2020-11-4 05:00 |

Bitcoin’s rapidly rising price has not matched its hash rate – which is a somewhat unusual occurrence.

While the network’s transaction volume and utilization rates remain incredibly high, the tera-hashes per second being performed by the network have collapsed over the past few days.

Some believe that this could be due to the end of the rainy season in parts of China, which has been contributing to ultra-cheap power stemming from hydro-electric power.

To account for this sliding hash rate, the Bitcoin network just saw its second-largest negative mining difficulty adjustment ever seen.

This makes it highly lucrative for miners based in the West, who can now mine blocks with greater ease due to the decreasing concentration of mining power in China.

This trend is considered fundamentally positive by many analysts, as the centralization of hash power in China has long been seen as a potential Achilles Heel for the benchmark cryptocurrency.

Bitcoin Hash Rate Slides as Dominance Shifts Out of ChinaBitcoin’s rapidly declining hash rate is likely coming about due to Chinese-based miners shutting off their rigs due to a spike in electricity costs as the rainy season comes to an end.

It’s fairly common to see large fluctuations in hash rate that come about due to seasonal changes within China, as dry season contributes to higher electricity prices due to the reduction of cheap hydro-electric power.

Jameson Lopp spoke about this in a recent tweet, explaining that the ongoing shift of hash power away from China is a positive development that is likely to continue for the next few years.

“Bitcoin hashrate has dropped by ~45% over past 3 days, presumably due to Chinese miners relocating equipment for the dry season. Hopefully in coming years the semi-annual hashrate fluctuations will decrease in volatility as China’s share of hashrate continues to drop.”

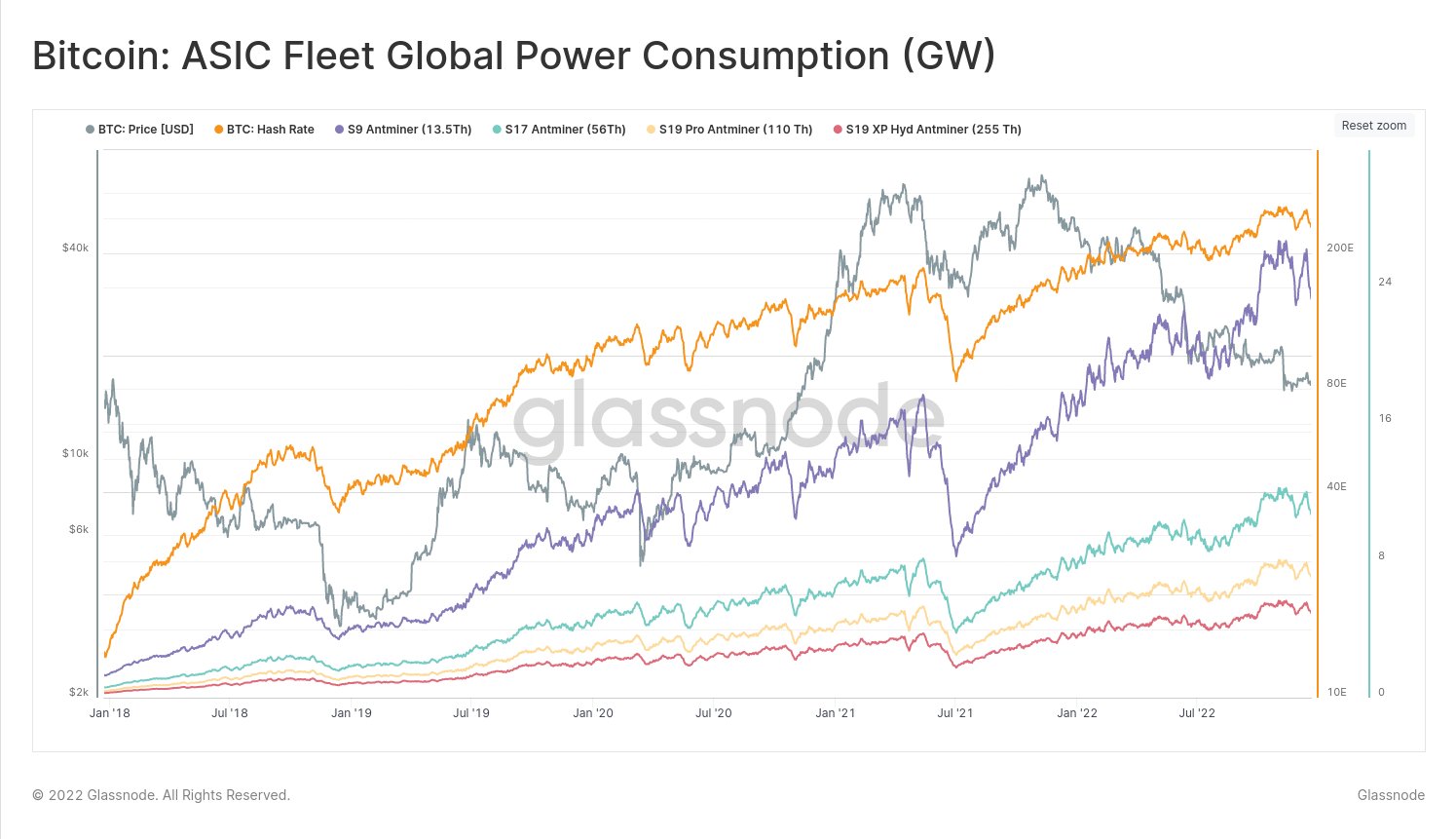

Sliding Hash Rate Contributes to Historic Difficulty AdjustmentAnalytics platform Glassnode explained in a recent tweet that the recent hash rate decline has led the Bitcoin network to see its second-largest difficulty adjustment ever.

“We just observed the 2nd largest negative Bitcoin mining difficulty adjustment in history: -16%. It topped the -15.9% change in March this year. The only other time difficulty saw a larger downwards adjustment (-18%) was over 9 years ago, in Oct 2011.”

Image Courtesy of Glassnode.If hash power continues shifting away from China and towards other countries in the years ahead, this could contribute to a significant boost in its underlying fundamental health.

Featured image from Unsplash. origin »Bitcoin price in Telegram @btc_price_every_hour

Santiment Network Token (SAN) на Currencies.ru

|

|