair and balanced publication and we’re committed to exploring every angle of the story.

Make no mistake, Bitcoin works as a monetary network because all the incentives are in exactly the right place. It’s miraculous. And, according to Shinobi, we can’t say the same thing about The Lightning Network.

The Lightning Network Has An Incentives ProblemShinobi’s essay starts with a bang:

The entire design goal for the Lightning Network is to allow the atomic routing of payments between parties that do not have direct payment channels between themselves, and this is literally impossible to accomplish without the economic incentive that routing fees provide except to count entirely on altruistic charitable motivations.

The way Shinobi sees it, The Lightning Network counts on altruism instead of greed. And there’s no way a network like that can flourish. Of course, he says it in a more colorful language:

Lightning as it stands right now is nothing but a children’s toy. Period. It is not some polished system, it is not a magical UX or UI, it is not even robust or solid in the face of adversarial attacks. It’s a fucking toy put together by a group of friends and maintained solely because it is composed predominantly of just that. Friends. Businesses who know each other. A tight social group that has not hit the point of growing past a socially scalable size.

Take your kids’ gloves off and tell us how you really feel, Shinobi. Geez.

Another characteristic of Bitcoin, the monetary network, is its invulnerability. It contains the biggest honeypot that the world has ever seen, and so far no one has been able to hack or exploit it. According to Shinobi, the same can’t be said about the Lightning Network. The “adversarial screws haven’t even been installed yet.” And he’s worried about the kinds of attacks it’s vulnerable to. And about the “very real economic incentives that will inevitably create entities in the perfect position to exploit these classes of attacks.”

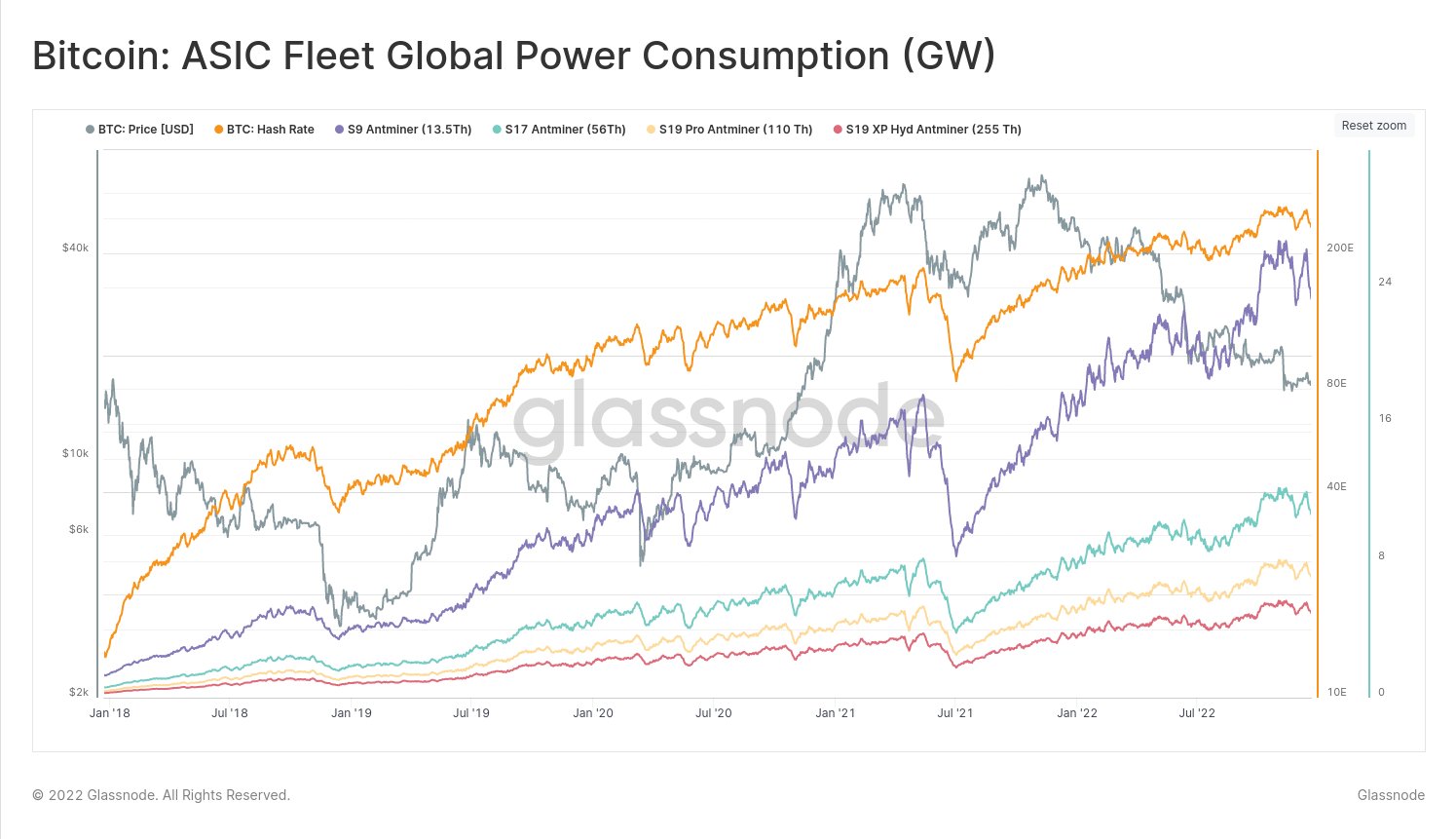

BTC price chart for 08/20/2021 on Bistamp | Source: BTC/USD on TradingView.com Vulnerabilities And Possible Attacks “The first class: passive privacy leaks.” According to Shinobi, if you control several nodes you could potentially learn a lot from the payments that go through them. “Firstly there is the decrementing timelocks. This allows me to guess both how many hops away the first node I run involved in the payment is from the origin point as well as how many hops away from the destination the last node I run that is involved is.” “The second class: actively probing channels by making payments” An adversarial actor could figure out how much Bitcoin a channel holds by constantly probing them. “Taking regular snapshots like this would allow you to start playing summing games in global channel balance shifts and guessing at payment flows with a much better accuracy because of knowledge of channel balance distribution over time with your snapshots.” Shinobi is also worried about “yield chasing” platforms like BlockFi and Ledn. Those would make any trade “to out perform the market.” “In this possible future scenario, this entity would be in the position to perform a systemic private attack on a certain % of the entire Lightning Network. It would also have an economic incentive to do so. That information is economically valuable, as evidenced by the existence of chainanalytics companies.” Conclusions And SolutionsFor the technically minded, we strongly recommend reading the original essay. Shinobi goes deep and explains the vulnerabilities in great detail. We did our best to simplify the concerns. The text ends with a call to action:

If Lightning is not going to be a profit incentive driven network organized by market forces…well…it’s time for people who feel that way to start being open about it, and start discussing how they are going to structure and incentivize a web of trust to make it something else.

Which is fair.

In the comments, Rene Pickhardt, co-author of the book “Mastering the Lightning Network” with Andreas Antonopoulos, exercised his right to reply:

I think it is rather unlikely that a single entity regularly will be on many hops of a path. Also with probabilistic pathfinding and optimal payment flows we believe a fee market for providing liquidity has the chance to emerge.

Which is also fair.

Featured Image by Keli Black from Pixabay - Charts by TradingView origin »Bitcoin price in Telegram @btc_price_every_hour

Santiment Network Token (SAN) íà Currencies.ru

|

|