2021-5-10 15:40 |

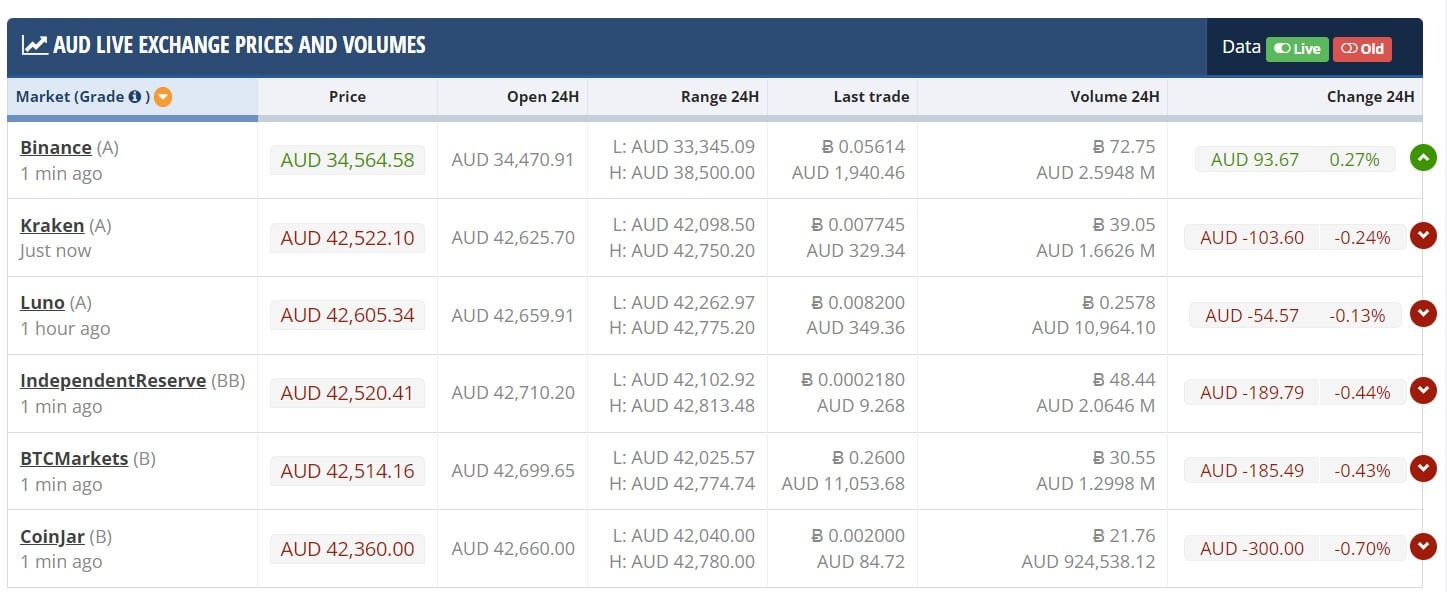

Changpeng Zhao, the Binance CEO, says Bitcoin’s volatility cannot be compared to other cryptos. Data shows that Bitcoin (BTC) is less volatile based on its returns.

The Binance CEO stated this during an interview with Bloomberg TV on May 3. According to the CEO, Tesla (TSLA) and Apple (AAPL) stocks were more volatile than BTC stocks. According to the CEO, volatility existed in all markets and not just the crypto market.

"There's always a large number of people having the herd mentality than the guys who actually do serious research."@cz_binance, founder of the world’s largest cryptocurrency exchange Binance, discusses volatility of #cryptocurrency markets on @BloombergTV pic.twitter.com/UAT4Kpy1tu

— Bloomberg (@business) May 3, 2021However, Zhao’s allegations are quite skeptical. Every trading expert will tell you that Bitcoin prices and other cryptocurrencies fluctuate more than company stocks.

Tesla is a unique caseTesla’s market capitalization stands at $633 billion. The company has lagged behind top global companies in terms of profits as its net income has failed to reach $500 million. Tesla stocks are less profitable compared to Microsoft (MSFT), Facebook (FB), Google (GOOG), and others.

The charts shows that Tesla stocks are more volatile than other stocks of companies valued at $200 billion. Tesla’s volatility cannot be compared to crypto. Unlike TSLA, BTC does not earn value, and it does not have a valuation model.

However, Zhao’s trading activity cannot be used to help retail investors gauge their earnings. While he may be the head of one of the leading crypto exchanges, he does not trade cryptocurrencies frequently. Rather, the CEO chooses to HODL. This helps him avoid the stress of market volatility. Holding is the best strategy for long-term speculation.

Volatility and Returns are ExclusiveVolatility cannot be used to measure the value of cryptocurrencies. Crypto holders can measure the value of cryptocurrencies using the amount of earned returns. The level of volatility for crypto does not matter. The only metric that matters is the high returns and gains earned.

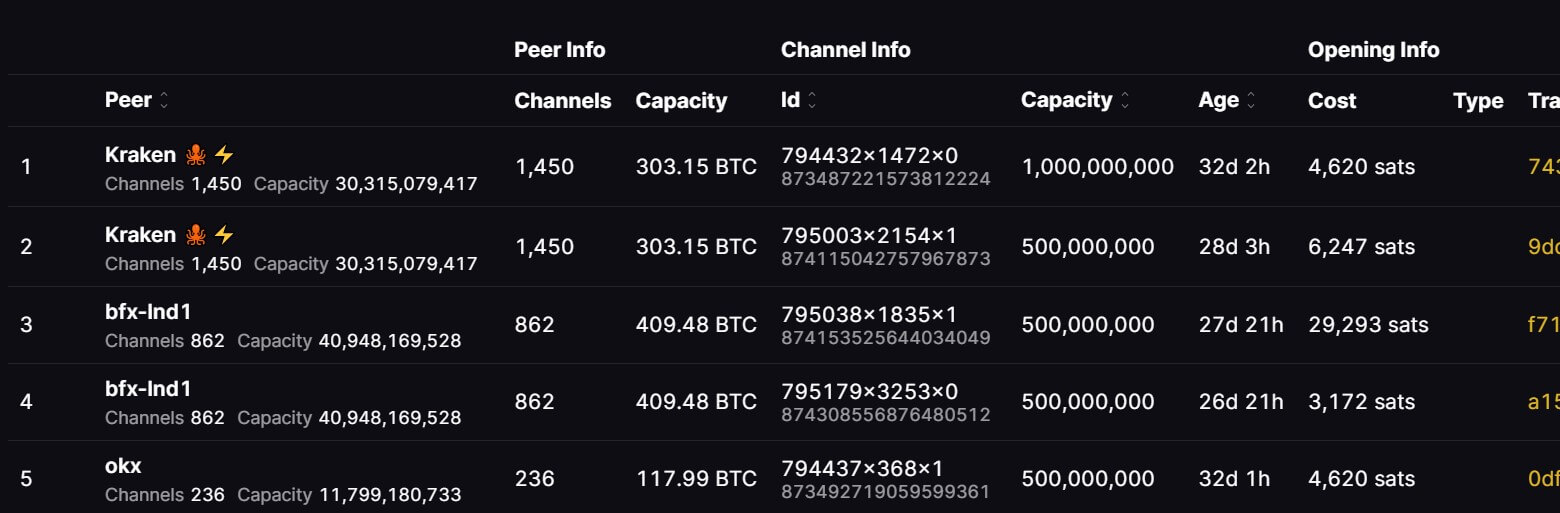

MicroStrategy, a crypto analyst company, has provided a chart that will assess the returns and Sharpe ratio of Bitcoin.

The Sharpe ratio is a measure of risk-adjusted (really volatility-adjusted) returns. It is a way to measure how much return an investment generated for the risk (volatility) endured over some time horizon.

The data from MicroStrategy shows that Bitcoin takes the lead in terms of risk returns. The returns were assessed using major assets and indices over a period of one month.

According to Zhao’s analysis, Bitcoin’s volatility may be similar to the stocks of billion-dollar companies. However, based on returns derived from volatility, Bitcoin takes the lead.

The post Bitcoin is less volatile than Tesla and Apple stocks: Binance CEO appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|