2019-7-23 19:00 |

Over the last few months, the interest surrounding cryptocurrency derivatives products has been growing fast. For some time now, open interest in CME’s bitcoin futures has been breaking records. Bakkt’s futures platform began testing contracts on Monday and the company says there are participants from all around the world. Elsewhere, bitcoin derivatives provider Ledgerx is listing a huge $100K call option with a December 2020 expiry.

Also read: Honestnode Founder Discusses the First Stablecoin Built on Bitcoin Cash

Bakkt Begins Testing Its Daily and Monthly Physically-Settled Bitcoin FuturesOn July 22, the Intercontinental Exchange’s (ICE) long-awaited cryptocurrency futures trading subsidiary Bakkt began testing its futures contracts. “Today kicks off user acceptance testing ICE markets for the Bakkt Bitcoin daily and monthly futures contracts. Testing is proceeding as planned with participants from around the world,” Bakkt tweeted on Monday. The parent company of the New York Stock Exchange, ICE announced the BTC futures offering about a year ago, but Bakkt’s physically-settled bitcoin futures was delayed. In order to provide the new derivatives products, Bakkt partnered with the ICE futures exchange so the service can provide clearing infrastructure for physical delivered bitcoin futures contracts to market participants. “Participants will undergo applicable AML/KYC reviews, consistent with CFTC-regulated markets and connect via ICE’s existing infrastructure,” Bakkt’s website explains.

Intercontinental Exchange chairman and CEO, Jeff Sprecher (right), with his wife and Bakkt CEO Kelly Loeffler (left).According to Bakkt’s blog, the company is testing two different kinds of products traded at ICE Futures U.S. and cleared at ICE Clear US. Former Coinbase executive and Bakkt COO, Adam White, said the launch will usher in a new standard for accessing cryptocurrency markets. “Compared to other markets, institutional participation in crypto remains constrained due to limitations like market infrastructure and regulatory certainty — This results in lower trading volumes, liquidity, and price transparency than more established markets like ICE’s Brent Crude futures contract, which has earned global trust in setting the world’s price of crude oil,” White opined. The Bakkt executive added:

Bakkt’s efforts to help institutions launch safely into this market is the right stuff for the future.

Other firms like Erisx and Ledgerx are also planning to offer physically-settled bitcoin futures contracts. On June 25, news.Bitcoin.com reported on Ledgerx’s designated contract market (DCM) license approval by the U.S. Commodity Futures Trading Commission (CFTC) to offer these products to institutional and retail investors.

Bakkt Bitcoin (USD) monthly futures contract. The exchange is also offering a daily contract as well. The Centurion Contract: A $100K BTC Call OptionThe U.S.-based crypto derivatives and clearing platform Ledgerx announced on July 17 that current investors can purchase a $100K call option called the “Centurion Contract” with a December 2020 expiry. Essentially this means that the price has to be $100,000 per BTC by 2020 and the market capitalization of BTC would be over 2 trillion dollars. “How much would you pay today for the right to buy one bitcoin for $100,000 in December 2020?” Ledgerx tweeted. “$100K option now available to Ledgerx customers, coming to all investors soon,” the company teased.

“Dozens and dozens of institutions got back to us saying we’d be interested in trading a contract like this,” Chief Executive Officer Paul Chou told the press. “I understand $100,000 is a large number, but a lot of us who’ve been in this space remember Bitcoin at $1, and then it hit $10 and $100 and $10,000. A $100,000 contract doesn’t even make us blink.”

Excited to share that @ledgerX completed the first SOC 1 Type 2 audit for a bitcoin company, and received unqualified opinion. Audit conducted by @friedmanllp.

— LedgerX (@ledgerx) July 19, 2019

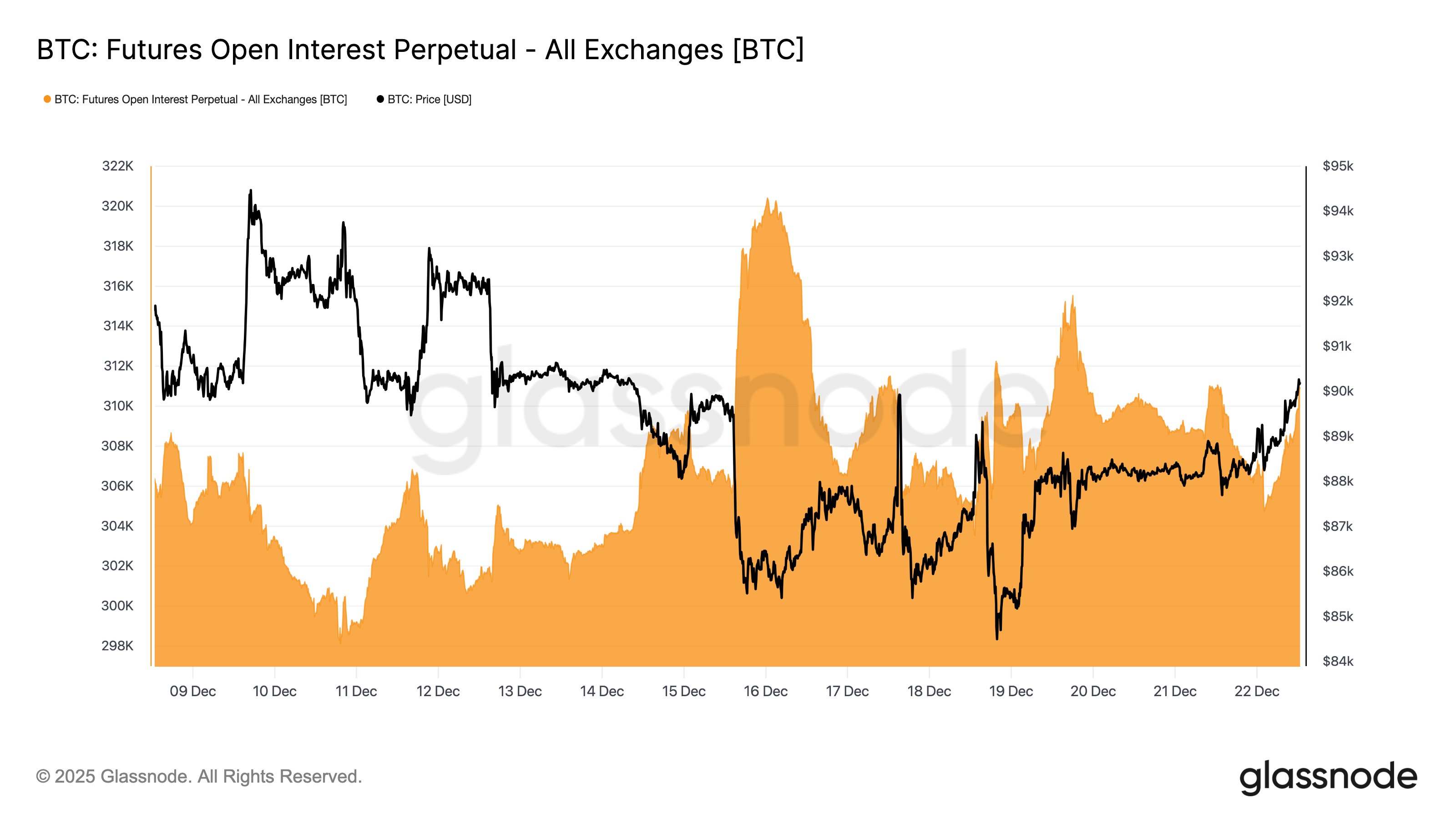

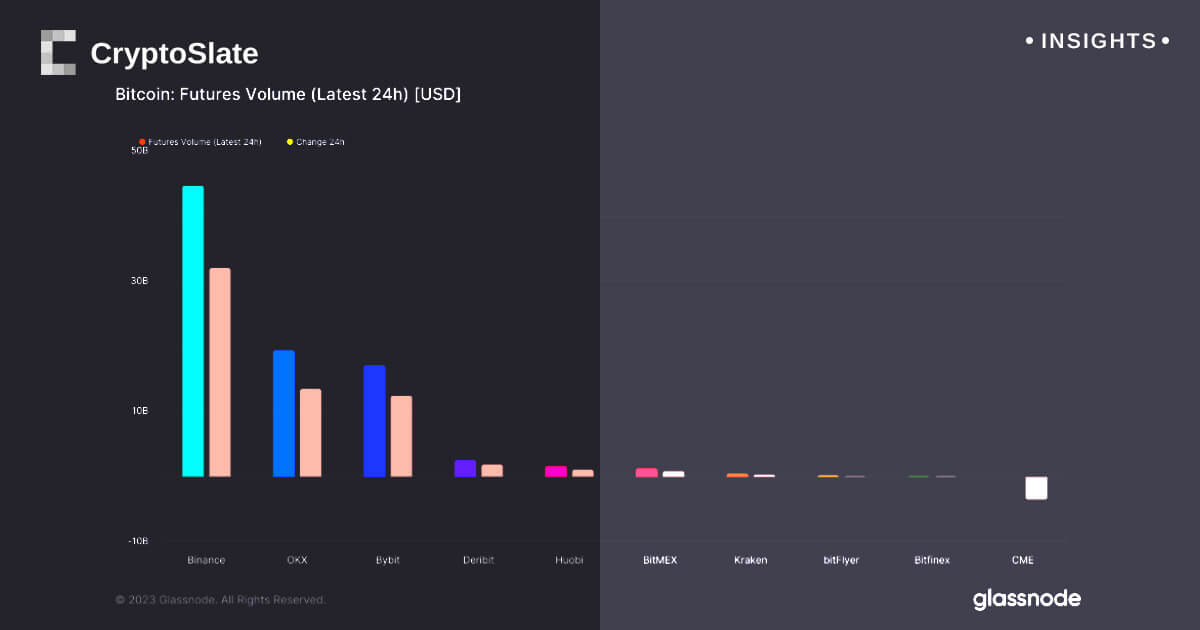

Following May’s Records, CME Group’s Bitcoin Futures Touch All-Time Highs in JuneDuring the first week of June, news.Bitcoin.com briefed our readers on the Chicago Mercantile Exchange (CME Group) seeing a massive amount of interest for its bitcoin futures in May. For instance, the exchange posted 33,000 contracts ($1.3 billion notional value) on May 13. After that record day, CME’s open interest for its bitcoin derivatives positions saw an all-time high of approximately 5,190 contracts the following week. The rise in interest in CME’s bitcoin products had continued to grow larger in June.

“CME Bitcoin futures reached a record $1.7B in notional value traded on June 26, surpassing the previous record by more than 30% — The surge in volume also set a new open interest record of 6,069 contracts as institutional interest continues to build,” CME Group stated.

CME Group’s bitcoin futures open interest broke records in May and then again in June with 6,069 contracts.CME Group has reaped the benefits of more investors when the Chicago Board Options Exchange (Cboe) announced it was ending its bitcoin futures products back in March. Being one of the largest derivatives marketplaces worldwide, CME Group followed Cboe’s trail after the company launched its futures products in December 2017. For a while, Cboe smashed records and led the race between the two global market companies. Many spectators have assumed that the latest bullish prices have been due to professional traders and larger financial institutions who want to get in on these types of markets, even with the large price fluctuations.

Overall, people think that large institutions gearing up to offer cryptocurrency derivatives and other types of crypto products will continue to entice institutional investors who would rather use traditional investing terminals. Two weeks ago, Fidelity International launched a cryptocurrency trading simulator, and according to reports a few days ago, the company has also filed an application to be a New York Trust. Prior to launch, Bakkt will have to obtain approval from the New York Department of Financial Services (NYDFS) as well. The company Seed CX revealed two of its subsidiaries, Seed Digital Commodities Market and Zero Hash, were granted the 20th and 21st Virtual Currency License approvals from the NYDFS. When the company announced the approvals, Seed CX disclosed it also has plans to offer a market for CFTC-regulated digital asset derivatives products.

What do you think about the recent interest in cryptocurrency derivatives products? Let us know what you think about this subject in the comments section below.

Image credits: Shutterstock, Pixabay, CME Group, Twitter, and Bakkt.

Do you want to keep an eye on moving cryptocurrency prices? Visit our Bitcoin Markets tool to get real-time price updates, and head over to our Blockchain Explorer tool to view all previous BCH and BTC transactions.

The post Bitcoin Futures Update: Bakkt Testing, CME Breaks Records, and a $100K Call Option appeared first on Bitcoin News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|