2019-12-30 19:04 |

Coinspeaker

Bitcoin Post-Holiday Consolidation Opens Up New Opportunities for Altcoins

Bitcoin’s market capitalization has grown by 1.4% over the past 24 hours and now stands at $ 197.1 billion. Trading volume also rose to $ 17.2 billion (+ 26.6%). The weakness of the Bitcoin consolidation made it lose a bit of dominance, which now stands at 68.08%.

Bitcoin (-0.16%) uninterrupted with growth over the weekend, but with fears among buyers, while Bitcoin SV, Litecoin and Bitcoin Cash has grown by 3.5% over the past 24 hours. Also a solid momentum: Binance Coin (+ 5-15%), Ethereum (+ 4.7%) and XRP (+ 2.47%). In the Ethereum token section, the best performer with the most capitalization is Maker (MRK + 5.48%). Also of benefit to discuss are UTT (+ 12%) and Quant (+ 20%).

Bitcoin, on the flip side, is at an analytical zone where a rise above $ 7,500 indicates a further increase in price, while a fall may lead to a re-testing of support at $ 7,100.

Even though Bitcoin’s low performance is practically not welcome, this is an ideal opportunity for altcoins. Traders will look for altcoins that record significant price movements, such as Ethereum, and occupy higher positions. This will lead to an acceleration of their price movement and a shock to dominance in the Bitcoin market.

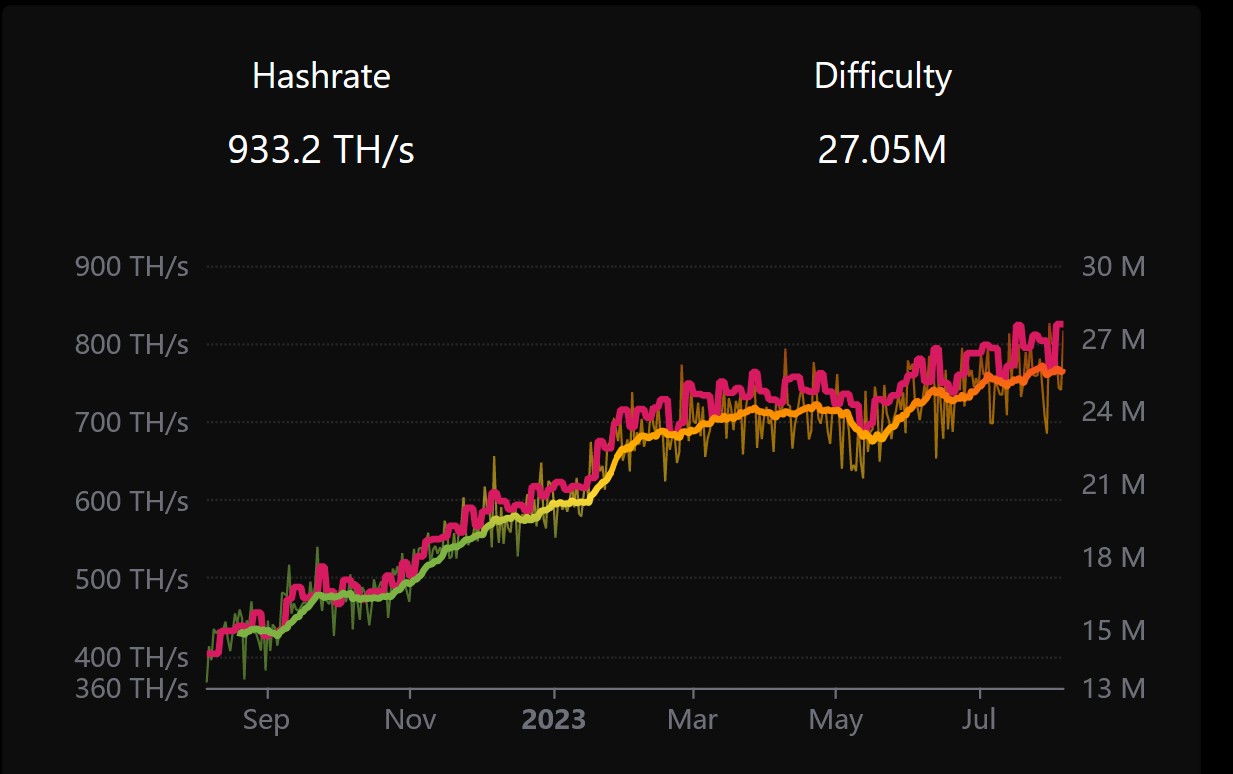

Four and a half months before the next halving of Bitcoin, forecast about whether the event may affect the price of BTC become vastly effective.

Crypto analyst Jacob Canfield published a two-fold viral forecast that will cut the number of BTC miners who have earned power on the network by half, which will further slow down the supply of new Bitcoin to the market.

Consistent with Canfield’s unreliable logic, halving is already public, appreciated and predictable that it is virtually no longer evaluated at all.

BTC/USD Eyes the Price Level at $7,600 ResistanceSupply Levels: $ 7,100, $ 6,800, $ 6,500

Demand Levels: $ 8,000, $ 7,800, $ 7,600

A break above the $ 7,600 level will be extremely optimistic for the BTC/USD pair and may trigger a test of $ 8,000 this week. Only a steady loss of the Bitcoin is rising on Monday to the level of $ 7,600, after last Friday there was a strong interest in buying from the price level of $ 7,300.evel at $ 7,100 should be a concern for buyers of BTC/USD in the short-term.

The BTC/USD trend remains bullish when it is trading past the level of $ 7,100, the key resistance is located at the levels of $ 7600 and $ 8000.

If the BTC/USD pair is trending below the $ 7,100, sellers can test the support level of $ 6800 and $ 6500.

Bitcoin Post-Holiday Consolidation Opens Up New Opportunities for Altcoins

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|