2020-12-9 17:55 |

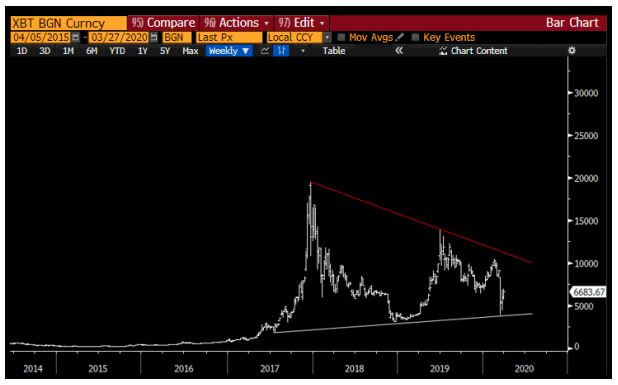

Bitcoin’s price is down by over $1,000 over the past week as signs show that some traders are starting to reassess the bullish outlook

Bitcoin (BTC) price lost $1,000 over the past week as analysts believe that traders are reconsidering their positive sentiment about the cryptocurrency. Bitcoin reached a record-breaking $19,900 a week ago, but the leading cryptocurrency has since retraced, and it is currently trading at the $18,100 level.

Yesterday, the leading crypto fell to around $18,031 from $18,770. Although it has retraced slightly to above the $18,100 mark, the cryptocurrency is testing a key level of psychological support close to $18,000.

The leading cause of the decline could be the Bitcoin whales who are reassessing their positive outlook on the cryptocurrency. According to Ki Young Ju, CEO of CryptoQuant, most whales moved their BTC to cryptocurrency exchanges in anticipation of sell orders. This means that the whales are looking to cash out on their Bitcoin holding and wait for the price to decline before they buy again.

Whales are traders and investors that hold sizable amounts of Bitcoin on either exchanges or personal wallets. Some experts believe that an 80% growth in Bitcoin price over the past two months is too good for most traders and they should book profits.

According to blockchain data source company Glassnode, Bitcoin balance held in accumulation addresses declined by 4%. Hot wallets currently hold 2,698,719 BTC, an indication that some investors that were previously holding their bitcoins are looking to sell.

Brexit concerns affecting the marketsWhile some analysts believe the decline is due to whales and their readiness to sell their Bitcoin holdings, the cryptocurrency market might be reacting to the sentiment in the general market. Traditional markets took a hit yesterday over fears of a “no-deal” Brexit.

There are only three weeks left until a deal should be agreed upon between the United Kingdom and the European Union. However, they are still at a deadlock regarding trade deals, and the outcome is affecting the traditional markets.

Yesterday, major European stock market indices like the UK FTSE and Germany’s DAX all dropped by roughly 0.3%. Furthermore, the futures tied to the S&P 500 declined by 0.3% as negotiations continued between the UK and the EU.

As such, investors are selling equities and pushing their funds to safe-haven assets like the US dollar and are exploring new digital assets like Bitcoin. Market experts believe that a Brexit with no trade deal in place could affect the UK and the remaining EU member states for years to come. Hence, investors are concerned about the long term economic outlook.

The post Bitcoin loses $1,000 as traders reassess bullish stance appeared first on Coin Journal.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|