2020-7-12 01:00 |

Bitcoin has entered yet another consolidation phase, this time hovering around $9,200 as it reestablishes its position within its previously held range between $9,000 and $9,300.

The cryptocurrency’s recent price action has done little to offer any significant insight into its macro outlook, as it still remains caught within its long-held range between $9,000 and $10,000.

Until one of these levels breaks, the cryptocurrency will still remain caught firmly within a prolonged bout of sideways trading.

As for what analysts are saying about where Bitcoin could trend next, one explained that he is closely watching the $9,000 level for insight into its mid-term trend.

He notes that a break below this support would lead BTC to its multi-month lows of $8,600, with a decline beneath this level giving rise to “nasty price action” that could cause the crypto to see a far-reaching selloff.

Bitcoin Consolidates at $9,200 as Buyers and Sellers Remain DeadlockedBoth Bitcoin’s buyers and sellers have been unable to gain firm control of the benchmark cryptocurrency’s midterm trend throughout the past two months.

The consolidation phase, which first began in May, is showing no signs of slowing down anytime soon, and there do not appear to be any near-term catalysts to break this trend.

The trading range BTC has been caught within has been narrowing as well.

At the time of writing, Bitcoin is trading down roughly 1% at its current price of $9,225. This is around where it has been hovering in the time following its recent rejection at $9,500.

The rejection here proved to be grave for the cryptocurrency’s outlook, and even put an end to the immense rallies posted by many major altcoins throughout the past couple of weeks.

One analyst explained that he now believes Bitcoin is on the cusp of seeing a leg down towards $8,600. This possibility would be invalidated if the crypto rises towards $9,500.

“I’m short (LTF)… If we are going to get a leg down to 8.6-8.8k it should happen now. If I get stopped, we prob take back 9.5k and continue up,” he noted.

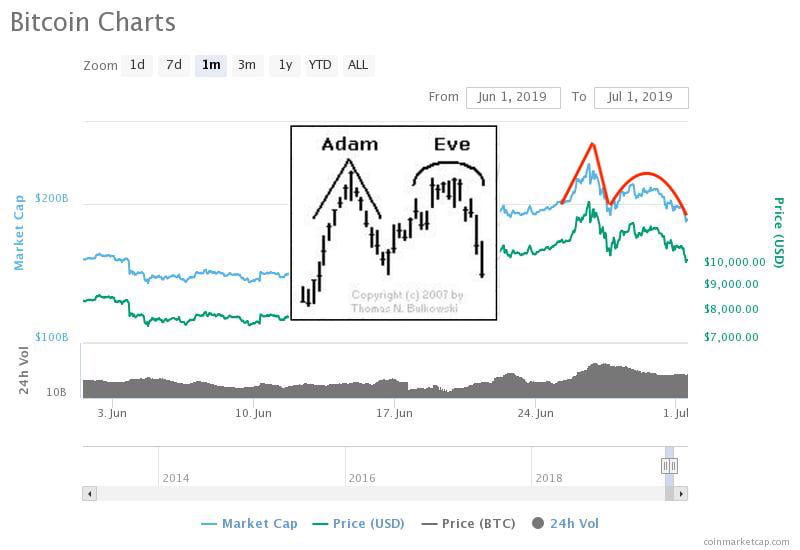

Image Courtesy of Credible Crypto. Chart via TradingView. Here’s the Level That Could Spark a “Nasty” BTC SelloffIf BTC does reel down to $8,600, how it reacts to the support here will be crucial for determining where it trends next.

In a recent blog post, another respected analyst explained that a break below $8,600 would put Bitcoin in firm bear territory and send it reeling lower.

“I think if we broke down from here and broke below $8600 then I think we could quickly turn bearish and start to see some nasty price action,” he said while pointing to the chart seen below.

Image Courtesy of Cactus. Chart via TradingView.Bitcoin’s looming weekly close may be one factor that helps spark some trend-defining volatility in the near-term.

Featured image from Shutterstock. Charts from TradingView. origin »Bitcoin price in Telegram @btc_price_every_hour

Action Coin (ACTN) íà Currencies.ru

|

|