2020-6-11 10:20 |

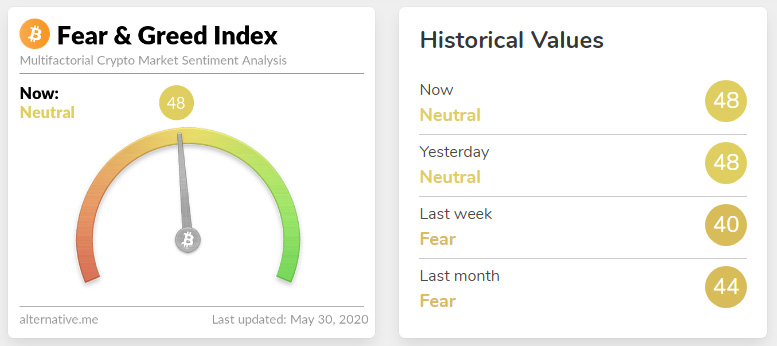

A bitcoin technical indicator that may have played a crucial role in predicting its 2017 price rally has flashed again. The “Chaikin Money Flow” is looking to climb into a buying area for the first time since mid-2016. After its previous formation, Bitcoin had surged from $700 to $20,000. Bitcoin is struggling to close above $10,000 in the past three months, but it may head exponentially higher if a super-bullish technical play out as planned. So sees Eric Thies, a prominent market analyst, who spotted the so-called “Chaikin Money Flow,” or CMF, on Bitcoin’s monthly charts. The technical indicator, by definition, combines an asset’s volume and price action by considering that the former leads the latter. “CMF moves above and below zero based on whether, on average, the stock is finishing in the upper portion of the daily range or the lower portion respectively,” reads its description on BinaryOptions.net. “Each day is multiplied by volume, so a down day accompanied by big volume will result in a lower indicator reading than a down day on small volume.” BTCUSD monthly CMF is climbing above zero for the first time since 2016 | Source: Eric Thies The last time CMF moved above zero was in September 2016 when Bitcoin was trading near $700, noted Mr. Thies. Its occurrence followed an exponential price rally that eventually sent the cryptocurrency up by 2,757 percent – to $20,000 – in December 2017. “1M CMF suggests that smart money is climbing into the market as its closing in [towards] zero,” wrote Mr. Thies. “Anything rising above zero is bullish for the Chaikin Money Flow.” Bullish Confluence Mr. Thies studied the CMF tool in conjugation with another popular technical indicator, the Stochastic Relative Strength Indicator, noting that it helped to determine the bitcoin’s 2016-2017 bull run. The BTCUSD monthly Stock RSI enters bullish area | Source: Eric Thies In May 2020, the Stock RSI on Bitcoin’s monthly chart crossed to the upside, right when the CMF is looking to make a similar move above zero. The 2016 fractal showed the same pattern: the Stoch RSI jumping above 50, thus confirming a bullish bias, followed by the CMF’s jump into the positive area. Mr. Thies noted that Stoch RSI above 50 is “a bull trend with continuation.” Meanwhile, the analyst added that its occurrence typically leads to a 300 percent price rally. “1M SRSI has crossed-up, and each time this has happened led to 3x returns at least,” he said. That puts Bitcoin’s upside price target near $30,000. Long-Term Profits for Bitcoin The technical analysis appeared as Bitcoin struggles to move past $10,000 despite a favorable macroeconomic scenario. But Mr. Thies noted that short-term bearish moves do not have any authority to predict a long-term bias. Looking at the cryptocurrency’s charts from monthly perspectives prove that even the daily, weekly, and bi-monthly charts could flip into bullish territory. origin »

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|